Hi, Jae here. I have a great guest post for you today but I wanted to share some thoughts that came up while reading this.

The stock analysis today is not all about forward thinking analysis. The premise of this article is looking back at the initial investment thesis and seeing how it turned out along with some additional thoughts about the future.

What I really like about this is that it reminded me of a money management fund where analysts did not receive performance bonuses based on the last 3-6 month performance. Instead, this fund paid analysts on how well their picks did 2-5 years AFTER they had purchased it.

If a stock shot up 30% in one year and then fell 30% in year two, that performance was considered to be worth 0%. Just something that popped into my head while reading this article and thought it was interesting enough to share

Articles like this, which revisits an investment 20 months later, or even 4 years later, is a process that we all should be in the habit of practicing.

Without further ado, here is Dan McIntosh’s article on CALM.

Back in January 2011 I made a post on the Old School Value Forum concerning Cal-Maine (CALM, Financial) and my investing plan with the company. Twenty months later after making my initial investment I decided to write a detailed follow-up to see how CALM is performing.

[1] I see the CEO as having true Board loyalty on his side, and all of the Board members are pretty well invested in the future of this company. However the loyalty and stubbornness associated with a family business can cut both ways (i.e. if the company initiatives are driving towards EPS destruction…little chance the train will stop).

So I wanted to examine again the fundamentals. First from where I saw them in 2010 vs. now.

Note: CALM rarely trades below 8 and above 12 P/E. A P/E of 11 is about where Mr. Market values CALM as of this writing.

[1] Interestingly, the board member’s bonuses are directly tied to the net profit per dozen of egg for that quarter. Thus, the higher the net margin the higher the Board member bonus. This type of honest and clear compensation is what I wish more Boardmember’s bonuses were tied to.

As any of their 10-Ks indicate, margins on specialty eggs are much higher than others and in 2010 the percentage of specialty eggs as total revenue was 20%, with the expectation that it would continue to grow.

Analyst primary concerns at the time (and current) were the unstable chicken feed costs. Price of grain fluctuations can have a big impact on margins and interestingly, after digging through the 2010 10-K, the company reports that as grain prices initially rise margins are squeezed. But as egg prices rise to compensate, there is a greater spread on top, thus over time, the company actually gets more revenue from higher costs as the price sits high.

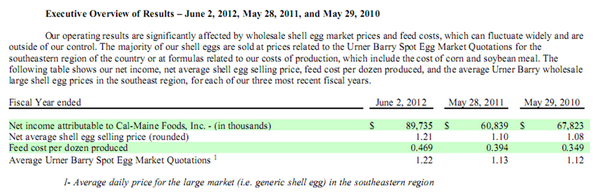

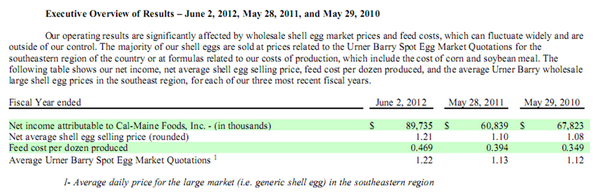

Here’s an example. Look at 2012 10-K.

Net margins for egg carton prices minus feed costs for 2010 was $1.08 (avg selling price per carton) – $0.35 (avg feed cost per carton) or $0.73.

As feed costs went up in 2012, so did the prices to overcompensate: $1.22-0.47 or $0.75.

That is almost 3% increase in profit in a pretty low margin business.

Competitors are numerous, but there are no big operations to compete with. Thus CALM has the economy of scale that smaller mom & pop operations do not have. This company’s net margins are pretty tight (less than 10%), but consistent.

Dividend is based off of 1/3 of income, and thus will fluctuate a bit quarter to quarter.

Well halfway to 2015, as of 10 September 2012, CALM’s price is around $42, with a book value of $20.

Here are some numbers from the 2012 10-K showing nice growth

The fluctuation in feed prices will cause CALM to be a bit bouncy, but the dividend should keep a “calm” hand toward 2015.

I will try to write a similar articles on other holdings of mine as they hit the one year point.

The stock analysis today is not all about forward thinking analysis. The premise of this article is looking back at the initial investment thesis and seeing how it turned out along with some additional thoughts about the future.

What I really like about this is that it reminded me of a money management fund where analysts did not receive performance bonuses based on the last 3-6 month performance. Instead, this fund paid analysts on how well their picks did 2-5 years AFTER they had purchased it.

If a stock shot up 30% in one year and then fell 30% in year two, that performance was considered to be worth 0%. Just something that popped into my head while reading this article and thought it was interesting enough to share

Articles like this, which revisits an investment 20 months later, or even 4 years later, is a process that we all should be in the habit of practicing.

Without further ado, here is Dan McIntosh’s article on CALM.

CALM Like a Bomb

By Dan McIntoshBack in January 2011 I made a post on the Old School Value Forum concerning Cal-Maine (CALM, Financial) and my investing plan with the company. Twenty months later after making my initial investment I decided to write a detailed follow-up to see how CALM is performing.

Introducing Cal-Maine Foods (CALM)

- CALM is the largest egg producer in the US with sales in 29 states with a market cap of $996m.

- Founded in 1969 by Fred Adams, Jr, in Mississippi.

- Fred retired recently passing the torch to his son-in law, Adolphus Baker (who has been with CALM since the 80s).

[1] I see the CEO as having true Board loyalty on his side, and all of the Board members are pretty well invested in the future of this company. However the loyalty and stubbornness associated with a family business can cut both ways (i.e. if the company initiatives are driving towards EPS destruction…little chance the train will stop).

So I wanted to examine again the fundamentals. First from where I saw them in 2010 vs. now.

Note: CALM rarely trades below 8 and above 12 P/E. A P/E of 11 is about where Mr. Market values CALM as of this writing.

[1] Interestingly, the board member’s bonuses are directly tied to the net profit per dozen of egg for that quarter. Thus, the higher the net margin the higher the Board member bonus. This type of honest and clear compensation is what I wish more Boardmember’s bonuses were tied to.

What I saw in CALM in 2010

In late 2010, the company was trading in the high $20’s and topping out at $31 with a book value was $16 and a strong history of retained earnings.- EPS for 2010 was $2.85.

- Solid fundamentals: plenty of cash, low debt and dependable FCF.

As any of their 10-Ks indicate, margins on specialty eggs are much higher than others and in 2010 the percentage of specialty eggs as total revenue was 20%, with the expectation that it would continue to grow.

Analyst primary concerns at the time (and current) were the unstable chicken feed costs. Price of grain fluctuations can have a big impact on margins and interestingly, after digging through the 2010 10-K, the company reports that as grain prices initially rise margins are squeezed. But as egg prices rise to compensate, there is a greater spread on top, thus over time, the company actually gets more revenue from higher costs as the price sits high.

Here’s an example. Look at 2012 10-K.

Net margins for egg carton prices minus feed costs for 2010 was $1.08 (avg selling price per carton) – $0.35 (avg feed cost per carton) or $0.73.

As feed costs went up in 2012, so did the prices to overcompensate: $1.22-0.47 or $0.75.

That is almost 3% increase in profit in a pretty low margin business.

Competitors are numerous, but there are no big operations to compete with. Thus CALM has the economy of scale that smaller mom & pop operations do not have. This company’s net margins are pretty tight (less than 10%), but consistent.

Dividend is based off of 1/3 of income, and thus will fluctuate a bit quarter to quarter.

What I am Seeing with CALM for the Future

My initial theory with CALM was by 2015 that specialty egg sales would be almost 1/3 of revenue and EPS would have risen to $4.8 x P/E of 11 for a price of $53ish, factoring in that perfect 5-10% EPS growth for a company tied to unstable grain prices is unlikely.Well halfway to 2015, as of 10 September 2012, CALM’s price is around $42, with a book value of $20.

Here are some numbers from the 2012 10-K showing nice growth

- Specialty eggs was 24% of total revenue.

- EPS for 2012 is $3.75, a nice bump from $2.84 in 2010 (though EPS in 2011 dropped to $2.55 due to the fluctuations in feed prices).

- Retained earnings have jumped from $365m in 2010 to $466m in 2012.

- Specialty eggs as a percentage of revenue is rising, but slightly slower than I would like.

More Long Term Things to Think About

Long term risks I see is that some fashionable diet comes out where eggs are now uncool to consume. As humans have consumed eggs since the Stone Age, I see this pretty unlikely to have a lasting effect. Bacteria contaminations in eggs happen occasionally and will drive CALM’s stock down temporarily (great buying opportunity), but have little impact on revenue. Perhaps some of these acquisitions backfire, but that is hard to imagine. I find it hard to imagine a simpler business for merger than a chicken farm.Summing Up

So to sum up, CALM is sailing along and I still see a price of $53 as achievable by 2015, with retained earnings & book value continuing to grow. Eggs are not going out of style and as meat prices rise people might be more inclined to buy eggs. It is the cheapest protein at the grocery store.The fluctuation in feed prices will cause CALM to be a bit bouncy, but the dividend should keep a “calm” hand toward 2015.

I will try to write a similar articles on other holdings of mine as they hit the one year point.