After obtaining two seats on New Relic Inc.’s (NEWR, Financial) board earlier this month to help improve performance, investment firm Jana Partners (Trades, Portfolio) revealed on Tuesday it upped its stake by 307.20%.

Taking a value-oriented, event-driven approach to picking stocks, the New York-based firm founded in 2001 by Barry Rosenstein often enters activist positions in order to help unlock value for shareholders.

Having established the position in the first quarter of the year, GuruFocus Real-Time Picks, a Premium feature based on 13D, 13G and Form 4 filings, showed the activist firm picked up 2.6 million shares of the San Francisco-based software company on June 8, impacting the equity portfolio by 8.25%. The stock traded for an average price of $52.06 per share on the day of the transaction.

Jana now holds 3.53 million shares total, which represent 10.94% of the equity portfolio. It was the eighth-largest holding as of the end of the first quarter according to the 13F report. GuruFocus estimates the firm has lost 5.21% on the investment so far.

The company, which develops cloud-based software analytics solutions to help websites and apps track the performance of their services, has a $3.61 billion market cap; its shares were trading around $53.75 on Friday with a price-book ratio of 10.91 and a price-sales ratio of 4.34.

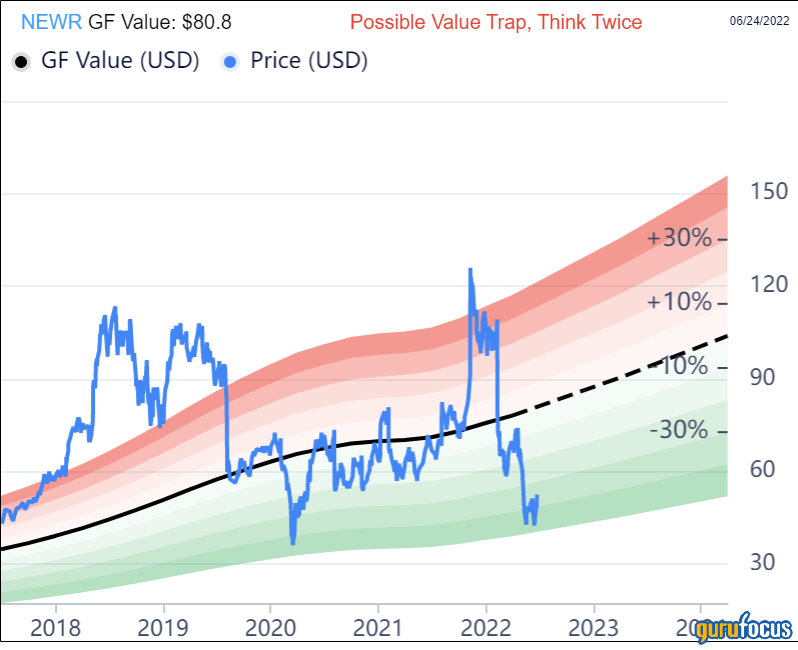

The GF Value Line suggests the stock, while undervalued, is a possible value trap currently based on historical ratios, past financial performance and future earnings projections. As such, potential investors should do thorough research before making a decision.

On June 6, New Relic announced it reached an agreement with Jana. According to the terms of the deal, the company agreed to accept the resignation of three current board members, Adam Messinger, Dan Scholnick and Jim Tolonen. It appointed Kevin Galligan, partner and director of research at Jana Strategic Investments, and Susan D. Arthur, the CEO of CareerBuilder, to replace them.

In exchange, Jana agreed to withdraw its director nomination notice, which was released on May 20, and to abide by certain customary standstill provisions.

Separately, the company also appointed Phil Bhat to the board.

In a statement, Vice Chair and Lead Independent Director Hope Cochran commented on the arrangement.

“We are pleased with the constructive engagement we have had with Jana, as we do with all shareholders, and welcome Kevin and Susan to the New Relic Board,” she said. “We are confident that with their diversified expertise and relevant experience, Kevin and Susan will add valuable perspective in the boardroom as we execute on our strategic plan to accelerate growth and drive shareholder value.”

In May, the company reported its fourth-quarter and full-year 2022 results. It posted an adjusted earnings loss of 24 cents per share on $206 million in revenue for the quarter. Both figures were up from the prior-year quarter.

For the full year, it recorded an adjusted net loss of 77 cents on revenue of $786 million. While revenue was up from 2021, the net loss widened.

GuruFocus rated New Relic’s financial strength 5 out of 10. In addition to a low Altman Z-Score of 1.57 that warns the company could be at risk of bankruptcy, it may be becoming less efficient since assets are building up at a faster rate than revenue is growing.

The company’s profitability did not fare as well, scoring a 3 out of 10 rating on the bank of negative margins and returns on equity, assets and capital that underperform a majority of competitors. New Relic also has a low Piotroski F-Score of 3 out of 9, meaning operations are in poor shape, and a predictability rank of one out of five stars. According to GuruFocus research, companies with this rank return an average of 1.1% annually over a 10-year period.

Of the gurus invested in New Relic, Jana has the largest stake with 5.27% of its outstanding shares. Steven Cohen (Trades, Portfolio) and Baillie Gifford (Trades, Portfolio) also own the stock.

Portfolio composition

As of the three months ended March 31, Jana had 28.30% of its $1.54 billion equity portfolio, which consisted of nine stocks, invested in the technology sector. Consumer defensive had the second-largest representation at 28.28%, followed by the health care space at 20.79%.

Based on 13F data, the firm’s top five holdings as of the end of the first quarter were Zendesk Inc. (ZEN, Financial), Conagra Brands Inc. (CAG, Financial), Mercury Systems Inc. (MRCY, Financial), Encompass Health Corp. (EHC, Financial) and Treehouse Foods Inc. (THS, Financial).

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.