The S&P 500 Index still has not recovered since I last covered it at the end of April. After observing key metrics in recent days, I unfortunely believe the benchmark index remains overvalued and is unlikely to rebound anytime soon.

According to Goldman Sachs analyst David Kostin, "Our economists estimate a 35% probability that the U.S. economy will enter a recession during the next two years and believe the yield curve is pricing a similar likelihood of a contraction."

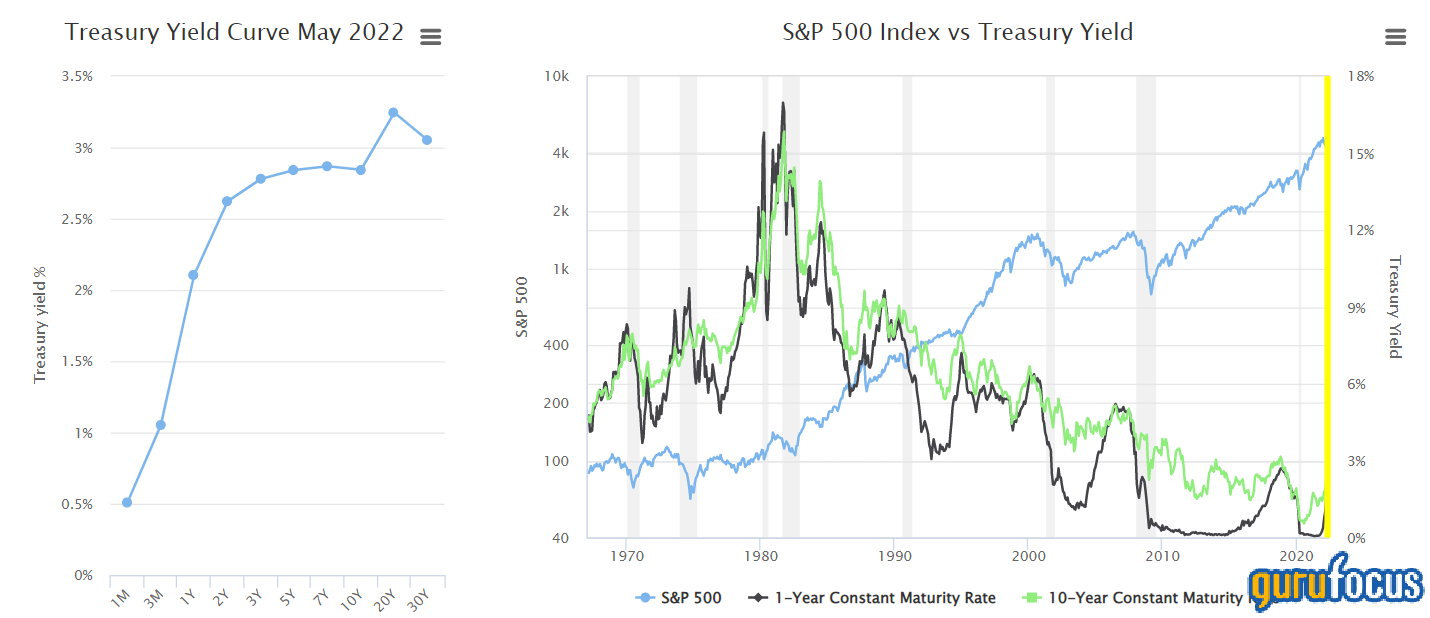

I agree with Kostin. The yield curve conveys that short-term spot rates are surging amid the expectation of aggressive interest rate hikes.

Although interest rate hikes might curb tightness in the labor market, they will not necessarily subdue the globe's ongoing supply chain issues. In fact, supply-side inflation from Covid-19 pandemic lockdowns in China and high freight costs tables a base case for prolonged inflation.

The supply-side issues coupled with rising interest rates will likely erode consumer spending power. Thus, the S&P 500's earnings yield is expected to contract, which doesn't bode well from a valuation vantage point considering the rising 10-year Treasury Yield.

Source: Yardeni Research.

What history tells us

Since World War II, the S&P 500 has sustained its presence through 12 recessions, which has seen the index draw down by a median of 24%. If it is measured from January 2022, the index is down by approximately 18%, suggesting another drop is potentially coming.

Furthermore, the S&P 500's earnings yield tends to contract by 13% during recessionary periods, which is likely still a long way off as the index's yield continues to hold at the 4 times handle. However, it needs to be considered that the S&P 500's PEG ratio of 1.2 suggests it is trading at a premium to the earnings yield, which wasn't the case at the turn of the year when the PEG ratio only stood at 0.9.

Source: Yardeni Research.

How can investors escape the bear market?

Long and short-term time series analysis tells us that investors prefer high-dividend, low-volatility and high-quality stocks during contractionary periods. These stocks usually exhibit strong balance sheets, industry strongholds and solid return metrics.

A few examples include Chevron Corp. (CVX, Financial), The Coca-Cola Co. (KO, Financial), Alphabet Inc. (GOOG, Financial)(GOOGL, Financial), Pfizer Inc. (PFE, Financial), Bank of America Corp. (BAC, Financial) and Exxon Mobil Corp. (XOM, Financial).

The bottom line

The S&P 500 still is not in great shape as its critical influencing factors and valuation metrics are not aligned toward the upside. Moreover, statistically, the benchmark index tends to lose more value than it already has whenever a contractionary bear market has occurred.