While researching the electric vehicle industry for potential investment opportunities, I was looking through the news for related stories and found three rather interesting tidbits of information. I may not be familiar enough with the industry yet to make any actionable bets on this information, but I still felt like it was worth analyzing them to see what I could learn. In this article, I will share my thoughts on these three intriquing EV stock developments: Volkswagen's (VWAGY, Financial) special dividend, George Soros (Trades, Portfolio)' bets on the sector and General Motors' (GM, Financial) deal to service Tesla (TSLA, Financial) vehicles.

Volkswagen, Porsche and a special dividend

It’s something of a tangled web, but Smead Capital Management said in a recent commentary that "it’s a $100 bill just lying on the sidewalk." Volkswagen AG (VWAGY, Financial), a German automaker, has announced it plans to issue a special dividend on Jan. 9, 2023 if its proposal is adopted at an extraordinary general meeting on Dec. 16.

While few details have been released to the public, Volkswagen has indicated it will pass along 49% of the proceeds of its Porsche initial public offering to shareholders.

It will be a significant special dividend, reportedly worth $18.66 per share. For comparison, Volkswagen was trading at just $18.93 per share on Nov. 30. Here’s a more in-depth explanation from Smead Capital on how valuable the special dividend is:

“Why did we tell you there is a $100 sitting on the street in the stock market and that P911 is our wildest dream? If you take 75% of the value of P911, you get roughly $67.854 billion. If you add the $9.25 billion special dividend to that, you come up with $77.1 billion. These are only two of the assets under the hood of Volkswagen! Volkswagen’s current market cap is $75.98 billion as of the close on October 28th, 2022. The rest of their assets are being left on the curb like the $100 bill.”

While this is hardly a play for cautious investors who don't want to make a short-term bet on an unfamiliar stock, it may attract the interest of traders and special situation investors. Smead Capital cetainly seems to see it as an excellent deal, writing, “Price is what you pay. Value is what you get. We believe there is incredible value in Porsche SE and Volkswagen as investors walk past it on the street while their eyes are trained above watching stocks fall from the sky.”

Soros spreads his EV bets

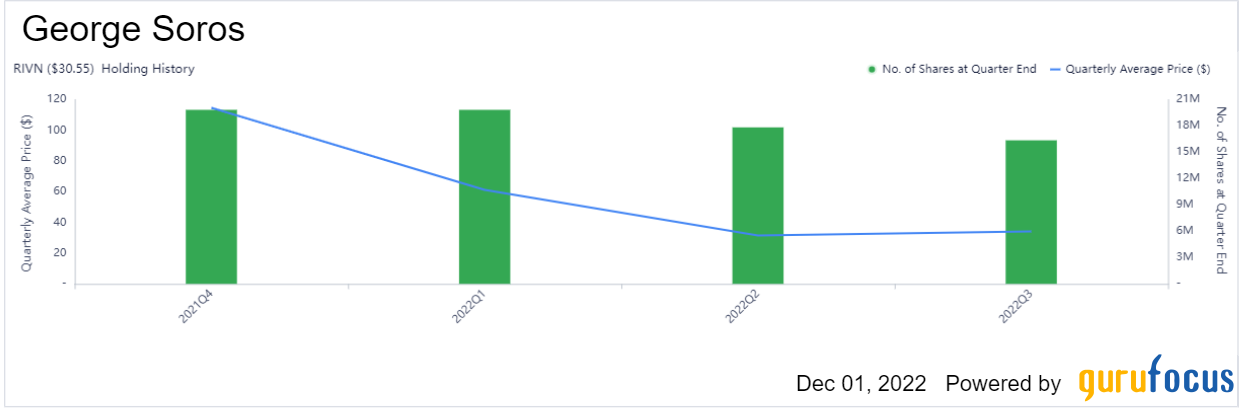

Guru George Soros (Trades, Portfolio) made several bets on EV stocks in recent quarters. According to his firm's 13F filings, it added Rivian Automotive Inc. (RIVN, Financial) to the portfolio in the last quarter of 2021, and even though it has reduced the holding slightly since then, it still makes up the largest holding in its 13F portfolio with a 13.33% weight.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Soros' firm also bought 29,883 shares of Tesla Inc (TSLA, Financial) in the second quarter of 2022 for a stake worth $20.124 million.

In addition, he also said he invested $29.50 million in the debt of Ford Motor Company (F, Financial), though debt holdings do not show up on the 13F so we must keep an eye out for the guru's interviews and shareholder letters for any potential updates on this investment.

GM to service Tesla vehicles

It’s not a big deal, at least so far, but General Motors (GM, Financial) dealers are generating new revenue by servicing Tesla (TSLA, Financial) vehicles. Speaking at the company’s investor day on Nov. 17, President Mark Reuss reported the company had serviced over 11,000 Teslas since 2021.

He called it a new business and a fast-growing business, but did not specify what types of maintenance or repairs were involved. According to a Road and Track article on Nov. 18, these are likely limited to operations that do not involve software.

A Barron’s article on Nov. 19 suggested most GM work on Teslas involves collision repairs, routine maintenance like brakes and tires, etc. Tesla does not have a full dealer network, which has led some Tesla owners to complain about long waits for repairs.

Providing repairs for Tesla vehicls does not contribute to GM’s top or bottom lines directly, since the dealerships are independently owned. Where it may help is with getting Tesla owners into GM showrooms. Many of us know that one way to pass the time while waiting for our vehicles to be serviced is to walk around and look at new cars on the sales floor. This may give GM dealers a new opportunity to show off their electric vehicles to customers who are already sold on driving EVs.

GM has firmly committed itself to EVs; in a Nov. 17 news release it noted, “General Motors Co. expects its rapidly growing portfolio of electric vehicles will be solidly profitable in 2025 in North America as the company scales EV capacity in the region to more than 1 million units annually, ramps up its software revenue opportunities, generates significant greenhouse gas benefits and realizes the positive impacts of new clean energy tax credits."