One of my conclusions in my review of "How to Avoid a Climate Disaster," the book by Bill Gates (Trades, Portfolio), was that the industrials sector looks to have structural tailwinds thanks to the public and private sector drives for decarbonization. This had led me to search for a handful of companies within the industrials space that I could consider for my portfolio.

One such stock that looks interesting is IMI PLC (LSE:IMI, Financial), a specialist engineering company that designs, manufactures and services highly engineered products that control the precise movement of fluids. The company has a range of innovative technologies, built around valves and actuators, which enable vital processes to operate safely, sustainably, cleanly, efficiently and cost effectively.

IMI employs around 10,000 people, has manufacturing facilities in 19 countries and operates a global service network. The company is a constituent of the FTSE 250 Index and the FTSE4Good Index.

It also designs and manufactures quite a few products that are going to help the world avoid a climate disaster.

One big idea Gates discussed was the fact Africa needs technology to improve crop yields. IMI’s valve technology is used in fertilizer spraying systems, which will help with that problem. Its valves are also used for reducing vehicle emissions, which in the medium term will be a growth market as more stringent environmental regulations for internal-combustion engine vehicles come into play.

First-half results, divisional overview and third-quarter financials

IMI’s interim results released at the end of July showed that a restructuring the company is implementing is helping margins. Its group operating margin increased by 0.7 percentage points year over year to 16.4%. Management is confident of getting this to 20% over the medium term. This is quite impressive given a lot of companies are currently struggling to show margin improvement and indicates the company must have some sustainable competitive advantage or, as Warren Buffett (Trades, Portfolio) would say, a moat. This could be a major advantage in the future as it shows the company has some pricing power, which allows it to offset cost inflation through higher prices.

The company operates through three segments: Precision Engineering, Critical Engineering and Hydronic Engineering.

The largest segment, Precision Engineering, operates across three principal business units: Industrial Automation, Precision Fluid OEM and Transport. In the recently released third-quarter trading statement, this segment saw organic revenue growth of 3% and adjusted revenue growth of 16% versus the same period in 2021.

IMI's Critical Engineering unit is a world-leading provider of flow control solutions that enable vital energy and process industries to operate safely, cleanly, reliably and more efficiently. The third-quarter results saw its order book 11% higher than the same period last year, reflecting strong demand in liquefied natural gas, oil and natural gas and power. Organic order intake for the period was up 21% from the year-ago quarter.

Quarterly revenue in the Hydronic Engineering business, which provides energy-efficient heating and cooling systems, was 3% higher on an organic basis when compared to the same period last year.

In a statement, CEO Roy Twite commented on IMI's progress.

"Our unifying purpose-led strategy [Breakthrough Engineering for a better world] continues to underpin sustainable, profitable growth," he said. "We are creating value by increasing customer intimacy, driving market-led innovation and reducing complexity. These actions have allowed us to generate strong growth in the order book and revenues as well as improved margins year to date. Given the continued momentum in the business, based on current market conditions, we are upgrading our EPS guidance for the full year to 103 pence to 106 pence and remain confident in delivering our Group growth targets and operating margin target of 20% through the cycle over time."

Growth area: Hydrogen

As the green transition continues, a clean energy consumers will be using more of is hydrogen. With the race to net-zero well underway, efforts to scale hydrogen production, distribution and application across the industry has been ramped up.

As part of this initiative, IMI is helping its customers navigate toward the hydrogen future. Across its divisions and every stage of the hydrogen value chain, from production, storage, transportation and distribution to use and application, the company is developing the transformative solutions its customers need. As Twite said:

"Hydrogen is set to play a significant, enabling role in the world’s race to de-carbonise and deliver a more sustainable future for all. At IMI, we’re already deploying market leading expertise to solve key industry problems, helping the industry to take shape. Truly Breakthrough Engineering for a better world."

Stock outperformance

The stock has some relative momentum. Over the past five years, the share price has risen 12.7%, which is 14.4% above the FTSE 350 Index performance of -1.7% over the same period. IMI's cumulative annualized growth rate over the five-year period has been 2.4%, while that of the FTSE 350 Index has been -0.3%.

Valuation and conclusion

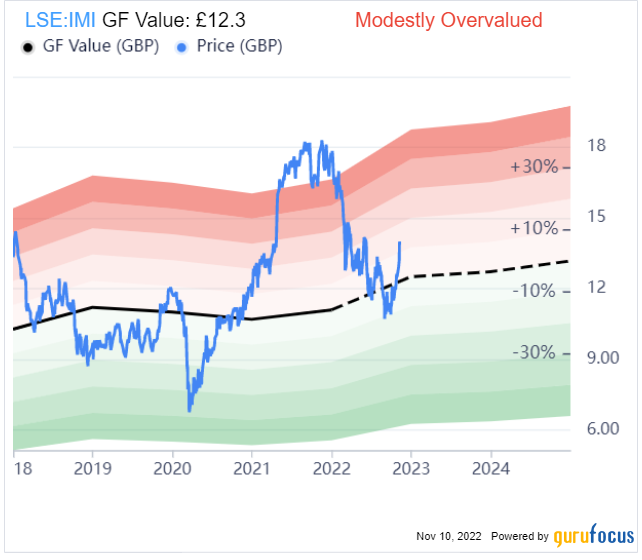

The company has a decent Piotroski F-Score of 6 out of 9 and a high Altman Z-Score of 3.11. Its forward price-earnings ratio is also reasonable at 13.2, but the GF Value Line suggests the stock is modestly overvalued based on historical ratios, past financial performance and analysts' future earnings projections.

As a result, value investors might want to put this stock on their watchlist and try to get a better price. Growth-oriented investors, however, might see IMI’s ability to solve industry problems and bet that the industrial sector's climate tailwind is going to take the stock much higher.