Sands Capital Management recently disclosed its 13F portfolio updates for the second quarter of 2022, which ended on June 30.

Founded in 1992 by Frank M. Sands Sr., Sands Capital Management is an independent investment management firm that invests in high-quality growth business. Frank Sands (Trades, Portfolio) Jr. joined the firm in 2000 and currently serves as CEO and chief investment officer. The Arlington, Virginia-based firm has two main concentrated growth strategies: Select Growth, which chooses innovative businesses, and Global Growth, which diversifies holdings in countries outside of the U.S. Sands Capital focuses on six investment criteria: sustainable above-average earnings growth, leadership position in a promising business space, a clear mission with a focus on value, good financial strength, rational valuation and significant competitive advantages.

According to the firm’s latest 13F portfolio, its top new buys for the quarter were tech stocks Nvidia Corp. (NVDA, Financial), Datadog Inc. (DDOG, Financial) and DLocal Ltd. (DLO, Financial).

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Nvidia

Sands’ firm bought a 1,463,586-share stake in Nvidia (NVDA, Financial), giving the stock a weight of 0.77% in the equity portfolio at the quarter’s average share price of $190.07.

Nvidia is primarily known for designing graphics processing units and system on a chip units. It has a strong presence in the mobile computing and automotive markets and is a leader in artificial intelligence and internet of things (IoT) innovations.

Its dominant position in the graphics card market, combined with emerging opportunities such as the increasing digitalization of business processes and automobiles, are all strong indications for future growth in a company that is already a market leader.

At a price-earnings ratio of 45.84 and a PEG ratio of 1.43, Nvidia’s stock is neither cheaper nor more expensive than historical averages after a 42% decline year to date. The GF Value chart rates the stock as a potential value trap because the current share price is so far below the intrinsic value estimate.

Datadog

The firm also added 2,141,968 shares of Datadog (DDOG, Financial) to the portfolio. At the stock’s average price of $110.56 per share for the quarter, it has a 0.71% weight in the equity portfolio.

Datadog has a reputation as a leader in observability for cloud-scale services, providing cloud monitoring as a service that allows clients to monitor and analyze their servers, databases, apps, tools and services anywhere, any time.

Providing more than 500 integrations with other apps and services, Datadog has built itself an exceptional business moat through a uniquely flexible product offering. Its other competitive advantages include faster data evaluation speeds and lower prices than peers.

The company is only just beginning to turn the occasional quarterly profit, but based on past growth and estimates of future business performance, the GF Value chart places the stock as significantly undervalued.

DLocal

The firm established a holding worth 2,819,185 shares in DLocal (DLO, Financial). The stock now has a weight of 0.26% in the equity portfolio. Shares averaged $25.69 apiece for the quarter.

DLocal is a Uruguayan fintech providing cross-border payment services that connect global merchants to emerging markets. Founded to close the gap in payments innovation between developed and emerging economies, DLocal operates primarily in the Latin America, Asia Pacific, Middle East and North Africa regions.

The company was founded in 2016 and went public this past June, earning it the distinction of being Uruguay’s first tech unicorn. It offers payment solutions that are tailored to the unique needs of emerging market clients.

Since the company went public on June 2, it is possible that Sands’ firm was a pre-initial public offering investor, though we have no way of knowing for sure unless the guru makes public comments on the subject. The stock is down 8% from its IPO price.

See also

Sands Capital Management’s other notable trades in the second quarter included additions to Lam Research Corp. (LRCX, Financial) and Airbnb Inc. (ABNB, Financial) and reductions to Zoetis Inc. (ZTS, Financial) and Intuit Inc. (INTU, Financial).

At the end of the quarter, the firm had holdings in 69 stocks in a 13F equity portfolio valued at a total of $28.89 billion. The top holdings were Visa Inc. (V, Financial) with 8.25%, Amazon.com Inc. (AMZN, Financial) with 6.37% and Sea Ltd. (SE, Financial) with 4.74%.

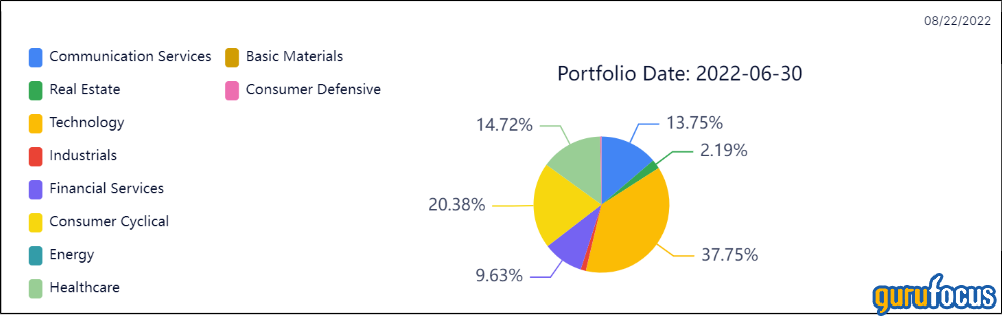

In terms of sector weighting, the firm was most invested in technology, consumer cyclical and health care.