Sypnosis:

With a modest intrinsic value per share of $20 based on a price/normalized earnings of 10x, the yield on Bank of America (BAC, Financial) common stock is 159%. But why invest in the common stock when you can invest in the warrants with a maturity date on Jan. 16, 2019, that would yield much bigger gains as book value and earnings would continue to grow at a modest rate in seven years time?

Assuming a very conservative 6% CAGR growth in BofA’s book value and earnings, the intrinsic value per share seven years later would be in the range of $30. While the seven-year yield on common stock becomes 289%, the warrants have a yield of 334%. Forget about BofA common stock; consider the warrants!

Introduction on BofA. As of March 6, 2012, BofA common stock has a share price of $7.71, with a book value per share of approximately $15.45 and tangible book value per share of $9.10 on 13,765 million number of shares outstanding (including Warren Buffett’s stake).

As its annual pre-tax-pre-provision-profit (PTPP) since the 2008 financial crisis has been complicated by (1) the acquisitions of Merrill Lynch and Countrywide, (2) massive R&W provisions, (3) Gains in asset sales and legacy writedowns, (4) litigation expenses and (5) a huge sales force hired to handle legacy mortgage issues, we have adjusted the PTPP and the normalized PTPP should be at least in the range of $50 billion or $3.60 per share.

The PTPP of $50 billion that has more-or-less been generated consistently for the past three years is a walloping figure when the $950 billion of loans are taken into consideration; it has the ability to lose 5.23% of total loans outstanding (not only mortgage loans) annually and still break even.

The balance sheet is also a fortress on its own as it has an allowance for bad loans of approximately $40 billion or 4.45% of total loans outstanding while non-performing loans is approximately 3.5% of total loans; the 1% differential is an underestimation as some of the non-performing loans should return to performing status.

(In our $50 billion PTPP calculation, we have not taken criteria (5) into consideration, but management has guided that at least $5 billion of annual cost savings will be effected once the legacy issues are resolved and will flow directly to earnings. Every $5 billion of incremental earnings is equivalent to $0.36 per share and will increase share price by $3.60 assuming a P/E of 10x.)

Utilizing a normalized provisions-to-loans ratio of 1.08% and a 30% tax figure, Profit after tax should be in the range of $28 billion or $2.00 per share. All these translate to P/B of 0.52x and P/normalized earnings of 3.86x.

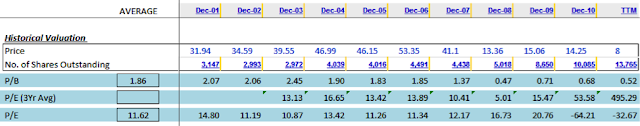

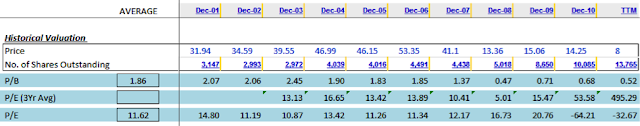

A modest intrinsic value per share of $20. The above table shows the past P/B and P/E that BofA common stock has been trading for the past 10 years. The average P/B and P/E of 1.86x and 11.62x is calculated based on the December 2004-2006 figures and December 2001-2006 respectively.

If a range of intrinsic value estimates is calculated based on past average P/B and P/E, there exists a profit potential of 200-300%. Our estimated intrinsic value per share of $20, therefore, is absolutely modest. (We suggest you do the calculations yourself – and be amazed!)

More on BofA. BofA’s circumstance in the 2008 financial crisis is unusual because BofA was supposed to be associated with the likes of Wells Fargo and JP Morgan that have (1) a huge banking franchise (deposits – viewed as "safe" liabilities) and (2) a relatively sound investment and loan portfolio on the asset side (as opposed to Citigroup in particular), and should have weathered the crisis relatively unscathed.

However, the Countrywide acquisition has proved to be a blow, if not a fatal one. Share count has approximately doubled because of issuance of shares to finance the Merrill Lynch and Countrywide acquisitions but after which almost tripled due to the mortgage woes associated with the Countrywide acquisition which has resulted in large expenses for BofA, including elevated net-charge-offs, delinquency and nonperforming loans and provisions for loan losses in the range of tens of billions of dollars, approximately $15 billion of R&W provisions and $5bn of recurring litigation expenses incurred in the past three years and at least $5 billion of additional expenses incurred annually to handle legacy mortgage issues.

What was viewed as the competitive advantage in BofA’s annual PTPP of $50 billion has turned blind to the investment public.

However, an investor in BofA has two advantages not recognized by the investment public: (1) Loans have a finite life of between four to eight years and these problems will gradually be resolved, if not disappeared on its own. (We are already in the fifth year into the 2008 crisis!!! It has to end soon!) (2) A meaningful amount of expenses associated with the mortgage woes, like the R&W provisions in particular — just like workers’ excess compensation insurance — is a long-tail event. While large one-time expenses are booked, the actual outflow of these expenses is gradual. The economics of the business is, therefore, very attractive.

If, through verification, you are stupefied by how undervalued BofA common stock is, you can forget about BofA common stock — consider BofA warrants:

Introduction on BofA warrants. BofA warrants are long-dated with a maturity date on Jan. 16, 2019, or approximately seven more years before maturity.

The current warrants price is $3.85, with a strike price of $13.30 (approximately equal to BV per share). The break-even share price, therefore, would be $17.15.

Downside risk is zero? Based on the current price and long-term nature of the warrants, I believe the downside risk is close to zero, if not zero. The payoff structure of a warrant is such that the investor of BofA warrants will lose its capital if the share price of BofA falls below $17.15.

Assuming a very conservative 6% CAGR growth in BofA’s book value and earnings, the intrinsic value per share seven years later would be in the range of $30. The break-even price of $17.15 is approximately 43% below the estimated intrinsic value of $30, seven years later. (Book value per share and EPS would increase to $23 and $3.00 respectively. At the break-even share price of $17.15, the P/B becomes 0.74x and P/E becomes 5.7x.)

What is the probability that on Jan. 16, 2019, BofA's share price would fall below $17.15 or trading below P/B of 0.74x and P/E of 5.7x?

An awesome 7-year yield of 334% on the warrants! Now on the upside: With an estimated 7-years-later intrinsic value per share of $30, P/B and P/E would become 1.29x and 10x respectively. The main flaw in my argument is, of course, earnings and book value do not compound at a rate of 6% per annum moving forward.

However, clues of the past (especially the 1990 case study of Wells Fargo) have suggested that my projected growth to be absolutely conservative. Assuming my argument is not flawed, the warrants will yield an awesome 334%. (BAC common stock still yields a pretty figure of 289% though.)

While the seven-year yield differential between the common stock and warrants may not seem sufficient to compensate the risk associated with the payoff structure of the warrants, the differential should be much wider and hence the risk much lower.

Remember, I have left out criteria (5) in calculating the normalized PTPP which will increase the share price by $3.60. Also recall that the cost price of the warrants is $3.85. This will result in an incremental profit of about 100% on the warrants, but only 50% on the common stock.

When (1) such incremental earnings power is coupled with (2) a higher than 6% CAGR growth in earnings for the next seven years and (3) a higher than P/E of 10x on Jan. 16, 2019, the yield differential between the warrants and common stock is going to be very big. Also remember that the warrants can be traded in the market, which gives flexibility to the investor to sell before maturity.

By now, you may be apprehensive of the too-many assumptions and calculations involved in our investment thesis on BofA warrants.

So let’s put the 1990 case study on Wells Fargo into perspective: Based on information provided in the 1990 Warren Buffett letter to shareholders, Wells Fargo was trading at a price/PTPP of 2.23 when Warren Buffett bought it. Nine years later, Wells Fargo's share price increase by 1000%.

Today, BofA is trading at price/PTPP of 2.14. And our assumptions and calculations dictate that the current share price of $7.71 will only increase by 290% to $30, seven years later.

If BofA's share price was to increase by 500% (we are not even thinking of anything in the range of 1000%), imagine what the warrants yield will be. (Hint: What is ($46-$13.3-$3.85)/($3.85)?) Most importantly, the risk underlying an investment in the warrants is close to zero, if not zero, to our understanding.

Disclosure: Long BofA warrants but none of BofA common stock.

If you are interested in our portfolio allocation of securities, go here: http://valueground.blogspot.com/p/portfolio.html

(Provocative comments are most welcomed regarding our portfolio allocation as we would expect it.)

Assuming a very conservative 6% CAGR growth in BofA’s book value and earnings, the intrinsic value per share seven years later would be in the range of $30. While the seven-year yield on common stock becomes 289%, the warrants have a yield of 334%. Forget about BofA common stock; consider the warrants!

Introduction on BofA. As of March 6, 2012, BofA common stock has a share price of $7.71, with a book value per share of approximately $15.45 and tangible book value per share of $9.10 on 13,765 million number of shares outstanding (including Warren Buffett’s stake).

As its annual pre-tax-pre-provision-profit (PTPP) since the 2008 financial crisis has been complicated by (1) the acquisitions of Merrill Lynch and Countrywide, (2) massive R&W provisions, (3) Gains in asset sales and legacy writedowns, (4) litigation expenses and (5) a huge sales force hired to handle legacy mortgage issues, we have adjusted the PTPP and the normalized PTPP should be at least in the range of $50 billion or $3.60 per share.

The PTPP of $50 billion that has more-or-less been generated consistently for the past three years is a walloping figure when the $950 billion of loans are taken into consideration; it has the ability to lose 5.23% of total loans outstanding (not only mortgage loans) annually and still break even.

The balance sheet is also a fortress on its own as it has an allowance for bad loans of approximately $40 billion or 4.45% of total loans outstanding while non-performing loans is approximately 3.5% of total loans; the 1% differential is an underestimation as some of the non-performing loans should return to performing status.

(In our $50 billion PTPP calculation, we have not taken criteria (5) into consideration, but management has guided that at least $5 billion of annual cost savings will be effected once the legacy issues are resolved and will flow directly to earnings. Every $5 billion of incremental earnings is equivalent to $0.36 per share and will increase share price by $3.60 assuming a P/E of 10x.)

Utilizing a normalized provisions-to-loans ratio of 1.08% and a 30% tax figure, Profit after tax should be in the range of $28 billion or $2.00 per share. All these translate to P/B of 0.52x and P/normalized earnings of 3.86x.

A modest intrinsic value per share of $20. The above table shows the past P/B and P/E that BofA common stock has been trading for the past 10 years. The average P/B and P/E of 1.86x and 11.62x is calculated based on the December 2004-2006 figures and December 2001-2006 respectively.

If a range of intrinsic value estimates is calculated based on past average P/B and P/E, there exists a profit potential of 200-300%. Our estimated intrinsic value per share of $20, therefore, is absolutely modest. (We suggest you do the calculations yourself – and be amazed!)

More on BofA. BofA’s circumstance in the 2008 financial crisis is unusual because BofA was supposed to be associated with the likes of Wells Fargo and JP Morgan that have (1) a huge banking franchise (deposits – viewed as "safe" liabilities) and (2) a relatively sound investment and loan portfolio on the asset side (as opposed to Citigroup in particular), and should have weathered the crisis relatively unscathed.

However, the Countrywide acquisition has proved to be a blow, if not a fatal one. Share count has approximately doubled because of issuance of shares to finance the Merrill Lynch and Countrywide acquisitions but after which almost tripled due to the mortgage woes associated with the Countrywide acquisition which has resulted in large expenses for BofA, including elevated net-charge-offs, delinquency and nonperforming loans and provisions for loan losses in the range of tens of billions of dollars, approximately $15 billion of R&W provisions and $5bn of recurring litigation expenses incurred in the past three years and at least $5 billion of additional expenses incurred annually to handle legacy mortgage issues.

What was viewed as the competitive advantage in BofA’s annual PTPP of $50 billion has turned blind to the investment public.

However, an investor in BofA has two advantages not recognized by the investment public: (1) Loans have a finite life of between four to eight years and these problems will gradually be resolved, if not disappeared on its own. (We are already in the fifth year into the 2008 crisis!!! It has to end soon!) (2) A meaningful amount of expenses associated with the mortgage woes, like the R&W provisions in particular — just like workers’ excess compensation insurance — is a long-tail event. While large one-time expenses are booked, the actual outflow of these expenses is gradual. The economics of the business is, therefore, very attractive.

If, through verification, you are stupefied by how undervalued BofA common stock is, you can forget about BofA common stock — consider BofA warrants:

Introduction on BofA warrants. BofA warrants are long-dated with a maturity date on Jan. 16, 2019, or approximately seven more years before maturity.

The current warrants price is $3.85, with a strike price of $13.30 (approximately equal to BV per share). The break-even share price, therefore, would be $17.15.

Downside risk is zero? Based on the current price and long-term nature of the warrants, I believe the downside risk is close to zero, if not zero. The payoff structure of a warrant is such that the investor of BofA warrants will lose its capital if the share price of BofA falls below $17.15.

Assuming a very conservative 6% CAGR growth in BofA’s book value and earnings, the intrinsic value per share seven years later would be in the range of $30. The break-even price of $17.15 is approximately 43% below the estimated intrinsic value of $30, seven years later. (Book value per share and EPS would increase to $23 and $3.00 respectively. At the break-even share price of $17.15, the P/B becomes 0.74x and P/E becomes 5.7x.)

What is the probability that on Jan. 16, 2019, BofA's share price would fall below $17.15 or trading below P/B of 0.74x and P/E of 5.7x?

An awesome 7-year yield of 334% on the warrants! Now on the upside: With an estimated 7-years-later intrinsic value per share of $30, P/B and P/E would become 1.29x and 10x respectively. The main flaw in my argument is, of course, earnings and book value do not compound at a rate of 6% per annum moving forward.

However, clues of the past (especially the 1990 case study of Wells Fargo) have suggested that my projected growth to be absolutely conservative. Assuming my argument is not flawed, the warrants will yield an awesome 334%. (BAC common stock still yields a pretty figure of 289% though.)

While the seven-year yield differential between the common stock and warrants may not seem sufficient to compensate the risk associated with the payoff structure of the warrants, the differential should be much wider and hence the risk much lower.

Remember, I have left out criteria (5) in calculating the normalized PTPP which will increase the share price by $3.60. Also recall that the cost price of the warrants is $3.85. This will result in an incremental profit of about 100% on the warrants, but only 50% on the common stock.

When (1) such incremental earnings power is coupled with (2) a higher than 6% CAGR growth in earnings for the next seven years and (3) a higher than P/E of 10x on Jan. 16, 2019, the yield differential between the warrants and common stock is going to be very big. Also remember that the warrants can be traded in the market, which gives flexibility to the investor to sell before maturity.

By now, you may be apprehensive of the too-many assumptions and calculations involved in our investment thesis on BofA warrants.

So let’s put the 1990 case study on Wells Fargo into perspective: Based on information provided in the 1990 Warren Buffett letter to shareholders, Wells Fargo was trading at a price/PTPP of 2.23 when Warren Buffett bought it. Nine years later, Wells Fargo's share price increase by 1000%.

Today, BofA is trading at price/PTPP of 2.14. And our assumptions and calculations dictate that the current share price of $7.71 will only increase by 290% to $30, seven years later.

If BofA's share price was to increase by 500% (we are not even thinking of anything in the range of 1000%), imagine what the warrants yield will be. (Hint: What is ($46-$13.3-$3.85)/($3.85)?) Most importantly, the risk underlying an investment in the warrants is close to zero, if not zero, to our understanding.

Disclosure: Long BofA warrants but none of BofA common stock.

If you are interested in our portfolio allocation of securities, go here: http://valueground.blogspot.com/p/portfolio.html

(Provocative comments are most welcomed regarding our portfolio allocation as we would expect it.)