According to current portfolio statistics, a Premium feature of GuruFocus, five stocks in Royce Investment Partners’ third-quarter 13F equity portfolio that are trading below discounted cash flow value are Marcus & Millichap Inc. (MMI, Financial), UFP Industries Inc. (UFPI, Financial), Mueller Industries Inc. (MLI, Financial), LCI Industries Inc. (LCII, Financial) and Asbury Automotive Group (ABG, Financial).

Founded in 1972 by Chuck Royce (Trades, Portfolio), the firm invests primarily in small-cap companies that trade below intrinsic value. Royce looks for stocks with strong balance sheets, a record of success and the potential for a profitable future.

The firm’s $8.84 billion third-quarter equity portfolio contains 931 stocks with a quarterly turnover of 7%. The top four sectors in terms of weight are industrials, technology, consumer cyclical and financial services, which represent 29.43%, 18.65%, 13.48% and 13.31% of the equity portfolio.

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Marcus & Millichap

Royce Investment Partners owns 2,056,728 shares of Marcus & Millichap (MMI, Financial), giving the position 0.76% equity portfolio weight.

Shares of Marcus & Millichap traded around $36.12, showing the stock is significantly undervalued based on its price-to-GF Value ratio of 0.53 as of Wednesday.

Based on earnings of $3.91 per share and a 10-year growth rate of 20%, Marcus & Millichap is valued at $134.54 assuming the default DCF Calculator parameters. With a margin of safety of 73.06%, the stock is significantly undervalued based on the DCF earnings model.

The Calabasas, California-based real estate brokerage company has a GF Score of 87 out of 100 based on a rank of 8 out of 10 for profitability and growth, a financial strength rank of 9 out of 10, a momentum rank of 7 out of 10 and a GF Value rank of 4 out of 10.

Other gurus with holdings in Marcus & Millichap include Hotchkis & Wiley and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

UFP Industries

The firm owns 560,914 shares of UFP Industries (UFPI, Financial), giving the position 0.46% equity portfolio weight.

Shares of UFP Industries traded around $82.89, showing the stock is fairly valued based on its price-to-GF Value ratio of 0.96.

While the stock is just fairly valued based on GF Value, UFP Industries is significantly undervalued based on the DCF earnings model with a margin of safety of 78.30%. The valuation is based on earnings of $11.10 per share and a 10-year growth rate of 20% assuming the default DCF Calculator parameters.

The Grand Rapids, Michigan-based lumber and wood products company has as GF Score of 98 out of 100, driven by a rank of 10 out of 10 for profitability and growth and a rank of 8 out of 10 for momentum and financial strength despite GF Value ranking just 6 out of 10.

Mueller Industries

The firm owns 526,520 shares of Mueller Industries (MLI, Financial), giving the position 0.35% equity portfolio weight.

Shares of Mueller Industries traded around $66.02, showing the stock is fairly valued based on its price-to-GF Value ratio of 1.09 as of Wednesday.

While the stock is slightly overvalued based on GF Value, Mueller Industries is significantly undervalued based on the DCF earnings model with a margin of safety of 68.7%. The valuation is based on earnings of $11.38 and a 10-year growth rate of 10.90% assuming the default DCF Calculator parameters.

The Collierville, Tennessee-based metal products company has a GF Score of 89 out of 100, driven by a financial strength rank of 10 out of 10 and a rank of 9 out of 10 for profitability and growth despite momentum ranking 6 out of 10 and GF Value ranking just 3 out of 10.

LCI Industries

Royce Investment Partners owns 293,998 shares of LCI Industries (LCII, Financial), giving the position 0.34% equity portfolio weight.

Shares of LCI Industries traded around $95.21, showing the stock is significantly undervalued based on its price-to-GF Value ratio of 0.41 as of Wednesday.

Based on earnings of $19.39 and a 10-year growth rate of 20%, LCI Industries is valued at $667.21 assuming the default DCF Calculator parameters. With a margin of safety of 85.73%, the stock is significantly undervalued based on the DCF earnings model.

The Elkhart, Indiana-based company has a GF Score of 92 out of 100 based on a growth rank of 10 out of 10, a profitability rank of 9 out of 10, a momentum rank of 7 out of 10, a financial strength rank of 6 out of 10 and a GF Value rank of 4 out of 10.

Ashbury Automotive Group

The firm owns 193,095 shares of Ashbury Automotive Group (ABG, Financial), giving the position 0.33% equity portfolio weight.

Shares of Ashbury Automotive Group traded around $177.41, showing the stock is modestly undervalued based on its price-to-GF Value ratio of 0.77 as of Wednesday.

Based on earnings of $35.12 and a 10-year earnings growth rate of 20%, the stock is valued at $1,208.47 assuming the default DCF Calculator parameters. With a margin of safety of 85.32%, the stock is significantly undervalued based on the DCF earnings model.

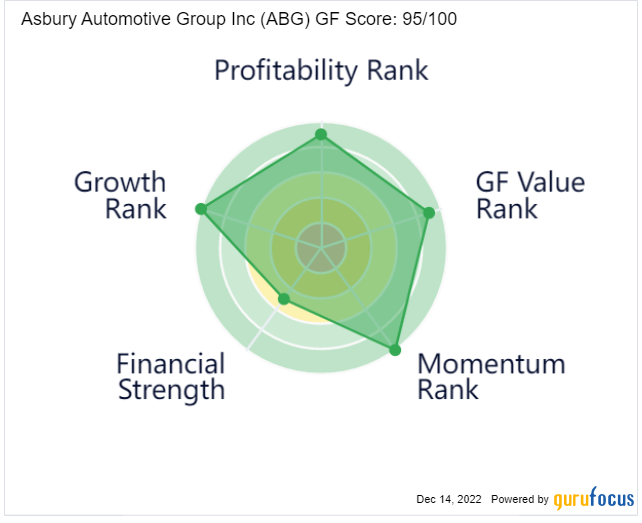

The Duluth, Georgia-based automobile dealership company has a GF Score of 95 out of 100, driven by a rank of 10 out of 10 for growth and momentum and a rank of 9 out of 10 for profitability and GF Value despite financial strength ranking just 5 out of 10.