Daniel Loeb (Trades, Portfolio), manager of Third Point Offshore, disclosed in a regulatory filing that its top trades during the second quarter included an activist stake in Walt Disney Co. (DIS, Financial). The firm also took new positions in Colgate-Palmolive Co. (CL, Financial) and Antero Resources Corp. (AR, Financial) and boosted its stake in Ovintiv Inc. (OVV, Financial).

The New York-based firm follows an event-driven, value-oriented investing style. Third Point identifies situations in which a catalyst event could unlock shareholder value and pushes for change to unlock said value.

As of June, the firm’s $7.68 billion 13F equity portfolio contains 75 stocks, with 10 new positions and a quarterly turnover ratio of 15%. The top four sectors in terms of weight are health care, energy, utilities and technology, representing 23.27%, 18.26%, 17.79% and 12.71% of the equity portfolio.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Walt Disney

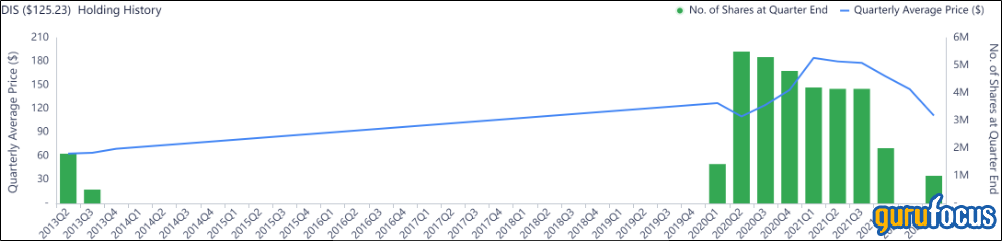

Having sold out of Walt Disney (DIS, Financial) during the first quarter, Third Point purchased 1 million new shares during the second quarter, giving the position 2.23% equity portfolio weight.

Shares of Walt Disney averaged $111.41 during the second quarter; the stock is modestly undervalued based on Tuesday’s price-to-GF Value ratio of 0.79.

Loeb discussed in a letter to Disney CEO Bob Chapek several initiatives to unlock shareholder value, including the spinoff of the Burbank, California-based entertainment giant’s ESPN business. The investor considered whether the two companies will be better off separated and if the needs of customers will be better served.

Walt Disney has a GF Score of 77 out of 100 based on a GF Value rank of 10 out of 10, a profitability rank of 8 out of 10, a growth rank of 3 out of 10 and a rank of 5 out of 10 for financial strength and momentum.

Other gurus with holdings in Disney include PRIMECAP Management (Trades, Portfolio) and Diamond Hill Capital (Trades, Portfolio).

Colgate-Palmolive

Third Point purchased 1.985 million shares of Colgate-Palmolive (CL, Financial), giving the position 3.77% weight in its equity portfolio. Shares averaged $78.16 during the second quarter; the stock is fairly valued based on Tuesday’s price-to-GF Value ratio of 0.98.

The New York-based home care company has a GF Score of 82 out of 100 based on a momentum rank of 10 out of 10, a profitability rank of 8 out of 10, a GF Value rank of 6 out of 10 and a rank of 5 out of 10 for growth and financial strength.

Antero Resources

Third Point invested in 3,392,891 shares of Antero Resources (AR, Financial), giving the stake 2.46% equity portfolio weight. Shares averaged $36.48 during the second quarter; the stock is significantly overvalued based on Tuesday’s price-to-GF Value ratio of 2.17.

The Denver-based natural gas company has a GF Score of 66 out of 100 based on a GF Value rank of 1 out of 10, a rank of 6 out of 10 for growth and momentum and a rank of 5 out of 10 for financial strength and profitability.

Ovintiv

Third Point added 3.87 million shares of Ovintiv (OVV, Financial), expanding the position by 172% and its equity portfolio by 4.05%.

Shares of Ovintiv averaged $51.58 during the second quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF Value ratio of 1.25.

The Denver-based oil and gas company has a GF Score of 72 out of 100 based on a profitability rank of 7 out of 10, a momentum rank of 6 out of 10, a financial strength rank of 5 out of 10, a growth rank of 4 out of 10 and a GF Value rank of 3 out of 10.

Other key trades

During the quarter, Third Point sold out of its positions in several companies, including S&P Global Inc. (SPGI, Financial), Intuit Inc. (INTU, Financial) and Avantor Inc. (AVTR, Financial). The three transactions reduced the equity portfolio by 5.13%, 4.54% and 3.68%.