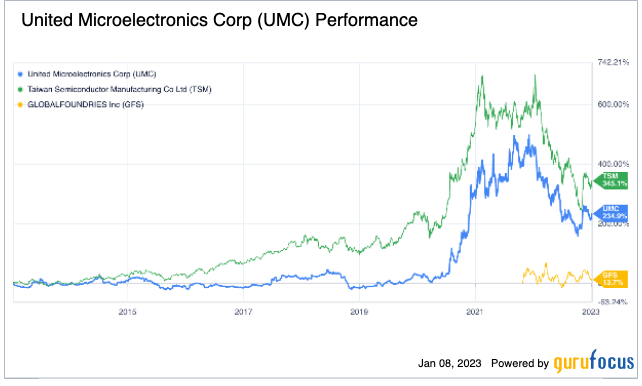

The market moves in mysterious ways, and sometimes, it seems to go against all logic. Witness the case of United Microelectronics Corporation (UMC, Financial), which has steadily grown its earnings per share without non-recurring items while the share price took a dive. That dive began at the end of 2021, a time when most of the market began falling, and we’re not sure when it will regain its upward momentum:

Shares of its national rival, Taiwan Semiconductor Manufacturing (TSM), also took a hit. Since then, their price charts have looked quite similar, although Taiwan Semiconductor is more expensive. Does this semiconductor company belong in the dumps, or is it worth much more?

About United Microelectronics

According to its 20-F for 2021 filing (the equivalent of a 10-K for non-domestic companies listed in the U.S.), the company describes itself this way:

“We are one of the world’s largest independent semiconductor foundries and a leader in semiconductor manufacturing process technologies. Our primary business is the manufacture, or “fabrication”, of semiconductors, sometimes called “chips” or “integrated circuits”, for others. Using our own proprietary processes and techniques, we make chips to the design specifications of our many customers. Our company maintains a diversified customer base across industries, including communication devices, consumer electronics, computer, and others, while continuing to focus on manufacturing for high growth, large volume applications, including networking, telecommunications, internet, multimedia, PCs and graphics.”

Based in Hsinchu City, Taiwan, United Microelectronics has a market cap of $17.47 billion and trailing 12-month revenue of $9.205 billion.

Competition

The company characterizes the industry as being highly competitive. It names key competitors Taiwan Semiconductor, Semiconductor Manufacturing International (Shanghai) Corporation (HKSE:00981, Financial) and Globalfoundries Inc. (GFS, Financial), as well as the foundry operations of integrated device manufacturers Samsung (SSNLF, Financial), Intel (INTC, Financial) and Toshiba (TOSBF, Financial).

This GuruFocus chart compares United Microelectronics' performance with those of Taiwan Semiconductor and Globalfoundries:

Financial strength

United Microelectronics receives an 8 out of 10 GuruFocus ranking for financial strength, based on the criteria in the chart below:

A quick look at the interest coverage ratio of 51.7 indicates the company has no problem with debt levels. It currently generates $51.70 of operating income for each dollar of interest expense.

On a trailing 12-month basis, it has short- and long-term debts of $1.482 billion ($7 million and $1.475 billion respectively) and revenue of $9.205 billion.

The Altman Z-Score is 3.57, putting it solidly into the safe zone and making financial distress quite unlikely.

And at the bottom of the table, we see the company earns much more on its borrowed and equity capital than it pays for said capital. The weighted average cost of capital (WACC) is 9.66% while the return on invested capital (ROIC) is 29.96%.

Profitability

The company gets anothre solid 8 out of 10 ranking from GuruFocus for profitability, based on the factors in the chart below:

United Microelectronics has an above-average Piotroski F-Score, coming in at 7 out of 9, and it has a business predictability ranking of 4 out of 5 stars.

After multiple years of sluggish operating margins and a serious dip in 2019, the company's results took a sustained upturn in 2020 and beyond:

Regarding the consistency of its profitability (earnings per share without non-recurring items), it has followed the lead of the operating margin:

Growth

Because the operating margin shot upward over the past three years, Ebitda and EPS without NRI also grew quickly, helping the way to a 10 out of 10 GuruFocus growth score:

Besides a strong Ebitda growth rate, the score was pulled up by its three- and five-year revenue growth and the predictability of its five-year revenue. This chart shows how revenue has grown relatively consistently over the past three and five years:

To finance its ongoing growth and dividends, United Microelectronics needs strong free cash flows:

Dividends and share repurchases

For a growth company, United Microelectronics has a surprisingly rich dividend yield of 6.77%. Still, there’s room for it to grow, since it currently stands at a payout ratio of just 0.47.

Don’t expect much of a return from the company’s share repurchases. The count has come down by an average of 0.08% per year over the past decade:

Valuation

In contrast to its other rankings and scores, United Microelectronics' GF Value rank is very low at just 1 out of 10. That’s based on the relationship between its current share price ($7.40 at the close on Jan. 10, 2023) and the intrinsic price calculated by the GF Value chart ($3.84):

Several other metrics clash with the GF Value chart in terms of fair value estimates. For example, its price-earnings ratio at 6.89 is roughly half the value of the industry median of 16.57. The PEG ratio, at 0.53, is in solidly undervalued territory, well below the fair value mark of 1.00.

Looking at a 10-year price chart, the company is slightly above its trendline:

Gurus

Four gurus held shares in the stock at the end of the third quarter of 2022 and two of them added to already substantial holdings:

- Jim Simons (Trades, Portfolio) of Renaissance Technologies increased his stake by 61.85% to to 5,403,034 shares, representing a 0.22% position in the company and 0.04% of the firm's 13F holdings.

- Ken Fisher (Trades, Portfolio) of Fisher Asset Management bumped up his stake by 42.48%, to 3,720,627 shares.

- Sarah Ketterer (Trades, Portfolio) of Causeway Capital Management neither bought nor sold during the quarter and finished with 172,099 shares.

- Jeremy Grantham (Trades, Portfolio) initiated a new holding of 49,200 shares.

According to the 20-F, insiders have a significant stake in the company:

Conclusion

United Microelectronics' profitability keeps going up, while its share price mostly went down in 2022. Will 2023 bring a new direction, or will it continue to languish along with most other stocks on the markets?

Over the long term, I believe investors should be optimistic. After a long string of mediocre results, the company has strung together some excellent growth since 2019.