Starbucks is an international specialty coffee chain that began paying and growing a dividend in 2010.

-Seven Year Revenue Growth Rate: 12%

-Seven Year EPS Growth Rate: 19%

-Current Dividend Yield: 1.29%

-Balance Sheet Strength: Quite Strong

I believe that Starbucks may represent a decent purchase at the current price, but the high valuation leaves little margin of error, and drives down the dividend yield despite the company’s reasonable dividend payout ratio. I’d therefore look for price dips rather than purchasing shares at the current price.

In 2011, 69% of total Starbucks revenue came from their U.S. segment, 22% came from their International segment, 7% came from their Global Consumer Products Group, and 2% came from “other”.

The company controls over 17,000 stores around the world, of which approximately half are company owned, and half are licensed. Of these stores, over 10,700 of them are in the United States, and approximately two-thirds of the U.S. ones are company-operated with the other third being licensed. The opposite is true for the 6,200+ international stores, where approximately one third are company-operated and the other two thirds are licensed. As of 2011, over 80% of revenue comes from the company-operated stores.

Three quarters of the retail sales mix are from beverages, with the majority of the rest coming from food, and few percent from packaged products.

Price to Free Cash Flow: 44

Price to Book: 8

Return on Equity: 28%

(Chart Source: DividendMonk.com)

Starbucks is still experiencing strong growth. Revenue grew at 12% per year over the last 7 year period, and grew Free Cash Flow by 15% per year over this same period, albeit at a more erratic pace.

The company opened its 500th Chinese location in 2011, and expects to have 1,500 open in 2015. Overall, with increasing store counts, especially internationally, Starbucks appears to have a lot of room to run.

(Chart Source: DividendMonk.com)

Earnings per share grew by 19% annually, on average, over this 7 year period, which is quite fast.

The company has not yet proved itself as a consistent dividend payer, having initiated the dividend in 2010. Their first quarterly dividend was $0.10, paid once, followed by five quarters of paying $.13, followed by three quarters of paying $0.17.

With a 1.29% dividend yield, Starbucks may not seem like much of a dividend payer. It’s certainly below the yield threshold for which I’d typically classify a company as a dividend stock. It’s worth noting, though, that this low yield is due primarily to the stock valuation at over 30x earnings, which drives the yield down. The dividend payout ratio out of earnings is quite respectable, at 40%, which is higher than some 2% and 3% yielding companies I’ve published stock reports for, such as Medtronic or Chevron.

How Starbucks Uses Its Cash

In 2011, Starbucks brought in a reported $1.6 billion or so in operating cash flow, and $530 million or so in capital expenditure, resulting in a bit under $1.1 billion in free cash flow.

Starbucks historically has not put a lot of money towards acquisitions, and reported only $56 million in net acquisition costs for the year (though the 2012 will be a bit higher). The company paid about $390 million in dividends, and spent about $556 million on share repurchases. Since $235 million worth of shares was issued over this period (which looks a rather high to me, especially if I were a shareholder), the net share repurchase sum was around $321 million. Overall, I think the company could do well by shareholders by spending a bit more on dividends, and a bit less towards share repurchases and issuance of shares.

The total debt to equity ratio is only around 11%, the total debt to income ratio is well below 100%, and the interest coverage ratio is over 40. Because Starbucks doesn’t spend a ton of cash on acquisitions, goodwill makes up a rather small portion of total shareholder equity.

I think initiating a dividend in 2010 was a good move for shareholders, even if it is somewhat obscured by a high valuation that drives the yield down on an otherwise respectable payout ratio. Time will tell if the dividend demonstrates consistent growth, but I see little reason why it won’t.

The company has rather strong prospects in several international markets. The company has a strong and growing presence in China, and plans to enter India, along with a presence in dozens of other countries around the world.

Recent news included a definitive agreement to acquire La Boulange, which the company plans to integrate into many of its locations to increase the breadth, appeal, and quality of their food offerings, which could potentially increase traffic and transactions in stores, and open them up to new customers, or increase the instances of selling food to coffee buyers.

Starbucks also is developing several retail channels that can leverage the power of their brand and accelerate total growth.

There’s opportunity for expansion of the profit margin as well. In the popular mind, Starbucks and their expensive coffees may be seen as being a high profit margin business. In reality, their profit margin has room for growth. The company’s net margin has been erratic over the past decade, but the general trend has been upwards, with the current profit margin at a bit over 10%. It’s not exactly an apples to apples comparison due to retail offerings and other differences, but in comparison, McDonald’s has approximately double the net profit margin of Starbucks, and Starbucks is the one offering the premium-priced goods while McDonald’s operates the bargain meals.

The profit margins of Starbucks are in part determined by the price at which they can purchase coffee that meets their requirements. A change in coffee prices translates into a change in the bottom line. Starbucks also competes with fast food businesses such as McDonald’s, Dunkin Donuts, and several other chains that offer less expensive coffee. This requires Starbucks to continue to differentiate themselves and justify their premium coffee prices to consumers.

By expanding into juices, and especially into stronger-branded food offerings, Starbucks enters markets that it has not yet demonstrated success in, and that deviate from but potentially compliment its core business. Although the company spends comparatively little on acquisitions and so the financial loss from them is limited, distractions can negatively affect long term profitability in the core areas if not managed well.

The valuation is a risk. At over 30 times net earnings, there is a lot of estimated growth factored into the company stock. Reductions in estimates, missed targets, restricted international growth, or less-than-successful acquisitions and changes could have disproportionate effects on the stock price.

The valuation implies a substantial amount of optimism for the company, however. For example, I calculate that the current valuation is reasonably fair if 14% annual free cash flow growth over the next decade, followed by 10% annual free cash flow growth over the decade after that, is achieved, and if a 10% discount rate is used.

Looking at it in another way, if the company achieves 15% annualized EPS growth over the next decade, which would imply strong top line growth, net profit margin improvement, and share reduction rather than share dilution, and an earnings multiple of 20 is placed on the company at that time, then the stock price would be around $140. If the dividend is added, this would result in a 11-12% annualized rate of return, and that’s only after a fairly optimistic scenario of revenue and EPS growth, and affixing a lower earnings multiple on what would at that point be a larger and presumably slower-growing company.

Overall, considering the significant macroeconomic issues that the world currently faces, I believe Starbucks stock shows some potential. It’s not a very good pick at all for current income despite their reasonable 40% dividend payout ratio, but if a medium-growth company is desired for a portfolio, Starbucks looks reasonable. There is, however, a fair bit of optimism already factored into the stock, so any major missteps, or a failure to meet fairly aggressive growth estimates, would likely negatively impact shareholders at this valuation. If I were interested in buying, I’d hold and look for dips, because I don’t currently view the company as offering quite enough potential long-term upside to offset the potential downside.

Full Disclosure: As of this writing, I own shares of MCD, MDT, and CVX, and have no position in SBUX.

-Seven Year Revenue Growth Rate: 12%

-Seven Year EPS Growth Rate: 19%

-Current Dividend Yield: 1.29%

-Balance Sheet Strength: Quite Strong

I believe that Starbucks may represent a decent purchase at the current price, but the high valuation leaves little margin of error, and drives down the dividend yield despite the company’s reasonable dividend payout ratio. I’d therefore look for price dips rather than purchasing shares at the current price.

Overview

Starbucks Corporation (SBUX, Financial) is a global chain for specialty coffee and other products such as teas, juices, and light foods. The company also owns the brands Seattle’s Best and Tazo tea. Starbucks sells coffee and other items at their locations, and also uses retail channels to distribute some of their products.In 2011, 69% of total Starbucks revenue came from their U.S. segment, 22% came from their International segment, 7% came from their Global Consumer Products Group, and 2% came from “other”.

The company controls over 17,000 stores around the world, of which approximately half are company owned, and half are licensed. Of these stores, over 10,700 of them are in the United States, and approximately two-thirds of the U.S. ones are company-operated with the other third being licensed. The opposite is true for the 6,200+ international stores, where approximately one third are company-operated and the other two thirds are licensed. As of 2011, over 80% of revenue comes from the company-operated stores.

Three quarters of the retail sales mix are from beverages, with the majority of the rest coming from food, and few percent from packaged products.

Ratios

Price to Earnings: 31Price to Free Cash Flow: 44

Price to Book: 8

Return on Equity: 28%

Revenue and Free Cash Flow

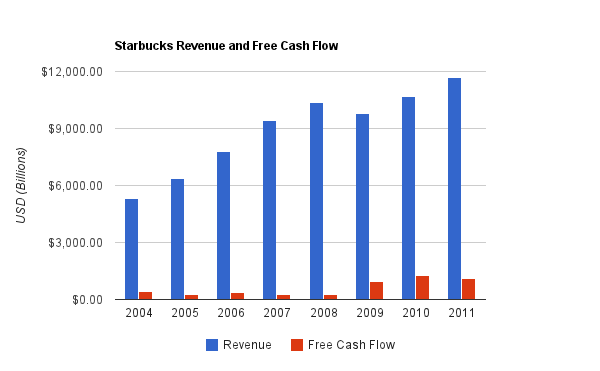

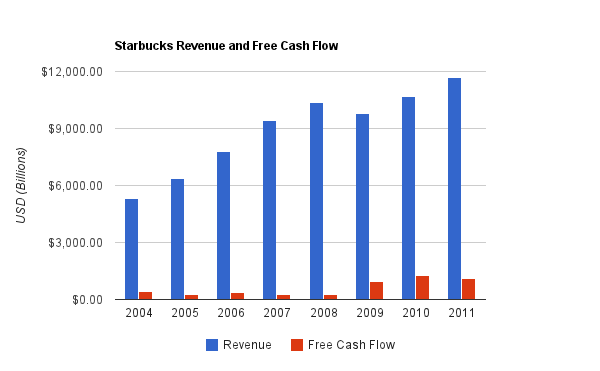

(Chart Source: DividendMonk.com)

Starbucks is still experiencing strong growth. Revenue grew at 12% per year over the last 7 year period, and grew Free Cash Flow by 15% per year over this same period, albeit at a more erratic pace.

The company opened its 500th Chinese location in 2011, and expects to have 1,500 open in 2015. Overall, with increasing store counts, especially internationally, Starbucks appears to have a lot of room to run.

Earnings and Dividends

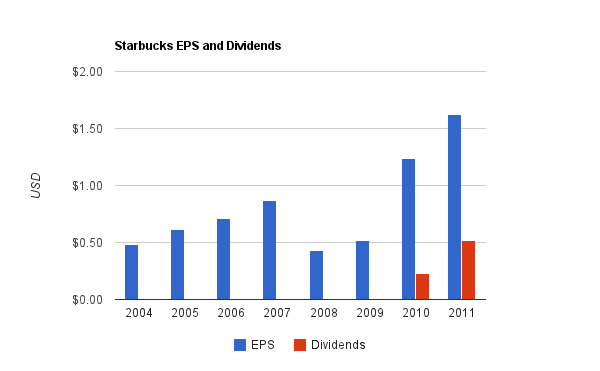

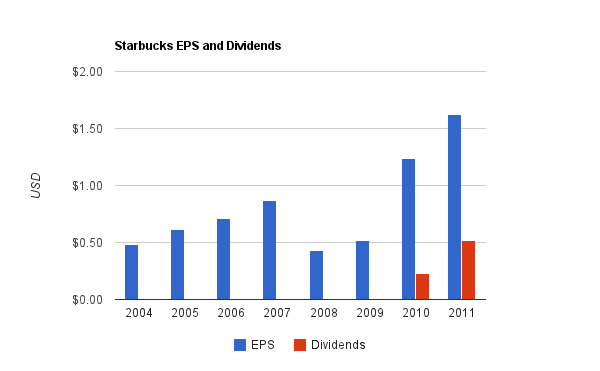

(Chart Source: DividendMonk.com)

Earnings per share grew by 19% annually, on average, over this 7 year period, which is quite fast.

The company has not yet proved itself as a consistent dividend payer, having initiated the dividend in 2010. Their first quarterly dividend was $0.10, paid once, followed by five quarters of paying $.13, followed by three quarters of paying $0.17.

With a 1.29% dividend yield, Starbucks may not seem like much of a dividend payer. It’s certainly below the yield threshold for which I’d typically classify a company as a dividend stock. It’s worth noting, though, that this low yield is due primarily to the stock valuation at over 30x earnings, which drives the yield down. The dividend payout ratio out of earnings is quite respectable, at 40%, which is higher than some 2% and 3% yielding companies I’ve published stock reports for, such as Medtronic or Chevron.

How Starbucks Uses Its Cash

In 2011, Starbucks brought in a reported $1.6 billion or so in operating cash flow, and $530 million or so in capital expenditure, resulting in a bit under $1.1 billion in free cash flow.

Starbucks historically has not put a lot of money towards acquisitions, and reported only $56 million in net acquisition costs for the year (though the 2012 will be a bit higher). The company paid about $390 million in dividends, and spent about $556 million on share repurchases. Since $235 million worth of shares was issued over this period (which looks a rather high to me, especially if I were a shareholder), the net share repurchase sum was around $321 million. Overall, I think the company could do well by shareholders by spending a bit more on dividends, and a bit less towards share repurchases and issuance of shares.

Balance Sheet

Starbucks has a particularly strong balance sheet.The total debt to equity ratio is only around 11%, the total debt to income ratio is well below 100%, and the interest coverage ratio is over 40. Because Starbucks doesn’t spend a ton of cash on acquisitions, goodwill makes up a rather small portion of total shareholder equity.

Investment Thesis

Starbucks has a lot going for it. Top line growth has been in the double digits, which allows for even faster growth of EPS.I think initiating a dividend in 2010 was a good move for shareholders, even if it is somewhat obscured by a high valuation that drives the yield down on an otherwise respectable payout ratio. Time will tell if the dividend demonstrates consistent growth, but I see little reason why it won’t.

The company has rather strong prospects in several international markets. The company has a strong and growing presence in China, and plans to enter India, along with a presence in dozens of other countries around the world.

Recent news included a definitive agreement to acquire La Boulange, which the company plans to integrate into many of its locations to increase the breadth, appeal, and quality of their food offerings, which could potentially increase traffic and transactions in stores, and open them up to new customers, or increase the instances of selling food to coffee buyers.

Starbucks also is developing several retail channels that can leverage the power of their brand and accelerate total growth.

There’s opportunity for expansion of the profit margin as well. In the popular mind, Starbucks and their expensive coffees may be seen as being a high profit margin business. In reality, their profit margin has room for growth. The company’s net margin has been erratic over the past decade, but the general trend has been upwards, with the current profit margin at a bit over 10%. It’s not exactly an apples to apples comparison due to retail offerings and other differences, but in comparison, McDonald’s has approximately double the net profit margin of Starbucks, and Starbucks is the one offering the premium-priced goods while McDonald’s operates the bargain meals.

Risks

Starbucks must balance its position carefully. If the company wishes to sell specialty items at premium prices, and yet also enjoy substantial growth, then they risk diluting the way people perceive their brand. Appearing too large, and too corporate, could damage their standing among the type of customers they target. So far, the business has been quite strong.The profit margins of Starbucks are in part determined by the price at which they can purchase coffee that meets their requirements. A change in coffee prices translates into a change in the bottom line. Starbucks also competes with fast food businesses such as McDonald’s, Dunkin Donuts, and several other chains that offer less expensive coffee. This requires Starbucks to continue to differentiate themselves and justify their premium coffee prices to consumers.

By expanding into juices, and especially into stronger-branded food offerings, Starbucks enters markets that it has not yet demonstrated success in, and that deviate from but potentially compliment its core business. Although the company spends comparatively little on acquisitions and so the financial loss from them is limited, distractions can negatively affect long term profitability in the core areas if not managed well.

The valuation is a risk. At over 30 times net earnings, there is a lot of estimated growth factored into the company stock. Reductions in estimates, missed targets, restricted international growth, or less-than-successful acquisitions and changes could have disproportionate effects on the stock price.

Conclusion and Valuation

Starbucks has a very strong balance sheet, quite rapid growth for its size, ample international opportunity, the potential for increases in profitability, and diverse areas of growth potential.The valuation implies a substantial amount of optimism for the company, however. For example, I calculate that the current valuation is reasonably fair if 14% annual free cash flow growth over the next decade, followed by 10% annual free cash flow growth over the decade after that, is achieved, and if a 10% discount rate is used.

Looking at it in another way, if the company achieves 15% annualized EPS growth over the next decade, which would imply strong top line growth, net profit margin improvement, and share reduction rather than share dilution, and an earnings multiple of 20 is placed on the company at that time, then the stock price would be around $140. If the dividend is added, this would result in a 11-12% annualized rate of return, and that’s only after a fairly optimistic scenario of revenue and EPS growth, and affixing a lower earnings multiple on what would at that point be a larger and presumably slower-growing company.

Overall, considering the significant macroeconomic issues that the world currently faces, I believe Starbucks stock shows some potential. It’s not a very good pick at all for current income despite their reasonable 40% dividend payout ratio, but if a medium-growth company is desired for a portfolio, Starbucks looks reasonable. There is, however, a fair bit of optimism already factored into the stock, so any major missteps, or a failure to meet fairly aggressive growth estimates, would likely negatively impact shareholders at this valuation. If I were interested in buying, I’d hold and look for dips, because I don’t currently view the company as offering quite enough potential long-term upside to offset the potential downside.

Full Disclosure: As of this writing, I own shares of MCD, MDT, and CVX, and have no position in SBUX.