According to the All-in-One Screener, a Premium feature of GuruFocus, five stocks that Ron Baron (Trades, Portfolio) and Daniel Loeb (Trades, Portfolio) both agree on and have outperformed the Standard & Poor’s 500 index over the past three months are UnitedHealth Group Inc. (UNH, Financial), Danaher Corp. (DHR, Financial), TransDigm Group Inc. (TDG, Financial), Membership Collective Group Inc. (MCG, Financial) and ION Acquisition Corp. 3 Ltd. (IACC, Financial).

U.S. markets end week lower as inflation remains near 40-year high

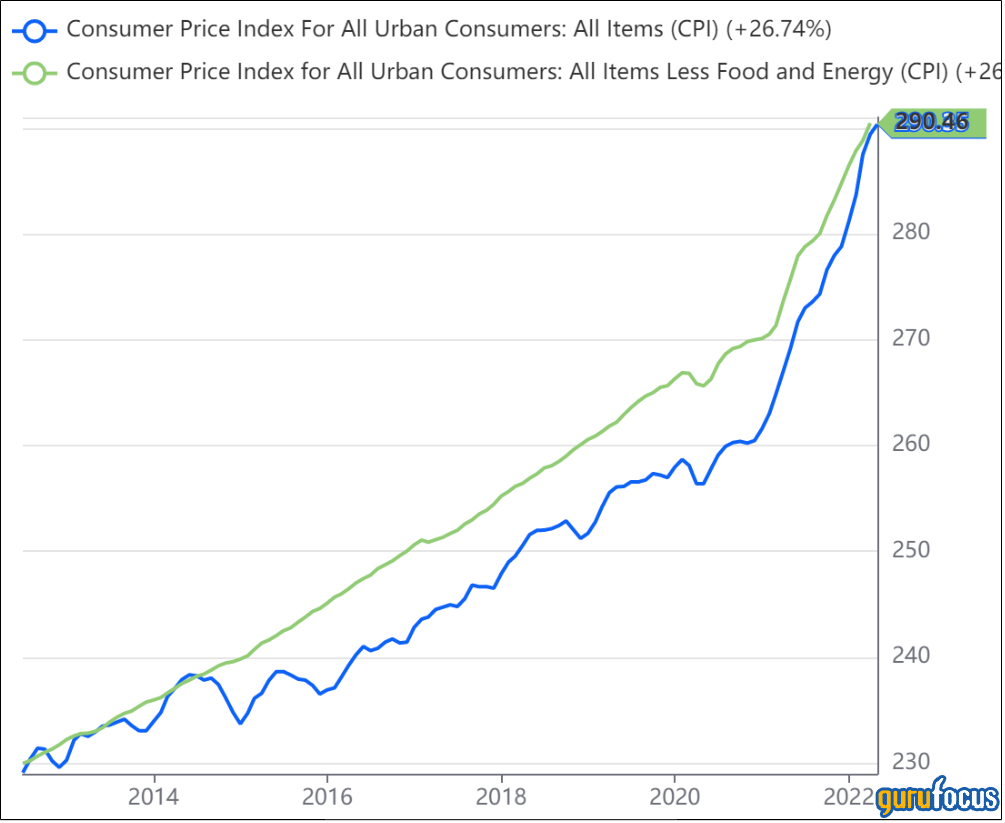

On Friday, the U.S. stock indexes tumbled at least 2% on the back of the consumer price index surging 8.6% year over year during May, the highest level since 1981 and outpacing the Dow Jones estimated growth of 8.3% year over year. Excluding food and energy prices, the core consumer price index accelerated 6% year over year, compared to the consensus estimate of 5.9% growth year over year.

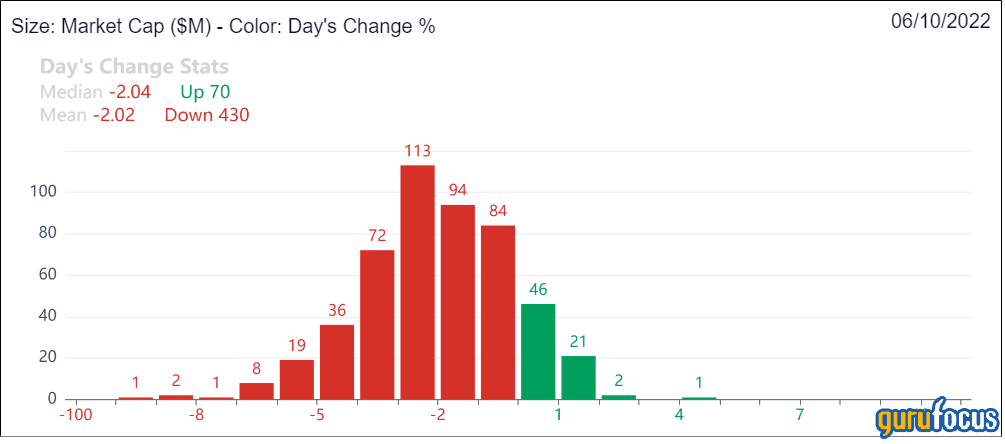

According to the aggregated statistics chart, a Premium feature of GuruFocus, the mean day’s change for S&P 500 stocks is -2.02% with a median of -2.04%.

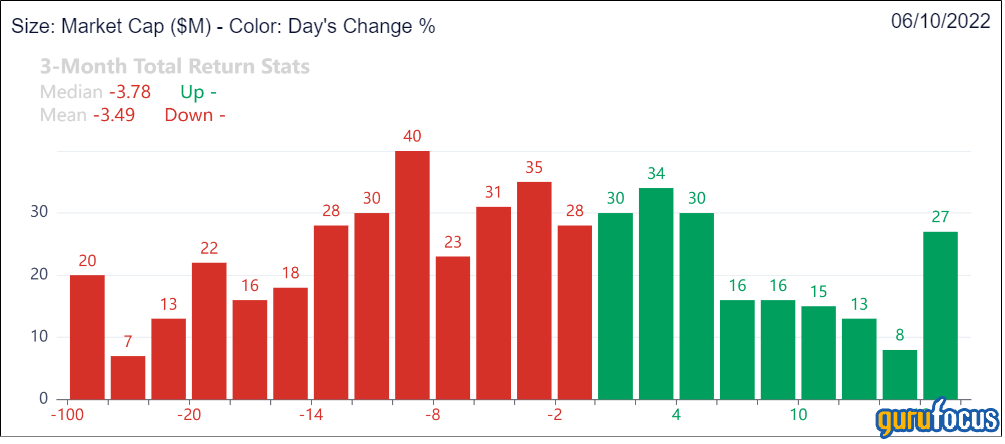

Likewise, the mean three-month total return for S&P 500 stocks is -3.49% with a median of -3.78%.

Baron and Loeb had high returns since inception, according to GuruFocus’ Score Board

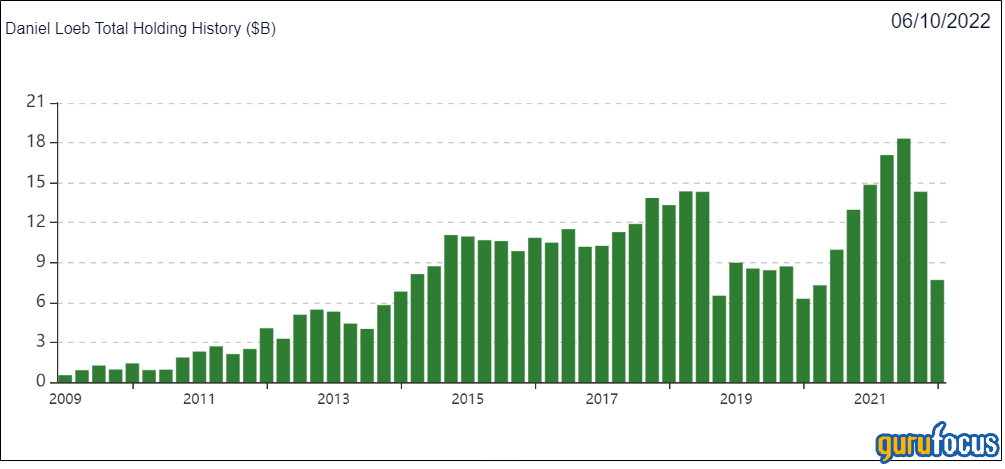

According to the Score Board of Gurus, Baron’s Baron Partners Fund has returned approximately 16.80% per year since inception in 1992, while Loeb’s Third Point Master Fund has returned approximately 16.90% per year since inception in 1995.

Baron’s New York-based firm invests primarily in small and mid-size companies that have open-ended growth opportunities and defensive niches. The firm applies a value-oriented, bottom-up approach to investing.

Likewise, Loeb’s firm follows an event-driven, value-oriented investment style: Third Point seeks undervalued companies in which a catalyst event can unlock value for shareholders.

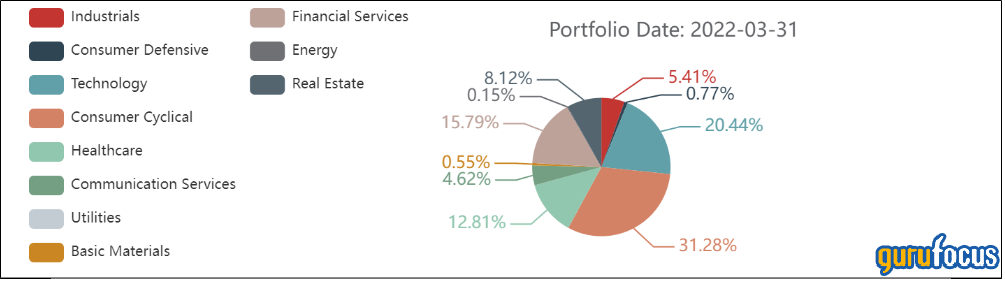

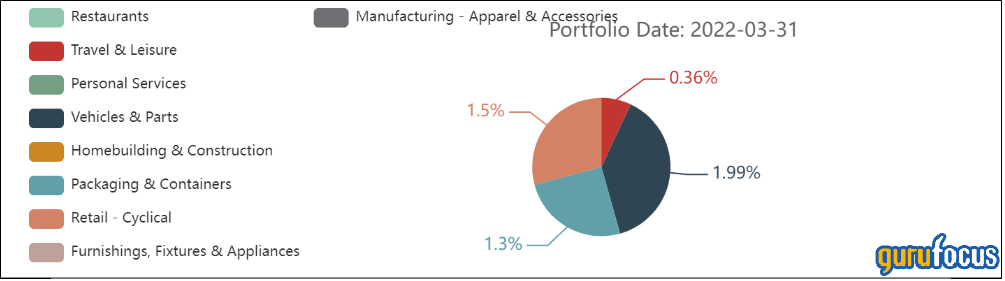

As of March, Baron’s $40.74 billion 13F equity portfolio contains 387 stocks with a quarterly turnover ratio of 4%. Likewise, Third Point’s $7.68 billion 13F equity portfolio contains 75 stocks with a quarterly turnover ratio of 15%.

Investors should be aware that 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

The All-in-One Screener listed five stocks that Baron and Loeb both agree on and outperformed the S&P 500 benchmark over the past three months.

UnitedHealth Group

Baron and Third Point have a combined weight of 4.07% in UnitedHealth Group (UNH, Financial).

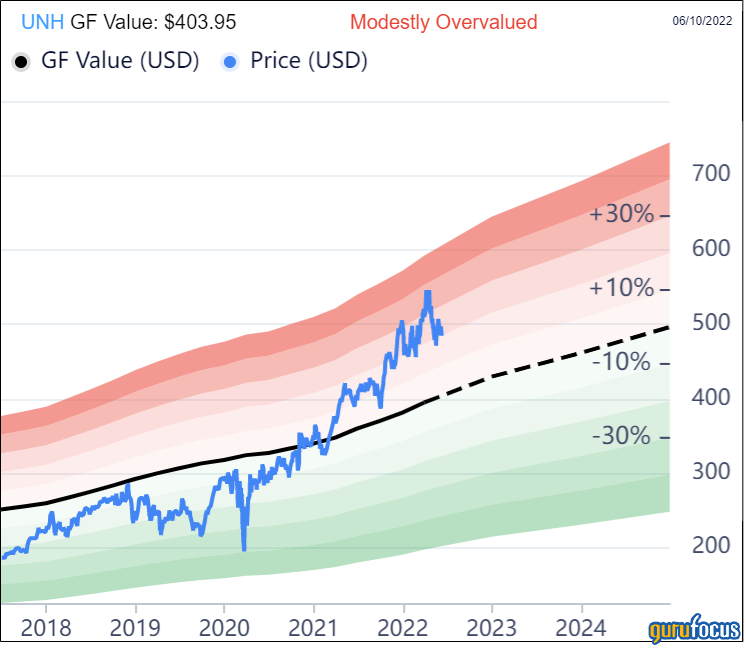

Shares of UnitedHealth Group traded around $484.63, showing the stock is modestly overvalued based on Friday’s price-to-GF Value ratio of 1.20. The stock outperformed the S&P 500 by approximately 6.88% during the past three months.

The Minnetonka, Minnesota-based health plans company has a GF Score of 89 out of 100 based on a growth rank of 10 out of 10, a profitability rank of 9 out of 10, a financial strength rank of 7 out of 10, a momentum rank of 6 out of 10 and a GF Value rank of 3 out of 10.

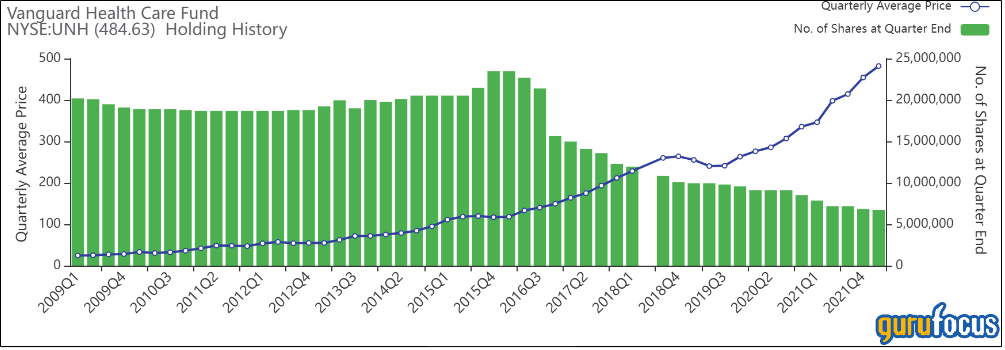

Other gurus with holdings in UnitedHealth Group include the Vanguard Health Care Fund (Trades, Portfolio) and Dodge & Cox.

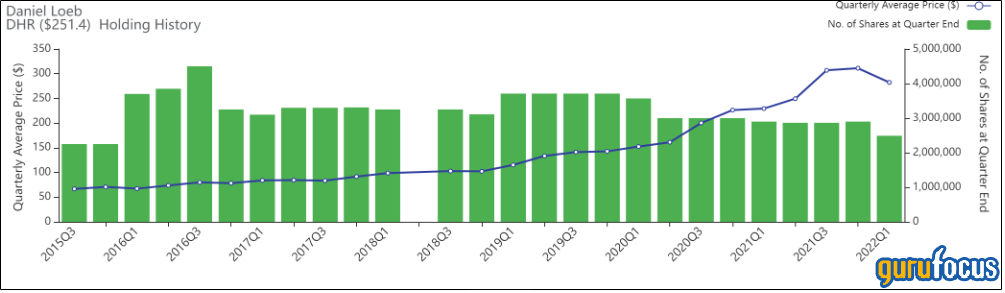

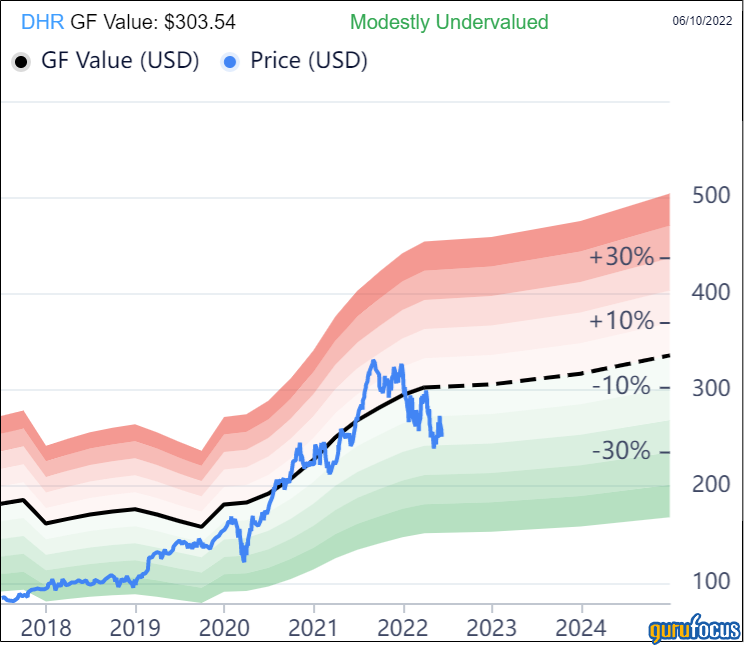

Danaher

Baron and Third Point have a combined weight of 9.51% in Danaher (DHR, Financial).

Shares of Danaher traded around $251.48, showing the stock is modestly undervalued based on Friday’s price-to-GF Value ratio of 0.83. The stock outperformed the S&P 500 by approximately 3.60% during the past three months.

The Washington, D.C.-based medical diagnostics and research company has a GF Score of 89 out of 100, driven by a GF Value rank of 9 out of 10, a rank of 8 out of 10 for profitability and growth, a momentum rank of 7 out of 10 and a financial strength rank of 6 out of 10.

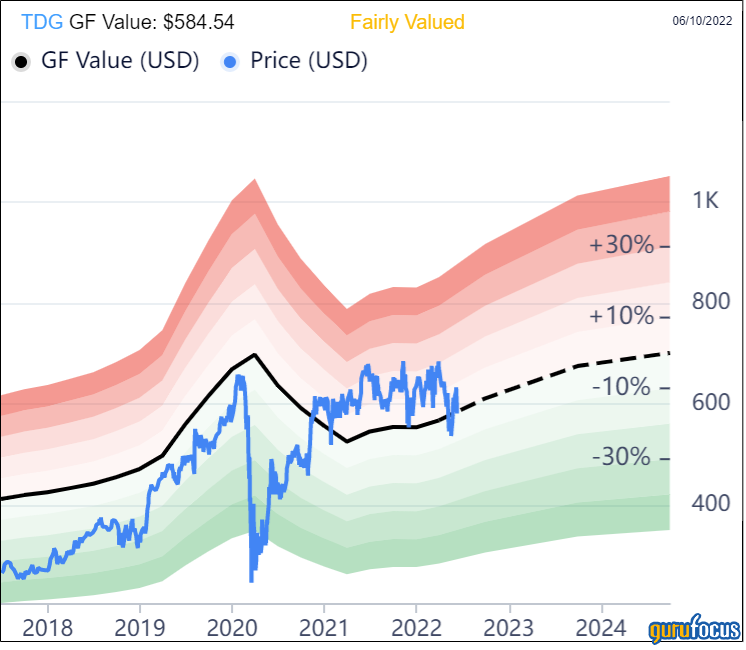

TransDigm

The two firms have a combined holding of 1.56% in TransDigm (TDG, Financial).

Shares of TransDigm traded around $581.13, showing the stock is fairly valued based on Friday’s price-to-GF Value ratio of 0.99. The stock has outperformed the S&P 500 by approximately 1.68% during the past three months.

The Cleveland-based aerospace and defense company has a GF Score of 87 out of 100: Although the company has a momentum rank of 10 out of 10 and a rank of 9 out of 10 for profitability and growth, TransDigm has a financial strength rank of just 3 out of 10 and a GF Value rank of just 5 out of 10.

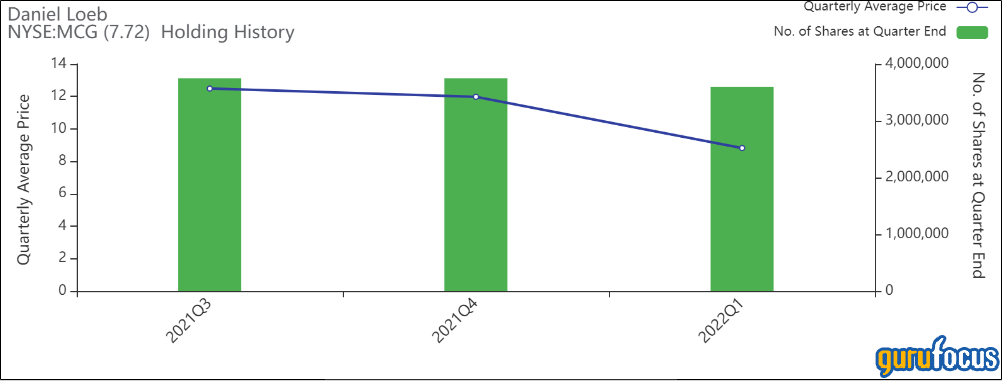

Membership Collection Group

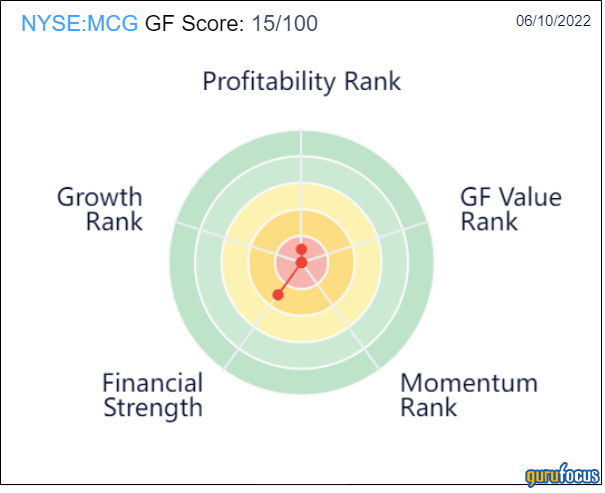

The two firms have a combined weight of 0.38% in Membership Collection Group (MCG, Financial).

Shares of Membership Collection Group traded around $7.76 on Friday. The stock has outperformed the S&P 500 by approximately 21.20% over the past three months.

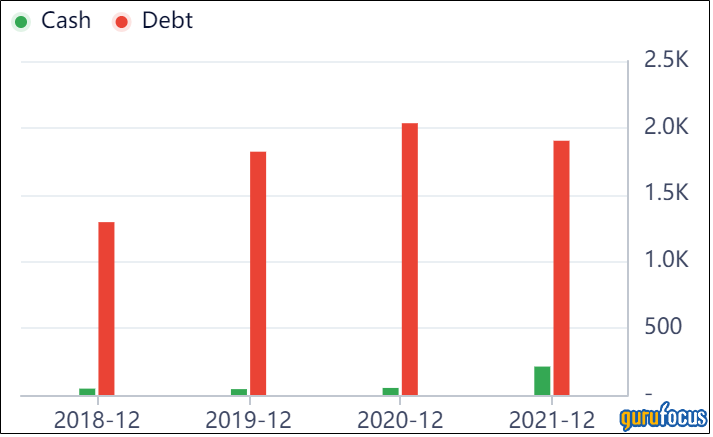

The U.K.-based membership platform company has a financial strength rank of 3 out of 10 on the back of debt-to-equity ratios underperforming more than 90% of global competitors.

The company does not have enough data to compute a GF Value rank, a momentum rank and a growth rank and thus, the GF Score may give an incomplete picture of the stock’s potential.

ION Acquisition Corp. 3

The two firms have a combined weight of 0.23% in ION Acquisition Corp. 3 (IACC, Financial).

The Israeli special purpose acquisition company seeks to find suitable technology and innovation-driven companies for merger opportunities.