Soros Fund Management LLC recently released its 13F report for the second quarter of 2022, which ended on June 30.

Founded by George Soros (Trades, Portfolio) in 1969, Soros Fund Management is the primary advisor for the Quantum Group of Funds. After helping define the modern hedge fund, the firm converted to a family office in 2011, becoming closed to outside investors. Soros’ investing principles are based on his “theory of reflexivity,” which holds that individual investor biases affect both market transactions and the economy, resulting in chaotic financial markets and the mispricing of assets.

In any given quarter, there is a good chance that most of the firm’s top trades are related to merger arbitrage opportunities – either buys for stocks that are about to be acquired, or sells for holdings that were recently acquired. However, the firm does make non-arbitrage trades as well, and one such trade that stood out in the second quarter was a new buy for leading electric vehicle maker Tesla Inc. (TSLA, Financial).

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Soros goes long on Tesla

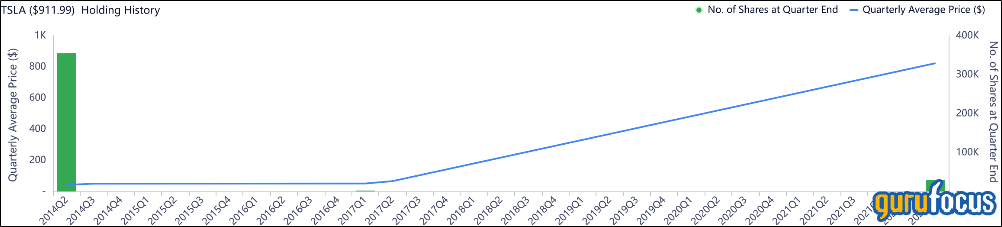

Soros’ firm ended the quarter with 29,883 shares of Tesla (TSLA, Financial), giving the stock a weight of 0.51% in the equity portfolio at the quarter’s average share price of $822.98.

This is not the first time the firm has owned Tesla shares. It first started a position in the second quarter of 2014 worth 355,250 shares, but it sold out the very next quarter for a meagre gain. It picked up 2,000 shares in the first quarter of 2017 before once again selling out the very next quarter for a small profit.

Those were the days before Tesla truly rose to fame, and it was still unprofitable back then, so perhaps Soros got cold feet due to the uncertain future, was uncomfortable with the negative bottom line or just wanted to make a short-term bet.

Now that Tesla is profitable and appears to have a bright future ahead of it, perhaps Soros could finally be thinking of investing for the long haul. There are a few stocks that have remained in his portfolio for many quarters despite the high turnover, such as Liberty Broadband Corp. (LBRDK, Financial), Alphabet Inc. (GOOGL, Financial) and T-Mobile (TMUS, Financial).

However, we cannot exclude the possibility that this time around will also see Soros turn around and sell Tesla for short-term gain in a quarter or two.

The Twitter acquisition fiasco

Supporting the short-term thesis is Tesla CEO Elon Musk’s decision to back out of his agreement to acquire short-format social media company Twitter Inc. (TWTR, Financial).

Twitter is suing to try and force the deal to go through, or at least to get some form of compensation for the havoc that the botched deal has wreaked on its business and its stock.

Naturally, Musk does not want either of those things, so he is claiming that Twitter’s failure to convince him of the truthfulness of its estimates of how many of its accounts are bots or spam accounts should allow him to break the deal scot-free.

Based on history of similar situations, it would actually seem extremely likely at first glance that Musk will be forced to go through with the deal. While technically a company can sue to get out of an acquisition agreement if the business turns out to be substantially different than advertised, it would have to be very different indeed for the courts to decide it made a difference. Legal experts warn that even if Twitter’s data on the bots and spam accounts is found to be inaccurate, it would not be enough grounds in and of itself to get him off the hook.

If the court orders the deal to go through anyway, Tesla’s stock could honestly go either way. Investors were optimistic about adding Twitter before Musk decided to pull the plug, but a lot of Tesla’s valuation depends on market sentiment, so what could be seen as a failure on Musk’s part could potentially cause the company's share price to drop.

On the other hand, if the two companies reach a settlement before the court date, or if Musk manages to get out of the deal without paying anyone except the lawyers, Tesla’s stock could be buoyed slightly on relief that the circus is over.

All in all, betting on the outcome of the Twitter trial seems a much more uncertain course of action than betting on Tesla’s long-term growth potential, but we will have to wait and see whether Soros is playing the market or taking the bull case with this one. Soros’ top holding as of the quarter’s end was another EV company, Rivian Automotive Inc. (RIVN, Financial), which is a point in favor of the long-term case.

See also

As of the quarter’s end, Soros Fund Management held shares of 236 common stocks in an equity portfolio valued at $3.92 billion. The turnover for the quarter was 29%. You can see the full trades here.

The top holdings were Rivian with 11.72% of the equity portfolio, Amazon.com Inc. (AMZN, Financial) with 5.44% and Liberty Broadband Corp. (LBRDK, Financial) with 5.17%.

In terms of sector weighting, the firm was most invested in the consumer cyclical sector, followed distantly by communication services and financial services.