John Paulson (Trades, Portfolio), head of investment firm Paulson & Co., disclosed his fourth-quarter portfolio earlier this month.

With the long-term goal of capital preservation, above-average returns and low correlation to the market, the activist guru's New York-based firm specializes in event-driven arbitrage strategies, including merger arbitrage, bankruptcy reorganizations and distressed credit.

Sticking to this strategy, the investor revealed he established four new positions during the three months ended Dec. 31, exited five stocks and boosted or trimmed a number of other existing investments. Notable transactions included the addition of Cerner Corp. (CERN, Financial) to the portfolio, increases to the SSR Mining Inc. (SSRM, Financial) and Pacira BioSciences Inc. (PCRX, Financial) stakes and a reduction of the BrightSphere Investment Group Inc. (BSIG, Financial) holding. The Cloudera Inc. (CLDR, Financial) position was dissolved after the company was acquired and taken private by affiliates of Clayton, Dubilier & Rice and KKR & Co. Inc. (KKR, Financial).

Cerner

Paulson invested in 474,010 shares of Cerner (CERN, Financial), allocating it to 1.36% of the equity portfolio. During the quarter, the stock traded for an average price of $76.38 per share.

The Kansas City, Missouri-based health care information technology company has a $27.37 billion market cap; its shares were trading around $93.30 on Friday with a price-earnings ratio of 50.43, a price-book ratio of 7.43 and a price-sales ratio of 4.87.

The GF Value Line suggests the stock is modestly overvalued currently based on its historical ratios, past performance and future earnings projections.

GuruFocus rated Cerner’s financial strength 6 out of 10. While the high Altman Z-Score of 6.86 indicates the company is in good standing, value creation is also occurring since the return on invested capital eclipses the weighted average cost of capital.

The company’s profitability scored a 9 out of 10 rating. Although the operating margin is in decline, returns on equity, assets and capital outperform over half of its competitors. Cerner also has a moderate Piotroski F-Score of 4 out of 9, meaning conditions are typical for a stable company. Despite having consistent earnings and revenue growth, the predictability rank of three out of five stars is on watch. According to GuruFocus, companies with this rank return an average of 8.2% annually over a 10-year period.

Of the gurus invested in Cerner, the Parnassus Endeavor Fund (Trades, Portfolio) has the largest stake with 0.41% of its outstanding shares. George Soros (Trades, Portfolio), Ray Dalio (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio), Jeremy Grantham (Trades, Portfolio), Louis Moore Bacon (Trades, Portfolio) and several other gurus also have positions in the stock.

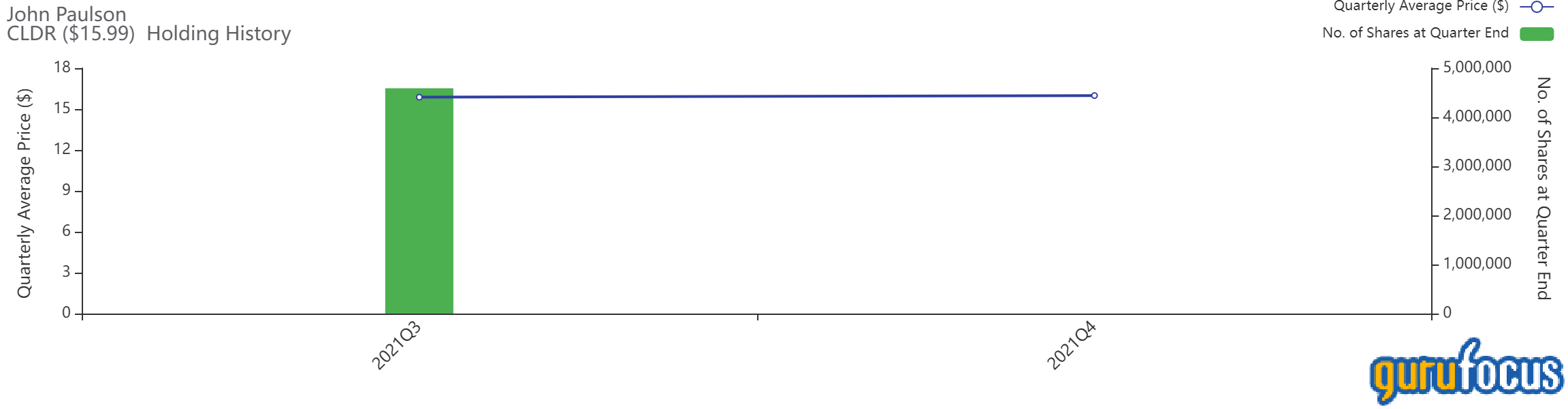

Cloudera

After establishing the holding in the third quarter, the investor’s 4.6 million-share stake in Cloudera (CLDR, Financial) was dissolved. The transaction had an impact of -2.09% on the equity portfolio. Shares traded for an average price of $15.99 each during the quarter.

GuruFocus estimates Paulson gained 0.76% on the short-lived investment.

The software company headquartered in Santa Clara, California, which provides a cloud-based platform for data engineering, data warehousing, machine learning and analytics, was taken private in an all-cash deal valued at $5.3 billion. The agreement, which was made with affiliates of Clayton, Dubilier & Rice and KKR (KKR, Financial), closed on Oct. 8.

Additional gurus who also benefited from the acquisition deal included Baillie Gifford (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), Carl Icahn (Trades, Portfolio) and Jones.

SSR Mining

Impacting the equity portfolio by 0.99%, the guru upped the SSR Mining (SSRM, Financial) stake by 138.14%, buying 1.81 million shares. The stock traded for an average per-share price of $17.18 during the quarter.

He now holds 3.12 million shares total, which represent 1.7% of the equity portfolio. GuruFocus data shows Paulson has gained 27.44% on the investment since the second quarter of 2019.

The Canadian mining company, which produces gold, silver, zinc and tin, has a market cap of $4.15 billion; its shares were trading around $19.45 on Friday with a price-earnings ratio of 16.6, a price-book ratio of 1.21 and a price-sales ratio of 3.15.

According to the GF Value Line, the stock is currently modestly undervalued.

SSR Mining’s financial strength was rated 6 out of 10 by GuruFocus, driven by a comfortable level of interest coverage. The Altman Z-Score of 2.83, however, indicates it is under some pressure. The ROIC is also being overshadowed by the WACC, indicating the company is struggling to create value.

The company’s profitability fared better, scoring an 8 out of 10 rating on the back of strong margins and returns that top a majority of industry peers. SSR Mining also has a high Piotroski F-Score of 7, indicating operations are healthy, and a one-star predictability rank. GuruFocus says companies with this rank return, on average, 1.1% annually.

Paulson is currently the company’s largest guru shareholder with a 1.47% stake. Other top guru investors are Jim Simons (Trades, Portfolio)’ Renaissance Technologies, Joel Greenblatt (Trades, Portfolio), Gabelli and Dalio.

Pacira BioSciences

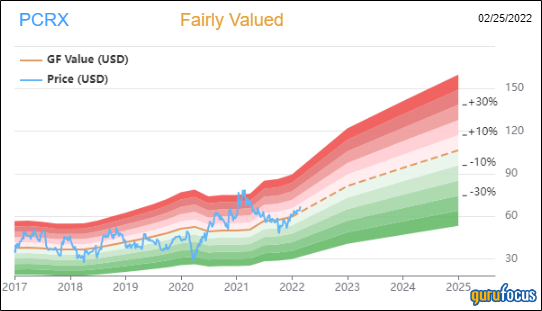

Paulson increased his Pacira BioSciences (PCRX, Financial) position by 35.42%, buying 446,081 shares. The transaction had an impact of 0.83% on the equity portfolio. During the quarter, the stock traded for an average price of $55.20 per share.

The investor now holds 1.7 million shares total, which represent 3.16% of the equity portfolio and is now his eighth-largest holding. GuruFocus says he has gained an estimated 36.32% on the investment since establishing it in the first quarter of 2019.

The Tampa, Florida-based pharmaceutical company, which focuses on non-opioid pain management and regenerative health solutions, has a $3 billion market cap; its shares were trading around $67.04 on Friday with a price-earnings ratio of 49.52, a price-book ratio of 4.17 and a price-sales ratio of 5.94.

Based on the GF Value Line, the stock appears to be fairly valued currently.

GuruFocus rated Pacira’s financial strength 6 out of 10 despite weak interest coverage. The high Altman Z-Score of 3.62 suggests the company is in good standing even though assets are building up at a faster rate than revenue is growing. The Sloan ratio is also indicative of poor earnings quality. Value creation is occurring, however, since the ROIC exceeds the WACC.

The company’s profitability did not fare as well with a 4 out of 10 rating despite having strong margins and returns that outperform over half of its competitors. Pacira is also supported by a moderate Piotroski F-Score of 5 and a one-star predictability rank.

With a 5.29% stake, Baillie Gifford (Trades, Portfolio) is Pacira’s largest guru shareholder. Simons’ firm, Jones, First Eagle Investment (Trades, Portfolio), Greenblatt, Ken Fisher (Trades, Portfolio) and John Hussman (Trades, Portfolio) also have positions in the stock.

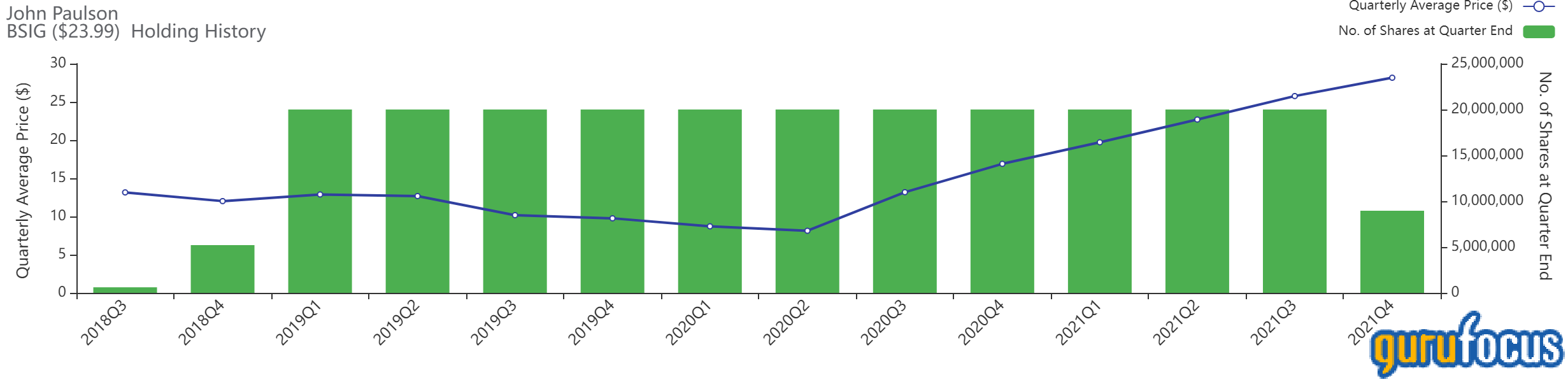

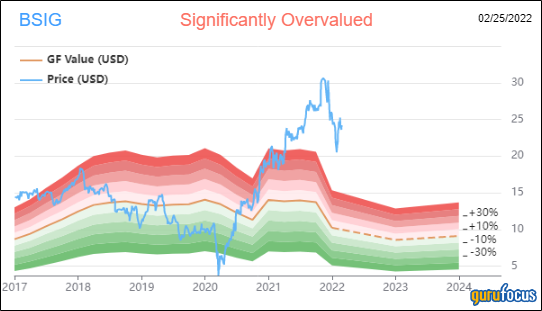

BrightSphere Investment Group

With an impact of -8.23% on the equity portfolio, the guru slashed his BrisghtSphere Invesment Group (BSIG, Financial) holding by 55.25%, selling 11.05 million shares. Shares traded for an average price of $28.16 each during the quarter.

As his third-largest holding, Paulson now has a total of 8.95 million shares, giving it 7.06% space in the equity portfolio. GuruFocus data shows he has gained an estimated 107.23% so far on the investment, which was established in the third quarter of 2018.

The asset management company, which is headquartered in Boston, has a market cap of $1.08 billion; its shares were trading around $24.11 on Friday with a price-earnings ratio of 2.07, a price-book ratio of 1.83 and a price-sales ratio of 2.82.

The GF Value Line suggests the stock is significantly overvalued currently.

BrightSphere’s financial strength was rated 7 out of 10 by GuruFocus, driven by adequate interest coverage and a high Altman Z-Score of 3.5. The ROIC also surpasses the WACC, so value creation is occurring.

The company’s profitability scored an 8 out of 10 rating on the back of an expanding operating margin and strong returns that outperform a majority of industry peers. BrightSphere also has a moderate Piotroski F-Score of 6.

Paulson is the company’s largest guru shareholder with a 20.08% stake. Other guru investors include Soros, Chuck Royce (Trades, Portfolio), Keeley-Teton Advisors, LLC (Trades, Portfolio), Third Avenue Management (Trades, Portfolio), Jones, Hussman and Lee Ainslie (Trades, Portfolio).

Additional trades and portfolio composition

During the quarter, Paulson also entered new positions in KraneShares CSI China Internet ETF (KWEB, Financial), Tellurian Inc. (TELL, Financial) and Athene Holding Ltd. (ATH, Financial) and sold out of Pretium Resources Inc. (PVG, Financial), Viatris Inc. (VTRS, Financial) and Stamps.com Inc. (STMP, Financial). The Kansas City Southern (KSU, Financial) holding was also eliminated following its merger with Canadian Pacific (CP, Financial).

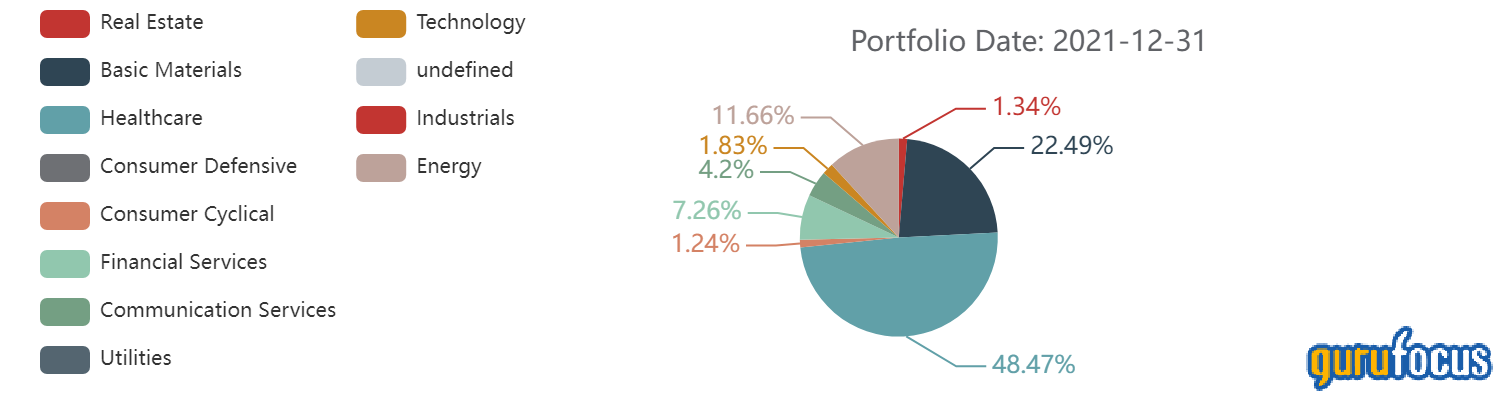

The guru's $3.24 billion equity portfolio, which is composed of 36 stocks, is most heavily invested in the health care sector with a weight of 48.47%, followed by the basic materials space with 22.49% exposure.