The yield on the 10-year Treasury bond has inched up about half a percentage point from its 2011 low–not enough of a move to call a bear market. But inventories of Treasury securities are building up at bond dealers, even as investors grow less fearful about the stock market’s prospects and more concerned about the Federal Reserve’s accommodative monetary policy.

This confluence of developments heightens the risk that interest rates will climb in 2012.

That’s bad news for bondholders. High-quality corporate issuers have enjoyed extraordinarily low costs of capital for the better part of three years. In this environment, even junk-rated companies have taken advantage of ultra-low rates to slash interest costs, eliminate refinancing risk and lard their balance sheets with inexpensive capital.

If the cost of corporate borrowing were to revert to historical norms, bondholders would suffer a substantial loss of capital. Closed-end funds and other investment vehicles that have taken on excessive leverage to boost their payouts to investors will also feel the pain.

Conventional wisdom holds that rising interest rates would also drive investors out of master limited partnerships (MLP, Financial) and other income-oriented stocks, saddling those who opt to stay the course with capital losses.

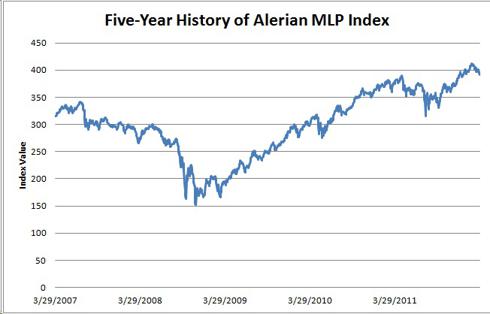

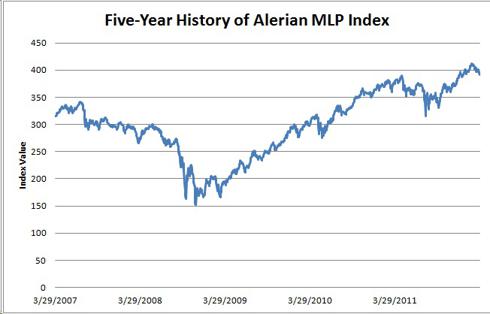

The opposite has occurred since the end of 2007. The Alerian MLP Index, which tracks the 50 largest energy-related MLPs, plummeted to a 41.6 percent loss in 2008, then surged 61.9 percent in 2009 and posted a 27.4 percent gain in 2010. The index overcame a mid-year sell-off in 2011 to return 7.3 percent to investors and is up 1.8 percent thus far in 2012.

Source: Bloomberg

In contrast, the Chicago Board Options Exchange 10-Year T-Note Index – the yield to maturity of the most recently auctioned 10-year Treasury note times a factor of 10–plunged sharply in 2008, as investors abandoned stocks for the safety of Treasuries. In 2009 the yield on 10-year Treasury securities surged, as investors piled into stocks after realizing that financial Armageddon had been avoided.

But bonds rallied hard once again during the summer swoon of 2010, when deteriorating U.S. economic data and rising concern about the EU sovereign-debt crisis sent investors scurrying to safer fare. By the end of the year, the flow of capital reversed, with improvements in the U.S. economy prompting investors to shift funds to equities and other riskier assets.

In 2011 Treasury yields plunged once again, compliments of renewed worry about the EU sovereign-debt debacle and another soft patch for the U.S. economy, before rising again as the stock market rallied into year-end.

Source: Bloomberg

The Cliff’s Notes version: The Alerian MLP Index has posted strong returns when interest rates have ticked up; when interest rates have trended lower, the benchmark index has tumbled. That is, MLPs’ stock prices have responded more to trends in the equity market than movements in interest rates.

In the current environment, the Alerian MLP Index’s fortunes have closely followed trends in the domestic economy, rallying when investors become more optimistic about the prospects for growth.

That’s not to suggest that higher interest rates won’t affect MLPs, which rely on the capital markets to finance acquisitions and organic growth projects. Access to low-cost debt and equity capital has fueled distribution growth and enabled MLPs to construct the necessary infrastructure to support the frenzied drilling activity in U.S. shale oil and gas plays.

But as I stated in The Truth about Dividend-Paying Stocks and Interest Rates, interest rates are unlikely to rise meaningfully until the economy recovers. Our forecast calls for U.S. gross domestic product to grow haltingly and at a subdued rate in the next few years.

Meanwhile, robust demand for takeaway capacity in prolific shale oil and gas plays shows no sign of slowing. MLPs continue to secure ample contract coverage before breaking ground on new midstream infrastructure, locking in reliable income streams that will support distribution growth.

Inexpensive financing and a full slate of growth opportunities have enabled several of my favorite MLPs to grow their quarterly payouts at an accelerated rate, pushing the stock prices to all-time highs.

Rising interest rates would threaten the bull market for energy-related MLPs, though blue-chip players such as Enterprise Products Partners LP (EPD, Financial) that enjoy superior access to capital will have a competitive advantage. At the same time, a stronger economy would improve the profitability of many projects, presumably offsetting some of the impact from higher interest rates.

As long as our picks have access to cheap debt and equity capital, we can look forward to solid distribution growth. Instead of the daily babble about interest rates, investors should focus on company-specific developments – that’s what will tip us off to deteriorating business conditions.

This confluence of developments heightens the risk that interest rates will climb in 2012.

That’s bad news for bondholders. High-quality corporate issuers have enjoyed extraordinarily low costs of capital for the better part of three years. In this environment, even junk-rated companies have taken advantage of ultra-low rates to slash interest costs, eliminate refinancing risk and lard their balance sheets with inexpensive capital.

If the cost of corporate borrowing were to revert to historical norms, bondholders would suffer a substantial loss of capital. Closed-end funds and other investment vehicles that have taken on excessive leverage to boost their payouts to investors will also feel the pain.

Conventional wisdom holds that rising interest rates would also drive investors out of master limited partnerships (MLP, Financial) and other income-oriented stocks, saddling those who opt to stay the course with capital losses.

The opposite has occurred since the end of 2007. The Alerian MLP Index, which tracks the 50 largest energy-related MLPs, plummeted to a 41.6 percent loss in 2008, then surged 61.9 percent in 2009 and posted a 27.4 percent gain in 2010. The index overcame a mid-year sell-off in 2011 to return 7.3 percent to investors and is up 1.8 percent thus far in 2012.

Source: Bloomberg

In contrast, the Chicago Board Options Exchange 10-Year T-Note Index – the yield to maturity of the most recently auctioned 10-year Treasury note times a factor of 10–plunged sharply in 2008, as investors abandoned stocks for the safety of Treasuries. In 2009 the yield on 10-year Treasury securities surged, as investors piled into stocks after realizing that financial Armageddon had been avoided.

But bonds rallied hard once again during the summer swoon of 2010, when deteriorating U.S. economic data and rising concern about the EU sovereign-debt crisis sent investors scurrying to safer fare. By the end of the year, the flow of capital reversed, with improvements in the U.S. economy prompting investors to shift funds to equities and other riskier assets.

In 2011 Treasury yields plunged once again, compliments of renewed worry about the EU sovereign-debt debacle and another soft patch for the U.S. economy, before rising again as the stock market rallied into year-end.

Source: Bloomberg

The Cliff’s Notes version: The Alerian MLP Index has posted strong returns when interest rates have ticked up; when interest rates have trended lower, the benchmark index has tumbled. That is, MLPs’ stock prices have responded more to trends in the equity market than movements in interest rates.

In the current environment, the Alerian MLP Index’s fortunes have closely followed trends in the domestic economy, rallying when investors become more optimistic about the prospects for growth.

That’s not to suggest that higher interest rates won’t affect MLPs, which rely on the capital markets to finance acquisitions and organic growth projects. Access to low-cost debt and equity capital has fueled distribution growth and enabled MLPs to construct the necessary infrastructure to support the frenzied drilling activity in U.S. shale oil and gas plays.

But as I stated in The Truth about Dividend-Paying Stocks and Interest Rates, interest rates are unlikely to rise meaningfully until the economy recovers. Our forecast calls for U.S. gross domestic product to grow haltingly and at a subdued rate in the next few years.

Meanwhile, robust demand for takeaway capacity in prolific shale oil and gas plays shows no sign of slowing. MLPs continue to secure ample contract coverage before breaking ground on new midstream infrastructure, locking in reliable income streams that will support distribution growth.

Inexpensive financing and a full slate of growth opportunities have enabled several of my favorite MLPs to grow their quarterly payouts at an accelerated rate, pushing the stock prices to all-time highs.

Rising interest rates would threaten the bull market for energy-related MLPs, though blue-chip players such as Enterprise Products Partners LP (EPD, Financial) that enjoy superior access to capital will have a competitive advantage. At the same time, a stronger economy would improve the profitability of many projects, presumably offsetting some of the impact from higher interest rates.

As long as our picks have access to cheap debt and equity capital, we can look forward to solid distribution growth. Instead of the daily babble about interest rates, investors should focus on company-specific developments – that’s what will tip us off to deteriorating business conditions.