Over the five years between 2013 and 2018, earnings at Jacobs Solutions Inc. (J, Financial) kept declining. From $3.23 at the end of fiscal 2013 (the company's fiscal year ended Sept. 23) to -$0.03 at the end of fiscal 2018, its earnings per share without non-recurring items dropped and dropped.

That began to turn around after its February 2019 Investor Day, when the company adopted a new strategy. According to its 10-K for fiscal 2022, the new plan was“focused on innovation and continued transformation to build upon our position as the leading solutions provider for our clients." The transformation included acquiring a 65% stake in PA Consulting Group and acquisitions of John Wood Group’s nuclear business, The Buffalo Group, BlackLynx and StreetLight.

As this 10-year chart of earnings per share without non-recurring items shows, the strategy worked:

The question for investors now is, can the company continue to grow?

About Jacobs

In the 10-K, the company said that it has a full spectrum of professional services that include consulting, technical, engineering, scientific and project deliveries. It serves both government and private sector clients.

At the Credit Suisse (CS, Financial) 10th Annual Global Industrials Conference, the company said that its total addressable markets are "big and growing."

Founded in 1947 and based in Dallas, Texas, the company has a long history of acquisitions. It now has a market cap of $15.95 billion and had $14.9 billion of revenue in fiscal 2022.

Its earnings turnaround came with that three-year plan adopted in February 2019. Now it has been succeeded by a new plan, as it explained in its annual report: “We are now focused on broadening our leadership in sustainable, high growth sectors. As part of our strategy, our new brand promise: Challenging today. Reinventing tomorrow. signals our transition to a global technology-forward solutions company.”

Competition

Jacobs’ competitive environment is somewhat unique. The company writes: “We compete with a large number of companies across the world including technology consulting, federal IT services, aerospace, defense and engineering firms. Typically, no single company or companies dominate the markets in which we provide services and in many cases we partner with our competitors or other companies to jointly pursue projects.”

Named competitors include AECOM (ACM, Financial), Booz Allen (BAH, Financial) and CACI International (CACI, Financial). Its performance compares unfavorably with those competitors,at least on the capital gains front:

GF Score

In terms of valuation, the company has a solid GF Score of 89 out of 100:

It has taken on a significant amount of debt in the past five years. At the end of the fiscal year in September, it had short-term debt of $50 million and long-term debt of $3.357 billion.

Still, it has a decent interest coverage ratio of 9.16, its revenue is roughly four times as high as its combined debts and its Altman Z-Score is just a couple of basis points below the safe zone at 2.97.

It has been profitable for every year of the past 10 years on an earnings per share (diluted) basis, but not on the EPS without NRI basis. Jacobs’ net margin is 4.32%, which is better than 59.17% of firms in the construction industry.

Notice on the growth table how its revenue, Ebitda and EPS without NRI compare. Although revenue growth over the past three years has been only 8% per year, its Ebitda has grown by 31.5% and earnings by 33.6% annually.

From another perspective, we might say the company became more efficient and effective over the past three years.

Morningside (MORN, Financial) analysts cited by GuruFocus expect the company to grow its revenue by nearly a billion dollars over the next three years to $16.957 billion by the end of fiscal 2025. Over the same period, they expect EPS without NRI to grow from $7.48 to $9.34, a 13.91% improvement.

For fiscal 2023, as outlined in the investor presentation, Jacobs expects its adjusted EPS to be up 12%. That’s on a constant currency basis, but if the outlook is based on foreign exchange rates in early November (when the presentation was prepared), then it expects a 6% improvement.

That the company calculates its earnings on two currency bases, and the differences being that high tells us it is highly sensitive to exchange rates. Thus, investors interested in it should carefully assess this issue.

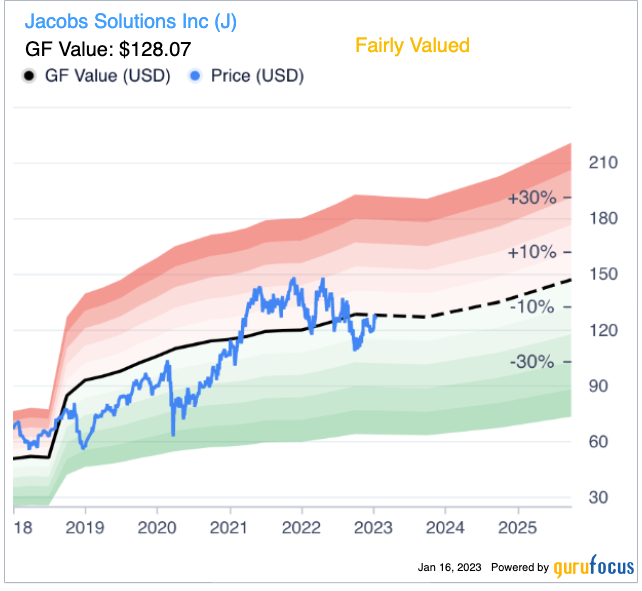

The GF Value chart gives Jacobs a “fairly valued” assessment. That’s based on its historical multiples, a proprietary adjustment factor and estimates of future business performance:

It gets a similar valuation from the PEG ratio of 1.05. The ratio is calculated by dividing the price-earnings ratio of 25.3 by the five-year Ebitda growth rate of 24.20% per year.

PRIMECAP Management (Trades, Portfolio) holds the most shares among the eight gurus who had positions at the end of the third calendar quarter. It had 6,303,507 shares, representing 4.94% of Jacobs’ shares outstanding and 0.66% of the firm's 13F portfolio.

Ruane Cunniff (Trades, Portfolio) & Goldfarb had 2,779,534 shares and Barrow, Hanley, Mewhinney & Strauss owned 485,481.

Investors should be aware that 13F reports do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Institutional investors owned 91.97% of shares outstanding, while insiders held 5.26%.

Conclusion

Jacobs Solutions transformed itself in 2019 when it implemented a new strategy and began growing its earnings again. It made significant progress over the past three years and has launched a new three-year strategy. Will this new strategy be as effective? I honestly don't know, but the fundamentals suggest the potential for turnaround will not be as dramatic. And, we can’t forget that the company’s earnings could be blown off course by currency exchange rates.