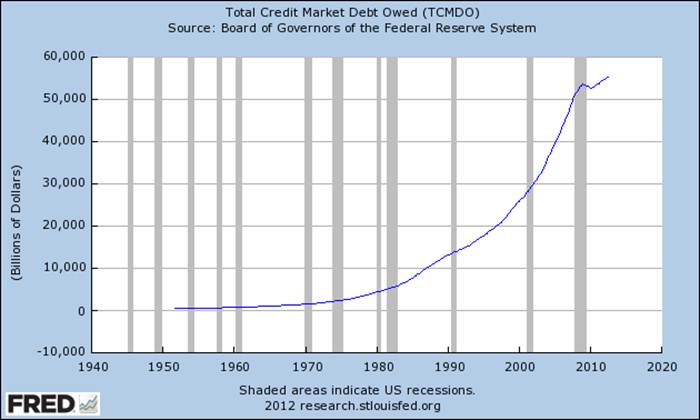

Since 2009, both the stock market and the broad U.S. economy have been dependent on perpetual support from massive federal deficits and unprecedented money creation. Meanwhile, Wall Street is content to ignore the extent of this support, and looks on every movement of the economy as a sign of intrinsic health – which is a lot like admiring the graceful flight of a dead parrot swinging by a string from the ceiling fan.

To put some numbers on this, it’s worth noting that since 1940, the S&P 500 has achieved an average annual total return of 14.5% in weeks where it was above its 200-day moving average as of the prior week’s close, and just 4.4% when it was below its 200-day moving average (only slightly more than the 4.2% average Treasury bill yield during that time, and with deep drawdowns usually concentrated in this partition). By contrast, since 2009, the S&P 500 has achieved an average total return of just 5.4% annually when it has been above its 200-day average, versus 36.7% when it has been below. Put another way, advancing trends above the 200-day average have repeatedly failed, making limited net progress overall, but declines have been halted and often breathtakingly reversed with each intervention. This pattern also reflects an unfinished cycle, the completion of which is likely to significantly damage the appeal of reflexively “buying the dip.”

Read the complete commentary

To put some numbers on this, it’s worth noting that since 1940, the S&P 500 has achieved an average annual total return of 14.5% in weeks where it was above its 200-day moving average as of the prior week’s close, and just 4.4% when it was below its 200-day moving average (only slightly more than the 4.2% average Treasury bill yield during that time, and with deep drawdowns usually concentrated in this partition). By contrast, since 2009, the S&P 500 has achieved an average total return of just 5.4% annually when it has been above its 200-day average, versus 36.7% when it has been below. Put another way, advancing trends above the 200-day average have repeatedly failed, making limited net progress overall, but declines have been halted and often breathtakingly reversed with each intervention. This pattern also reflects an unfinished cycle, the completion of which is likely to significantly damage the appeal of reflexively “buying the dip.”

Read the complete commentary