Akre Capital Management recently disclosed its 13F portfolio updates for the first quarter of 2023, which ended on March 31.

Chuck Akre (Trades, Portfolio) founded Akre Capital Management in 1989 and serves as the chairman and chief investment officer of the firm. The portfolio managers of the Akre Focus Fund are John Neff and Chris Cerrone. Headquartered in Middleburg, Virginia, the firm’s portfolio management team invests in a small number of quality businesses run by good managers who reinvest their free cash flow wisely. These are the three components that make up the unique “three-legged stool” investment philosophy which the firm is known for.

According to the firm’s latest 13F report, it did not make many significant changes to its portfolio during the quarter. The only trade that impacted the portfolio more than 1% was a reduction to CarMax Inc. (KMX, Financial). No new stocks showed up in the 13F filing, though it did exit one holding entirely, a minor stake in Alarm.com Holdings Inc. (ALRM, Financial).

Investors should be aware that 13F filings do not provide a complete picture of a guru’s holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarter’s end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

CarMax

Akre Capital slashed its stake in CarMax (KMX, Financial) by 41.44%, leaving a remaining stake of 3,098,466 shares. At the quarter’s average share price of $66.93, this slimmed the equity portfolio by 1.21%.

Headquartered in Richmond, Virginia, CarMax is an American used car retailer with approximately 195 stores across the U.S. It offers upfront prices, nationwide availability and online shopping.

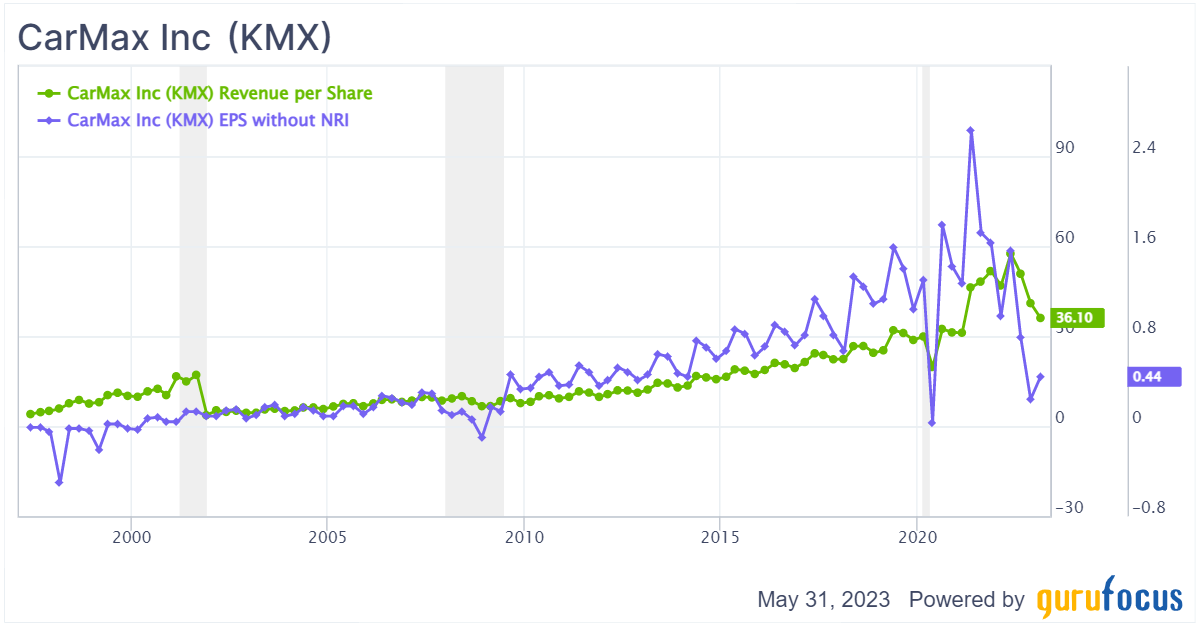

As the used car market begins to show signs of weakness amid high inflation, this used car retailer has come under pressure. CarMax was prioritizing market share gains over profitability increases during favorable market conditions resulting from Covid supply chain bottlenecks and monetary stimulus measures, which may or may not prove beneficial in the long run depending on how bad the economic downturn is and how long supply chain issues persist in the automotive industry.

There is also the gradual erosion of CarMax’s competitive advantage to consider. A big part of CarMax’s competitive advantage was its greater ability to match consumers with the car they want, but as online car buying has become more reliable, more competition has cropped up in this regard.

While the cash-debt ratio of 0.02 is worryingly low, the company does have a Piotroski F-Score of 5 out of 9, which indicates financial stability.

At a price of $71.19 per share as of this writing, CarMax has a market cap of $11.25 billion and a price-earnings ratio of 23.5. The GF Value chart rates the stock as significantly undervalued.

Alarm.com Holdings

The firm sold out of its 263,939-share position in Alarm.com Holdings (ALRM, Financial), which previously took up just 0.12% of the equity portfolio. During the quarter, shares averaged $51.48 apiece.

Alarm.com Holdings is a holding company based in Fairfax, Virginia. It owns Alarm.com, a tech company that provides automation, remote monitoring and remote control via cloud-based services for both homes and businesses for improved security, among other applications.

The company has seized on the smart home and connected security markets as its main growth avenues. These efforts have paid off with steady top-line growth, though the bottom line has remained fairly stagnant. Other growth opportunities include international expansion and smaller subsidiary businesses such as EnergyHub.

On the downside, Alarm.com has some fierce competitors, including Alphabet (GOOG, Financial)(GOOGL, Financial) in the connected home and remote monitoring markets. Its valuation has also gotten a little rich.

At a price of $49.71 as of this writing, Alarm.com has a market cap of $2.48 billion and a price-earnings ratio of 42.13. While the GF Value chart does consider the stock significantly undervalued, that assumes the stock can maintain historically high valuation levels.

Alarm.com does have plenty of financial firepower remaining, as shown by its interest coverage ratio of 15.78 and its cash-debt ratio of 1.14.

See also

The firm’s other trades for the quarter included minor reductions to Adobe Inc. (ADBE, Financial) and Dollar Tree Inc. (DLTR, Financial) and small additions to Brookfield Corp. (BN, Financial) and KKR & Co. Inc. (KKR, Financial). The turnover ratio for the quarter was 0%. Akre Capital’s 13F equity portfolio consisted of 20 holdings valued at a total of $11.37 billion as of the quarter’s end. You can view the full portfolio update as well as previous trades here.

The top holdings were Mastercard Inc. (MA, Financial) with 18.77% of the equity portfolio, Moody’s Corp. (MCO, Financial) with 15.36% and American Tower Corp. (AMT, Financial) with 12.58%. By sector, the firm was most invested in financial services, real estate and consumer cyclical stocks.