For much of the past year, the stock market theme has been deep undervalation brought on by the market-wide slump. For patient investors in RLI Corp. (RLI, Financial), though, capital gains have continued accumulating. And, to add frosting to the cake, despite growing by an average of 12.31% per year for the past decade, it has a price-earnings ratio of just 9.88, which implies healthy compounding and good value.

About RLI

Based in Peoria, Illinois, this $6 billion company calls itself “a specialty insurance company with a niche focus." What does “specialty” mean? As RLI explained in its 10-K for 2021:

“The specialty insurance market differs significantly from the standard market. In the standard market, products and coverage are largely uniform with relatively predictable exposures and companies tend to compete for customers on the basis of price. In contrast, the specialty market provides coverage for risks that do not fit the underwriting criteria of the standard carriers. Competition tends to focus less on price and more on availability, coverage, service and other value-based considerations.”

RLI goes on to report that while insurance risks are higher in specialty markets, it manages those risks efficiently to generate higher returns.

Competition

The company pointed out in its annual report that there are some 2,600 companies that actively sell property and casualty coverage. Some familiar names of publicly traded insurers are on that list, including Chubb (CB, Financial), American International Group Inc. (AIG, Financial) and Travelers Companies Inc. (TRV, Financial).

In its third quarter 2022 investor presentation, the company argued it has several competitive advantages, inlcuding capital strenght, underwriting expertise and diversification.

Source: RLI third-quarter presentation

Financial strength

For property and casualty companies, it's difficult to assess their balance sheets using traditional methods, so I like to use the ratings produced by the AM Best Company (a credit ratings company that specializes in insurance). In its third-quarter earnings release, RLI reported that each of its subsidiaries is rated A+ (Superior) by AM Best. In its third-quarter investor presentation, the company also bragged of an A rating for finanical strength from S&P Global (SPGI, Financial).

Profitability

A good starting point for checking the profitability of an insurance company is what’s called its combined ratio, which provides a thumbnail evaluation of an insurance company’s losses and premiums.

In its most basic form, the ratio is calculated by dividing losses plus expenses by earned premiums (the formula refers to “incurred” losses and “earned” premiums, to incorporate the timing of losses and premiums).

A combined ratio of less than 100 means the company has earned more than it has had to pay out and a ratio of over 100 means the opposite.

RLI reported in its third-quarter presentation that its combined ratio had been less than 100 for 26 consecutive years - an excellent track record meaning its insurance business has been profitable every year for the past 26 years.

Growth

RLI earns a GuruFocus ranking of 8 out of 10 for growth, based on solid three- and five-year revenue growth rates, five-year Ebitda growth and the predictability of revenue, among other factors:

Until the third quarter of this year, revenue had grown reasonably consistently, but in the three months that ended on Sept. 30, it suddenly spiked. The company explained, “Results for the third quarter of both years include favorable development in prior years’ loss reserves, which resulted in a $29.0 million and $25.1 million net increase to underwriting income for 2022 and 2021, respectively.” This trailing 12-month chart shows how revenue has grown over the past decade:

Both Ebitda and earnings per share without non-recurring items were less smooth. These two metrics declined significantly in 2016, 2017 and 2018 before briskly recovering in 2019. The following chart shows earnings per share without non-recurring items on an annual basis:

Growth of free cash flow also provides welcome news to investors. Over the past five years, free cash flow growth has averaged 17.18% per year, and over the past 10 years, it averaged 25.16% per year. That provides plenty of cash to reward shareholders and invest in growth.

Dividends and share repurchases

When it increased the annual dividend earlier this year, RLI marked its 47th year of consecutive dividend increases. On first impression, that might prompt us to think Dividend Aristocrat - and only three years from Dividend King status. However, RLI cannot earn those official designations because it is not a part of the S&P 500.

While the company has done a sterling job of increasing the dividend year after year, the market has pushed up the price of its shares even faster. As a result, the dividend yield remains modest:

The other piece of potential shareholder returns, beyond the dividend and share price, is share repurchases. RLI has bought back some shares, but over the past decade, it has been a net issuer most years:

Valuation

While dividends and buybacks have yielded much for shareholders, medium- to long-term investors have enjoyed capital gains averaging 12.39% per year:

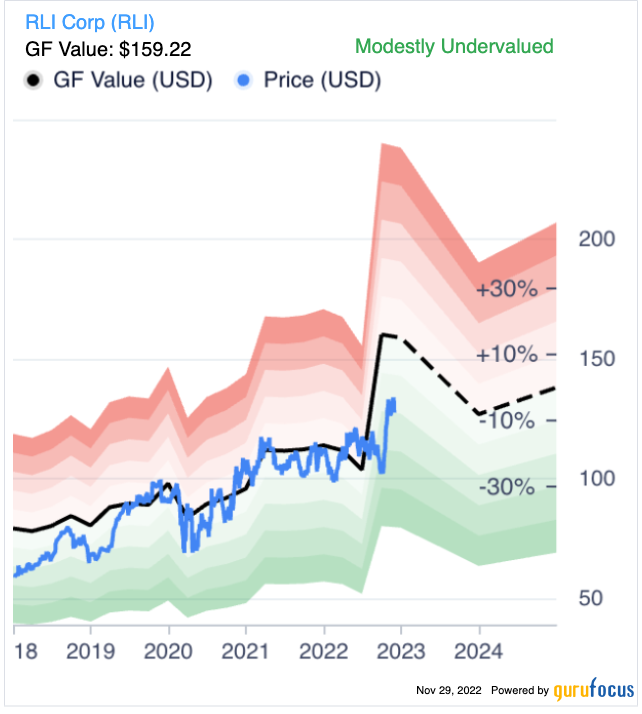

That will be one reason its shares are only modestly undervalued, as assessed by the GF Value chart:

Because of its high Ebitda growth rate, averaging 41.66% per year over the past five years, the company is also undervalued by the PEG ratio: 0.46.

Gurus

Seven gurus held positions in RLI at the end of the third quarter, with Tom Gayner (Trades, Portfolio) of Market Gayner Asset Management holding by far the biggest stake. He owned 1,197,272 shares, representing 2.64% of RLI’s outstanding shares and 1.81% of his fund’s assets under management. Chuck Royce (Trades, Portfolio) of Royce Investment Partners and Steven Scruggs (Trades, Portfolio) of the FPA Queens Road Small Cap Value Fund held 178,370 shares and 129,811 shares, respectively.

Institutional investors owned 80.98% and insiders owned 5.63% of the shares outstanding. Jonathan E. Michael, a director and the president, has the biggest stake among insiders with 723,952 shares as of February 1, 2022.

Conclusion

It might be a bit of a stretch to say that RLI could be a bond substitute, but it may not be too far off the mark. Steady interest among both institutional and retail investors means the price has grown quite consistently over the past decade. It has a sustainable dividend to go along with its promise of more capital gains in the future.