Introduction

The gross merchandise value (GMV) of Southeast Asia's on-demand food delivery market is estimated to be worth $15 billion as of 2021, and this is forecasted to grow at a massive 14.1% compound annual growth rate (CAGR) between now and 2030, reaching $49.7 billion, according to a study by Frost Research. The value of the ride hailing market is expected to grow from $13 billion to $42 billion by 2025. In addition, fintech funding in Southeast Asia increased by threefold in 2021 to reach a market size of $3.5 billion.

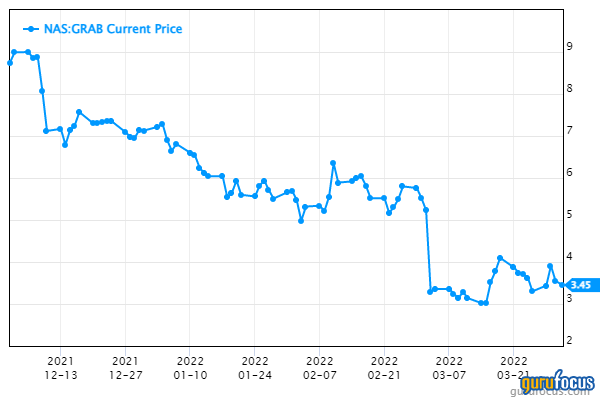

Grab Holdings (GRAB, Financial) is poised to ride all three of these incredible growth trends. With its stock price down 61% from post-IPO highs in December 2021, is this a value stock or a value trap?

Business Model

Grab is the holding company for its namesake Grab app, Southeast Asia's premier all-in-one Superapp. Headquartered in Singapore, the firm’s platform is like Deliveroo (LSE:ROO, Financial), Uber (UBER, Financial) and a digital bank all rolled into one. Their services include:

1. Delivery of food, groceries and express packages

2. Mobility (Rides)

3. Financial services such as Pay, Insurance and Invest

4. Hotel bookings

5. Rewards and gift cards

Source: Grab investor materials

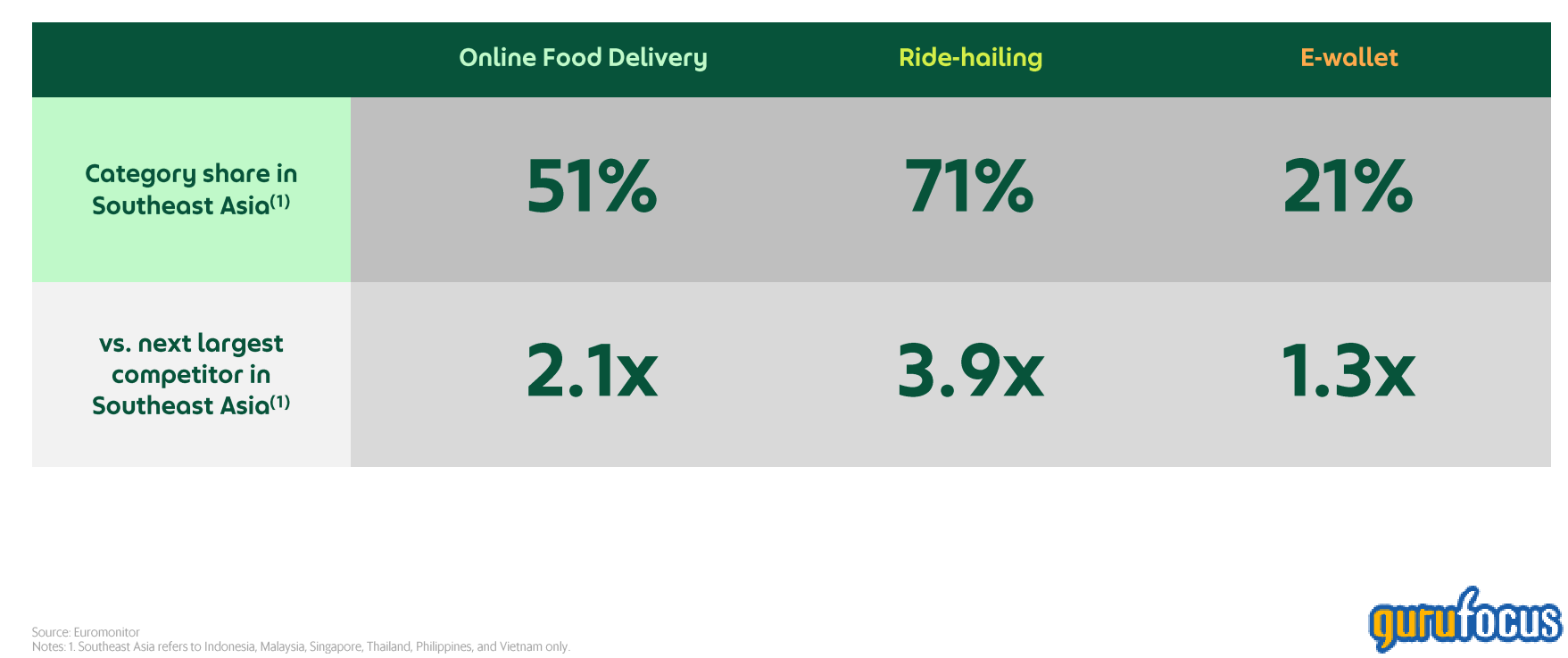

According to the firm, they have a massive 51% market share in food delivery, a 71% share in ride hailing and a 21% share of the e-wallet market in Southeast Asia. This is great news as economies of scale should help the business to become more profitable than competitors are they get larger.

Klarman is a buyer

Seth Klarman (Trades, Portfolio) has been dubbed “the next Warren Buffett (Trades, Portfolio)” due to his value investing approach. However, after tracking some of his most recent moves, he seems to be making investments into quite a few volatile growth stocks and even SPACs that Buffett would never tough. Grab was one of those investments. According to his latest 13F report, Klarman was buying shares of Grab in the fourth quarter of 2021, during which shares traded for an average price of $7. The stock is now trading under $4 a share, down 53% from the average fourth-quarter price.

Why is the stock down?

Grab Holdings went public at a whopping $40 billion valuation, which at the time seemed justified as Uber was trading at $90 billion and this company could be thought of as having a large Southeast Asian market share.

However, a clause inside the SPAC merger contract allowed insiders to sell between 20% to 30% of their shares, which put pressure on the stock. In addition, high inflation and a suspected rise in interest rates compressed the multiples of all growth stocks tremendously. Morover, Grab faces stiff competition and is not currently profitable.

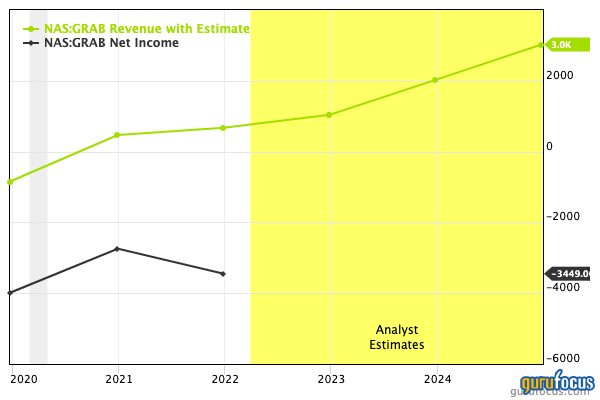

Volatile financials

Grab merged with Altimeter's SPAC and began trading in December 2021. As a former SPAC, I expect this company to operate like a volatile late-stage venture capital-backed company, rather than a stable public company, because it really wasn't ready to go public yet. Grab’s financials confirm this; in 2021, the firm grew revenues 44% year-over-year, from $469 million to $679 million, but made heavy losses of over $1.9 billion in the year. The good news is the firm is expected to be Ebitda profitable by 2024.

Grab is leveraged up to the eyeballs, with high debt even for a young growth company. They have $10.8 billion in long-term debt and $3.5 billion in cash. I suspect the firm is using this leverage to expand rapidly and take market share from competitors, so there could be a method to the madness.

The stock is trading at less than 2 times its tangible book value, with a forward price-sales ratio of 6 based on the revenue projections for 2023.

Final thoughts

Theoretically, Grab Holdings has everything to play for. They are at the intersection of three rapidly growing markets. In addition, the firm has dominant market positions and a great technology stack. However, the firm lost close to $2 billion in 2021 and the ride hailing and delivery businesses are notorious for being low margin, with Uber reportedly making just 50 cents per trip by the admission of its CEO. The high competition, high inflation and rising interest rates are expected to keep the multiples compressed in the short term. In the long-term, the stock could rebound, but for me, there are better opportunities in the market right now which offer less volatility.