Nordstrom Inc. (JWN, Financial) has seen its shares drop steadily for the past couple of years, and for good reason. The big-box retailer mainly sells luxury goods to the middle class, and as consumers struggle with the rapidly rising cost of living among high inflation everywhere from housing to food and electricity, even the middle class is beginning to see lower disposable income.

However, the stock staged a surprising turnaround on Friday, rising more than 20% following the news that activist investor Ryan Cohen had taken a stake it. The Chewy (CHWY) co-founder and chairperson of GameStop (GME, Financial) is now one of the top five non-family shareholders of Nordstrom’s stock, and he plans to leverage his stake to shake up the board and unlock value for shareholders.

There certainly seems to be room for improvement at Nordstrom. As the company keeps seeing lackluster sales and has to mark down merchandise, it may be time to ramp up cost-cutting efforts and look for new ways to drive growth.

Two other factors contribute to the value story for Nordstrom. For one, the stock looks dirt cheap on paper, even after recent gains. The other thing to consider is that Cohen is also a well-known meme stock investor, and the stocks he is involved with have a tendency to spike dramatically before declining again (i.e., GameStop, Bed Bath & Beyond (BBBY, Financial), etc.).

Cheap valuation

Nordstrom trades at a price-earnings ratio of just 12.72, which is lower than both the industry median and its own historical median. The price-sales ratio of 0.28 is lower than 86% of industry peers.

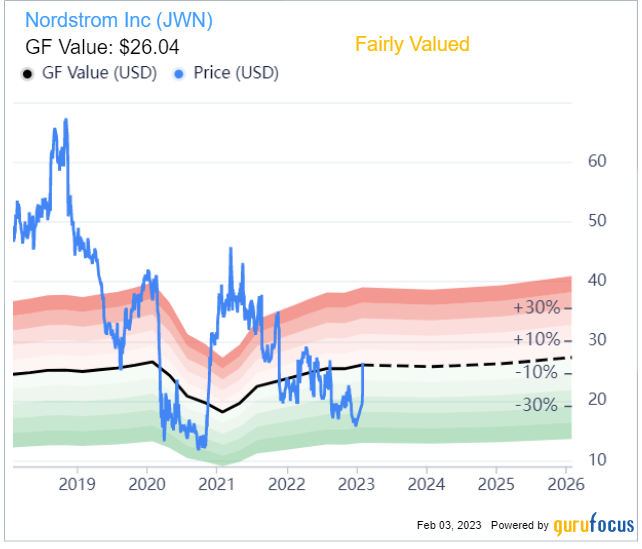

The GF Value chart rates the stock as fairly valued, but this is largely due to the fact the stock used to have much higher valuation ratios.

If we assume a case of no growth or continued declines, then Nordstrom would indeed look fairly valued at current levels. However, even if we do have a recession, the market for middle-class luxury goods will not disappear forever and will eventually rebound.

According to the GuruFocus discounted cash flow calculator, Nordstrom will need to grow its earnings at an average pace of just 5.28% per year over the next decade in order to be fairly valued at current levels.

Adding to the stock’s total return prospects is its 2.99% dividend yield. The dividend has been reinstated after being suspended during the early days of Covid.

Struggling to recover

Despite the current undervaluation and the likelihood of a long-term recovery, we cannot deny that Nordstrom has short-term issues that could continue impacting its stock price.

As of the end of 2022, as many as 51% of American individuals with annual income of $100,000 or above said they were living paycheck to paycheck, according to a survey from LendingClub and Pymnts.com. This was a significant increase from 42% a year ago and represents a weaker customer base for Nordstrom.

Thus, for the time being, Cohen’s focus on pushing for cost reductions seems appropriate. The activist investor seems particularly concerned with Mark Tritton, a Nordstrom board member and the former CEO of Bed Bath & Beyond who drew widespread criticism for granting himself huge profits while running the company into the ground.

“Mr. Tritton should recognize that chief executives who are awarded outsized compensation and seek frequent publicity also invite much higher expectations when it comes to growth and shareholder value creation,” Cohen wrote in a letter to Bed Bath & Beyond last year. With Nordstrom, he has raised concerns with Tritton being on the board and the compensation committee for Nordstrom family members.

Just another meme stock?

Given Cohen’s involvement with GameStop and Bed Bath & Beyond, it is no surprise people are calling Nordstrom his next big meme stock. It certainly does not help that Cohen pocketed millions in profits off of his stakes in these two companies after they achieved meme stock status. This track record makes it difficult to take him seriously as an activist investor.

Personally, I think the meme stock phenomenon has nothing to do with Cohen specifically and is more a phenomenon of the retail trading community, short-selling and a stock market that remains persistently overvalued. However, Nordstrom does have high short interest at 26% of float, so there is indeed a possibility that this could turn into another meme stock.

Takeaway

Even before Cohen decided to take an interest in the stock, I did consider Nordstrom to be undervalued compared to its long-term outlook, even though the stock will likely do badly if the U.S. economy enters an extended recession. Even after spiking 20%, the stock still looks cheap on paper.

Cohen does seem genuinely interested in working to help turn around struggling companies, and if we look past the meme stock fluctuations, GameStop has made progress in evolving its business model with his aid. Bed Bath & Beyond’s problems appear to run too deep as the company continues to consider declaring bankruptcy.

Nordstrom is still sufficiently profitable for now, so I think the chances of surviving for an eventual turnaround are good. However, there is a very real chance that this might turn into another meme stock, which could have unpredictable repercussions.