San Antonio-based investment firm, BIGLARI CAPITAL CORP. (Trades, Portfolio), recently made a significant addition to its portfolio. The firm entered a new stake in El Pollo Loco Holdings Inc (LOCO, Financial), purchasing 3,277,064 shares on July 18, 2023. This article provides an in-depth analysis of this transaction, the profiles of both BIGLARI CAPITAL CORP. (Trades, Portfolio) and El Pollo Loco Holdings Inc, and the potential implications for value investors.

Profile of BIGLARI CAPITAL CORP. (Trades, Portfolio)

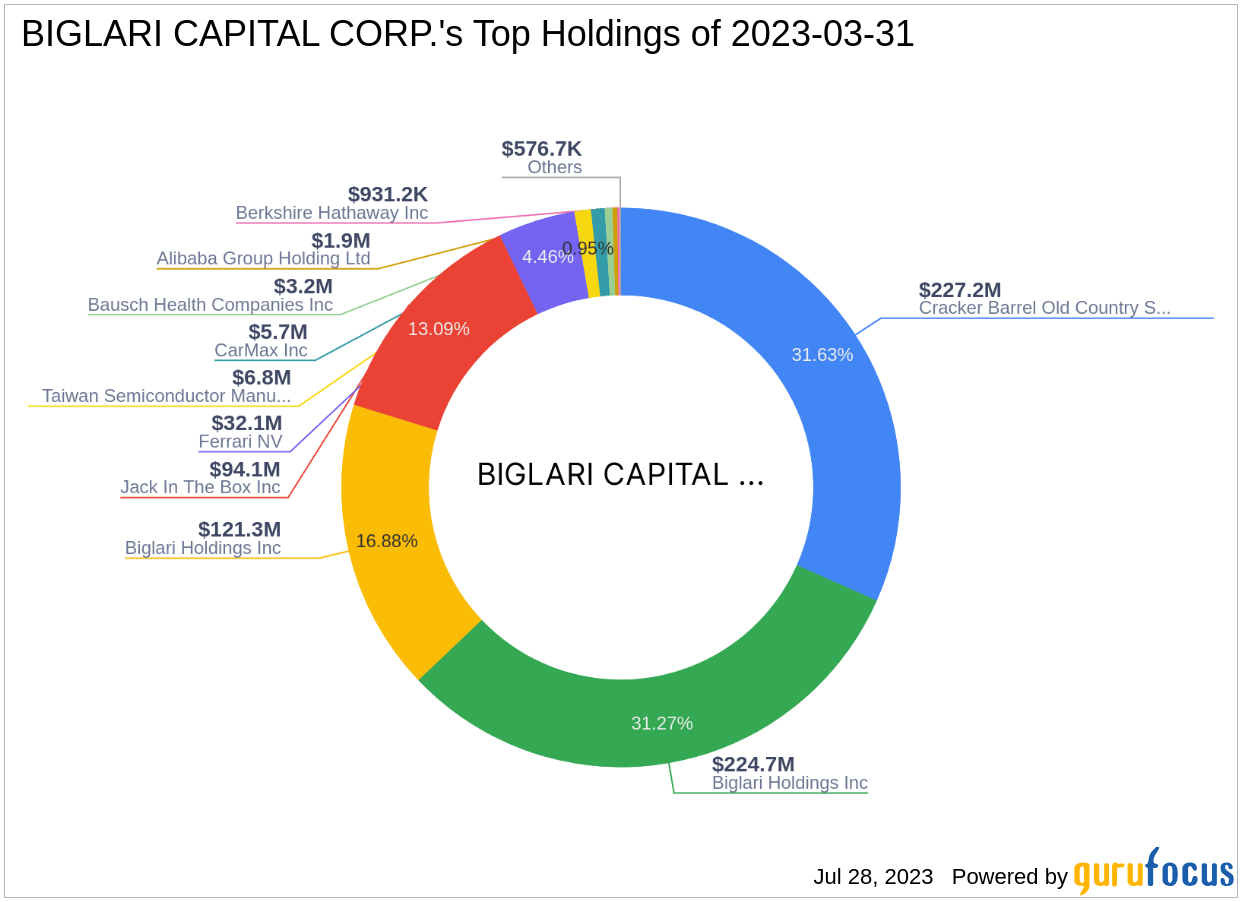

BIGLARI CAPITAL CORP. (Trades, Portfolio), located at 17802 IH 10 West, Suite 400, San Antonio, TX 78257, is an investment firm with a diverse portfolio. The firm's top holdings include Cracker Barrel Old Country Store Inc (CBRL, Financial), Jack In The Box Inc (JACK, Financial), Biglari Holdings Inc (BH, Financial), Ferrari NV (RACE, Financial), and Biglari Holdings Inc (BH.A, Financial). The firm's equity stands at $718 million, with the Consumer Cyclical and Technology sectors being its top sectors. The firm currently holds stocks in 12 companies.

Details of the Transaction

The acquisition of El Pollo Loco Holdings Inc shares by BIGLARI CAPITAL CORP. (Trades, Portfolio) was executed at a trade price of $9.95 per share. This transaction resulted in a 4.34% impact on the firm's portfolio, making El Pollo Loco Holdings Inc one of its significant holdings. The firm now holds a 9.10% stake in El Pollo Loco Holdings Inc, with the total shares amounting to 3,277,064.

Overview of El Pollo Loco Holdings Inc

El Pollo Loco Holdings Inc (LOCO, Financial), a fast-casual chicken restaurant operator in the United States, has a market cap of $386.551 million. The company, which went public on July 25, 2014, operates and franchises hundreds of restaurants, offering many low-priced options. Its largest food cost is poultry, accounting for roughly 38% of total food and paper cost. The company's segments include Company-operated restaurant revenue, Franchise advertising fee revenue, and Franchise revenue.

El Pollo Loco Holdings Inc is currently modestly undervalued with a GF Value of 15.19 and a PE percentage of 16.51%. The stock's current price is $10.73, representing a 7.84% gain since the transaction.

El Pollo Loco Holdings Inc.'s Financial Health

El Pollo Loco Holdings Inc has a balance sheet rank of 5/10, a profitability rank of 7/10, and a growth rank of 5/10. The company's cash to debt ratio is 0.02, with an interest coverage of 15.17. The company's ROE and ROA ranks are 152 and 125, respectively. The company's gross margin declined approximately 4.20% per year on average over the past five years, while its operating margin averaged a decline of 2.40% per year over the same period. The company's 3-year revenue growth is 2.80%, while its EBITDA and earnings decline over the same period are 6.40% and 5.20%, respectively.

El Pollo Loco Holdings Inc.'s Stock Performance

Since its IPO, El Pollo Loco Holdings Inc's stock has decreased by 43.53%. However, the stock has gained 9.83% year-to-date. The company's GF Score is 80/100, indicating good outperformance potential. The company's RSI 14 Day rank is 298, and its Momentum Index 6 - 1 Month rank is 299.

Comparison with the Largest Guru

The largest guru holding shares in El Pollo Loco Holdings Inc is Hotchkis & Wiley Capital Management LLC. Compared to this, BIGLARI CAPITAL CORP. (Trades, Portfolio)'s 9.10% stake in El Pollo Loco Holdings Inc is significant, indicating the firm's confidence in the stock.

Conclusion

In conclusion, BIGLARI CAPITAL CORP. (Trades, Portfolio)'s acquisition of a new stake in El Pollo Loco Holdings Inc is a notable addition to its portfolio. This transaction reflects the firm's strategic investment decisions and its confidence in El Pollo Loco Holdings Inc's potential. Value investors may find this information useful in their investment decisions. Please note that all data and rankings are accurate as of July 28, 2023.