Yes. To some extent. The stock price has substantially increased since the end of 2018. It rose by about 82%. Let us begin by examining the company’s business.

Business Overview

American Tower (AMT, Financial), a Boston-based REIT (real estate investment trust), was founded in 1995. The company mainly deals in property operations and service operations.

In the property operations segment, it lets out the space on communications sites to wireless service providers, radio and television broadcast companies, wireless data providers, etc. On the other hand, service operations offer tower-related services in the United States, such as site application, zoning and permitting, and structural analysis. The service operations function as the company’s right hand. It assists with property operations, such as the addition of new tenants and communication site equipment.

According to American Towers’ 2021 Annual Report, property operations accounted for 97%, 99%, and 98% of their total revenues for the years ended December 31, 2021, 2020, and 2019, respectively, and service operations accounted for 3%, 1%, and 2% of their total revenue for the years ended December 31, 2021, 2020, and 2019, respectively.

Furthermore, the Annual Report stated that it has almost 220,000 communications infrastructure assets, of which more than 43,000 are in the United States and Canada, nearly 76,000 in Asia-Pacific, more than 22,000 in Africa, more than 30,000 in Europe, and nearly 49,000 in Latin America.

Experienced Management

The company has a team of experienced management and leadership. Steven B. Dodge was the co-founder of this global leader. He nurtured the company until his resignation in 2004.

Mr. Thomas A. Bartlett has served as the CEO of the company since March 2020. In his overall career, he spent almost 25 years with Verizon Communications. He is a dynamic person who has taken Covid as an opportunity and is striving to push his company toward the 5G era to improve the quality of life of people across the globe. He aims to increase the rate of growth in the international market as compared to the US market.

In the Top Players

With the oligopolistic-like market condition, American Tower has few competitors, namely Crown Castle International (CCI, Financial) and SBA Communications (SBAC, Financial) in the USA. These three dominate the sector in the USA. There are about 131 tower companies handling 130,899 towers, out of which around 76% are owned by these three giants domestically. The remaining ones, like Vertical Bridge and United States Cellular (USM, Financial), own a mere 7% of the towers.

Being a global giant, with around 218,000 towers over six continents, American Tower Co. also brings competition from companies like Indus Towers (BOM:534816, Financial) in India which is the largest market for American Tower. In India, Indus Towers owns 184,748 towers and American Towers owns 75,000. Cellnex Telecom (CLNXF, Financial) and Vantage Towers (VTAGY, Financial), the two European peers, own around 101,802 and 82,200 towers over Europe.

Growing rapidly

As per the Q1 2022 earnings conference call, the company believes they are strategically positioned to capture incremental demand from global 4G and 5G deployment initiatives. They expect to see accelerating Hybrid IT and multi-cloud deployments drive, increasing the demand for a highly interconnected portfolio. This would result in opportunities to selectively deploy capital toward high-yield development projects.

With the beginning of the 5G revolution, the company anticipates that the demand for their data center campuses over the coming years would accelerate, pushing storage and compute requirements further out to the network edge.

In the slide below, the company anticipates the total Mobile traffic growth in the U.S. is expected to grow at 25% CAGR through at least 2027.

As per the company's Q1 2022 Financial and Operational Update, to cope with the growing mobile traffic, Stand and Deliver is the strategy for the next decade which they plan to seek by the following means:

- Improving the internal processes, maximizing leasing growth, investing in and deploying more renewable energy solutions which would help to drive the operational efficiency

- Focusing more on classic macro tower investment opportunities, seeking more of incremental investments and securing the franchise communications real estate assets will help them grow the portfolio.

- Expand the platform by positioning itself for the 5G world, leveraging its existing assets for additional applications, and evaluating new communications real estate architectures

- Company would also want to enhance its leadership by elevating its position as preferred communications real estate partner for existing and new customers and also expand the reach of mobile broadband.

But Valuations Seem High

American Tower seems to be trading at higher valuations. The stock trades at a price-to-earnings ratio of 44.38, which is higher than the industry average of 13.36. Similarly, the price-to-book seems to be higher than the industry average.

The company’s free cash flows have been rising over the past few years. As per data provided by GuruFocus, in the past five years, it has risen by 9.40%. However, its prices have risen at a rapid rate of 87.81% in the same period. Perhaps the growth plans are fuelling the stock price. No wonder the company’s price-to-free-cash-flow ratio stands tall at 39.49

However, it has good returns with an ROE of 54.51%. The stock also provides a dividend yield of 2.15%

Stretched Balance Sheet

The company’s balance sheet seems quite stretched.

As per American Tower’s 10-Q for Q1 2022, it had $38 billion of long-term obligations. However, it had about $1.9 billion in cash and equivalents. Such a high level of debt weighs on the company’s financial strength and flexibility.

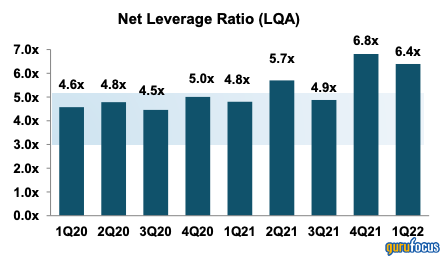

As per the company’s presentation, its net leverage ratio stands at 6.4 times. That has risen over the past quarters. The company intends to lower it to 3-5 times.

Also, the company’s ongoing expansion plans will require further capital investment. This could put more pressure on the company’s financials.

Overall

American Tower, one of the giant telecommunications companies, does have a strong growth record. Its revenues, as well as cash flows, have been soaring in the past few years. Plus, its expansion plans will lead to higher future earnings. Its market positioning and global presence are other plus points in its favor.

However, we do not understand American Tower’s current price. Though the company is expected to grow rapidly in the coming future, does the high valuation and stretched balance sheet justify it as an investment opportunity?

Disclaimer/Disclosure

We don’t have any beneficial long-term position in the shares of American Tower, either through stock ownership, options, or other derivatives. We wrote this article to express our opinions. We are not receiving compensation from any individual or entity for it.

You should not treat any opinion expressed in this article as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of our opinion. This is not investment advice. Before you invest in anything you might possibly read in our articles or those of the other people offering investment advice online, do your own research to verify the soundness of what you might have read. Please consult your investment advisor before making any decisions.