Investment firm Dodge & Cox disclosed last week it upped its stake in II-VI Inc. (IIVI, Financial) by 63.42%.

Founded in 1930, the San Francisco-based investment firm takes a classic long-term value approach, steering clear of popular companies that trade at premium prices. Rather, its managers prefer to conduct in-depth research into companies trading at low valuations that have promising earnings and cash flow growth prospects.

According to GuruFocus Real-Time Picks, a Premium feature based on 13D filings, the firm invested in 4.3 million shares of the tech company on May 31, which had an impact of 0.16% on the equity portfolio. The stock traded for an average price of $62.50 per share on the day of the transaction.

Dodge & Cox now holds 10.9 million shares total, accounting for 0.42% of the equity portfolio. GuruFocus estimates the firm has lost 11.38% on the investment since establishing it in the fourth quarter of 2021.

The company headquartered in Saxonburg, Pennsylvania, which manufactures optical materials and semiconductors, has a $61.08 billion market cap; its shares were trading around $57.26 on Monday with a price-earnings ratio of 31.63, a price-book ratio of 1.89 and a price-sales ratio of 2.03.

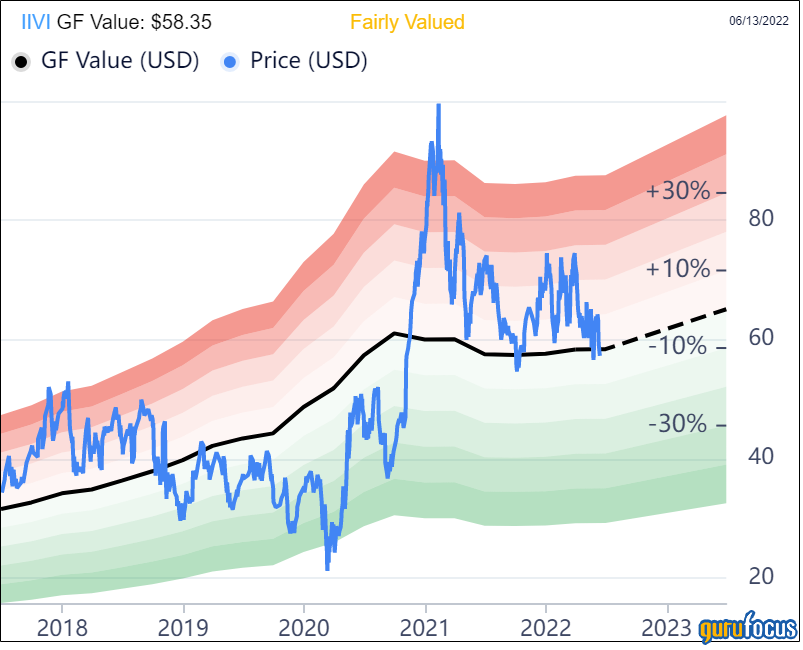

The GF Value Line suggests the stock is fairly valued currently based on historical ratios, past financial performance and future earnings projections.

The GF Score of 93 out of 100 also suggests the company has strong outperformance potential moving forward. It received high marks for momentum, growth and profitability as well as middling ranks for financial strength and GF Value.

On May 10, II-VI reported its third-quarter 2022 results. It posted adjusted earnings of 95 cents per share on $828 million in revenue.

In a statement, Dr. Vincent D. Mattera Jr., the company’s chair and CEO, commented on the “record-breaking” quarter.

“Clearly, we continue to benefit from a broad and diverse portfolio of differentiated products that serve a rapidly growing list of industry-leading customers,” he said. “Our substantial investments in innovation and scale, our ability to integrate our offerings in large and fast-growing markets, and our diversification strategy has become increasingly well-known and regarded industry-wide.”

GuruFocus rated II-VI’s financial strength 6 out of 10 despite having weak interest coverage and a low Altman Z-Score of 2.29, which indicates the company is under some pressure due to assets building up at a faster rate than revenue is growing. The return on invested capital is also eclipsed by the weighted average cost of capital, meaning the company is struggling to create value as it grows.

The company’s profitability fared better with an 8 out of 10 rating. Although the operating margin is in decline, the returns on equity, assets and capital are outperforming versus competitors. II-VI also has a moderate Piotroski F-Score of 5 out of 9, suggesting conditions are typical for a stable company. Due to a decline in revenue per share in recent years, the predictability rank of three out of five stars is on watch. GuruFocus data shows companies with this rank return an average of 8.2% annually over a 10-year period.

Of the gurus invested in II-VI, Dodge & Cox has the largest stake with 10.32% of its outstanding shares. Barrow, Hanley, Mewhinney & Strauss, Chuck Royce (Trades, Portfolio), First Eagle Investment (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio) also have positions in the stock.

Portfolio composition and performance

Dodge & Cox’s $164.57 billion 13F equity portfolio was composed of 198 stocks as of the end of the first quarter of 2022. The financial services sector had the largest representation at 23.30%, followed by the health care (17.97%) and technology (16.87%) spaces.

Other hardware companies the firm held as of March 31 included Apple Inc. (AAPL, Financial), Motorola Solutions Inc. (MSI, Financial), TE Connectivity Ltd. (TEL, Financial), Cisco Systems Inc. (CSCO, Financial), Hewlett Packard Enterprise Co. (HPE, Financial), Corning Inc. (GLW, Financial) and Juniper Networks Inc. (JNPR, Financial).

GuruFocus data shows Dodge & Cox’s Stock Fund returned 31.73% in 2021, outperforming the S&P 500’s 28.7% return.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.