One of my favorite investment strategies is to find stocks trading at a discounted valuation that also offer a high yield. This helps to maximize the potential total return on an investment.

In this article, we will look at three names trading at a discount to their respective GuruFocus Values while also offering at least twice the yield of the S&P 500 Index.

Enterprise Products

First on this list is Enterprise Products Partners (EPD, Financial), a master limited partnership, or MLP, that is a top integrated provider of natural gas and natural gas liquids. The company provides processing, transporting and storage services to clients. Enterprise Products collects fees based on products transported and stored, making it slightly more immune to the price of energy than peers. The $52 billion company has annual revenue of more than $27 billion.

Like most MLPs, Enterprise Products has a very generous yield, currently at 7.8%, which is six times the average yield of 1.3% for the S&P 500 Index. According to Value Line, Enterprise Products has an average yield of 5.8% since 2011, so today’s yield is vastly superior to the long-term average. In fact, if this was the stock’s average yield for the entire year, it would be the second highest average after last year.

Enterprise Products has increased its distribution for 22 consecutive years, placing the company just three years shy of Dividend Champion status. The MLP has seen multiple energy bear markets and still raised its distributions to shareholders. Distributions have a compound annual growth rate of 4.4% over the last decade.

Enterprise Products trades at just over 11 times earnings estimates for 2022, which compares extremely favorably to the 10-year average price-earnings ratio of close to 19.

Shares are also trading at a discount to their intrinsic value according to the GuruFocus Value chart.

With the stock closing Friday at $23.99 and a GF Value of $31.59, Enterprise Products has a price-to-GF-Value ratio of 0.76. Shareholders would see a nearly 32% gain in the stock price were it to reach its GF Value. Combined with the dividend, total returns for Enterprise Products could be in the high 30% range. GuruFocus rates Enterprise Products as modestly undervalued.

Newmont

The second stock on this list is Newmont Corporation (NEM, Financial), which has gold and copper mines on four continents: North America, Africa, Asia and South America. The company has proven reserves of more than 94 million ounces of gold, 6.9 million tons of copper and 613 million ounces of silver. Newmont is valued at $49 billion and has annual sales of $11.5 billion.

Newmont closed the most recent trading session yielding 3.6%, well ahead of the market index and twice what the stock has historically offered.

The company has an uneven dividend growth history as it cut its dividend each year from 2013 to 2015. Dividend increases started the next year and shareholders saw three increases in 2020 and one raise last year. Dividend growth is erratic, but the total distributed in 2021 was Newmont’s highest ever.

Shares are trading with a price-earnings ratio of 20. This is below the stock’s 10-year average price-earnings ratio of 23.

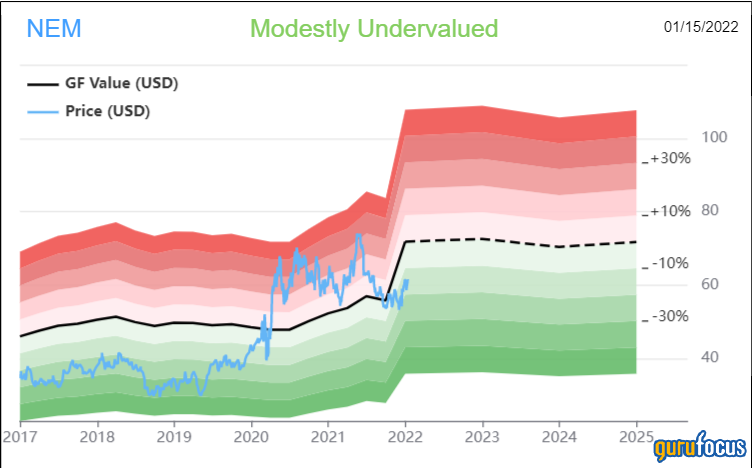

Newmont looks undervalued using the GF Value as well.

Shares of the company trade at $61.22 and have a GF Value of $71.88, giving Newmont a price-to-GF-Value ratio of 0.85. Newmont offers a potential return of 17.4% from the current price. Factor in the dividend and total returns could reach the 20% range. The stock is rated as modestly undervalued.

Pfizer

The last stock for consideration is Pfizer Inc. (PFE, Financial), is leading pharmaceutical company. Following spinoffs of its consumer healthcare and generics businesses, Pfizer is now focused on pharmaceuticals and vaccines. The $312 billion company has annual revenue approaching $48 billion.

The stock yields 2.9%, which is 160 basis points higher than the average yield of the market index. However, Pfizer’s 10-year average yield is 3.6%. Shares have returned nearly 50% over the last year, which has driven the yield down to levels rarely seen. If Pfizer was to average the current yield for an entire year it would be the lowest since at least 2005.

Pfizer has increased its dividend for 12 consecutive years. The company cuts its dividend in both 2009 and 2010 as it digested large acquisitions. The dividend has a CAGR of 6.6% over the last decade.

Pfizer trades at 13 times 2021 earnings expectations, but just 8.6 times 2022 estimates.

Shares look inexpensive on a GuruFocus Value basis.

Pfizer trades hands at $54.95. GuruFocus estimates that the stock has a GF Value of $62.79, giving shares a price-to-GF-Value ratio of 0.88. The stock could return more than 14% if it reached its GF Value. With the dividend yield, the total return could begin to approach the upper teens. Even after a tremendous gain over the last year, Pfizer still looks undervalued. Shares are also rated as modestly undervalued.

Final thoughts

Investing in stocks that are trading at a discount to their fair value and also offer high yields can lead to excellent total returns. Enterprise Products, Newmont and Pfizer are three such names. Each stock offers double-digit total return potential based on my valuation model.