Super Micro Computer Inc (SMCI, Financial), a prominent player in the hardware industry, has been making waves with its impressive performance. As of August 7, 2023, the company's stock price stands at $351.61, with a market cap of $18.46 billion. The stock has seen a gain of 4% today and a significant increase of 35.71% over the past four weeks. This article will delve into the company's GF Score and other key financial metrics to provide a comprehensive analysis of its performance and future prospects.

GF Score Analysis: Good Outperformance Potential

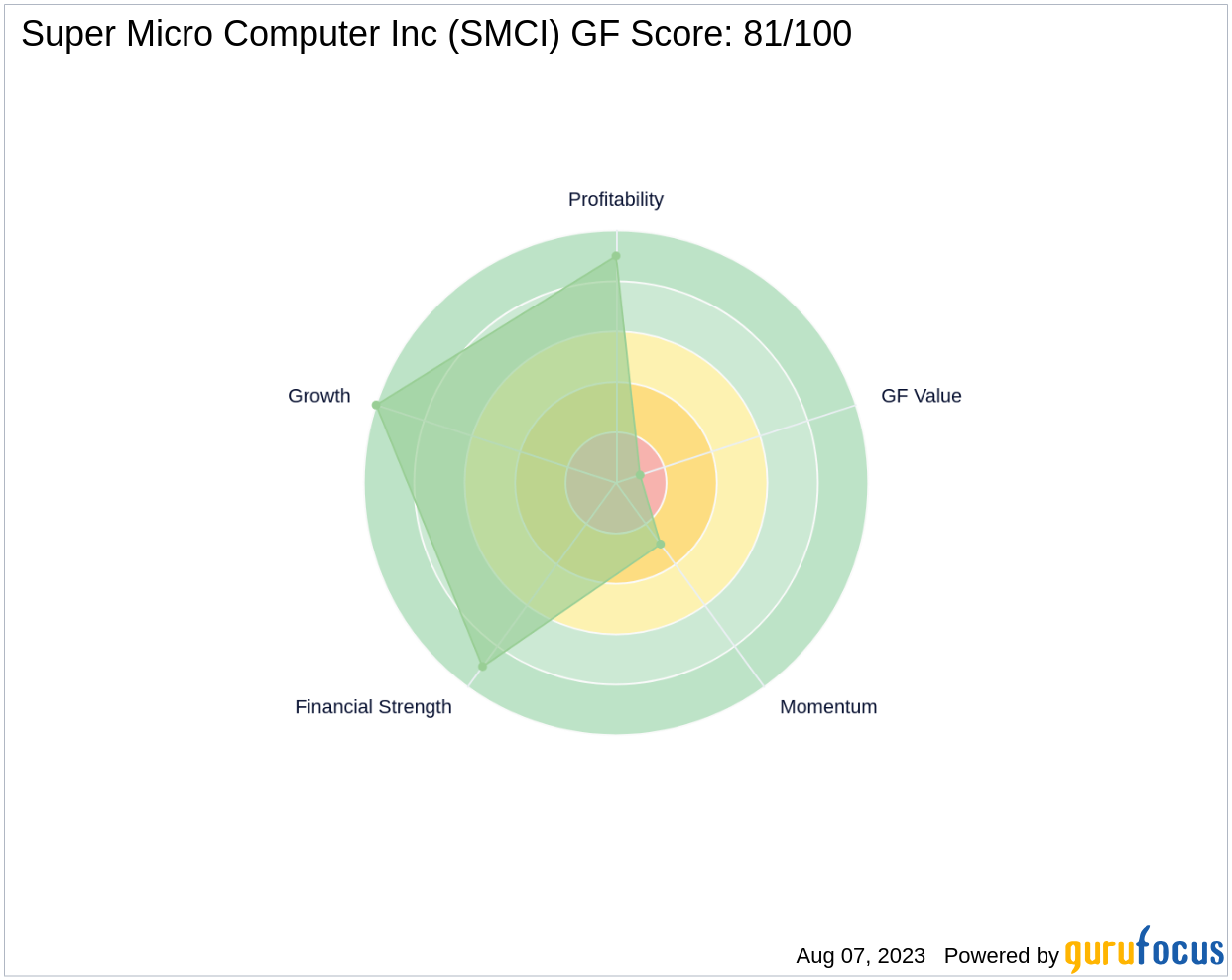

Super Micro Computer Inc boasts a GF Score of 81 out of 100, indicating good outperformance potential. The GF Score is a stock performance ranking system developed by GuruFocus, which is closely correlated with the long-term performances of stocks. A higher GF Score generally suggests higher returns, making SMCI an attractive investment option.

Financial Strength: Robust and Reliable

With a Financial Strength Rank of 9 out of 10, SMCI demonstrates a strong financial situation. The company's low debt to revenue ratio of 0.03 and high interest coverage of 70.60 further reinforce its financial stability. Additionally, its Altman Z-Score of 11.42 suggests a low probability of bankruptcy.

Profitability Rank: Consistently High

SMCI's Profitability Rank stands at 9 out of 10, reflecting its high profitability. The company's operating margin of 10.64% and a Piotroski F-Score of 7 indicate a healthy operating environment and strong financial health. Furthermore, SMCI has maintained consistent profitability over the past 10 years, enhancing its attractiveness to investors.

Growth Rank: Stellar Performance

SMCI's Growth Rank of 10 out of 10 reflects its impressive growth in terms of revenue and profitability. The company's 5-year revenue growth rate of 10.60% and 5-year EBITDA growth rate of 20.70% suggest a strong growth trajectory, making it a promising investment.

GF Value Rank: Overvalued

Despite its strong performance, SMCI's GF Value Rank of 1 out of 10 indicates that the stock may be overvalued. This suggests that investors should exercise caution and thoroughly evaluate the company's fundamentals before investing.

Momentum Rank: Room for Improvement

SMCI's Momentum Rank of 3 out of 10 indicates a relatively low momentum. This suggests that the stock's price performance may not be as robust as its other financial metrics.

Competitor Analysis: Leading the Pack

When compared to its main competitors - NetApp Inc (NTAP, Financial), Western Digital Corp (WDC, Financial), and Seagate Technology Holdings PLC (STX, Financial) - SMCI stands out with its high GF Score. NTAP, WDC, and STX have GF Scores of 87, 57, and 67 respectively, indicating that SMCI is a strong contender in the hardware industry. For more details, please visit our competitors' analysis page.

In conclusion, Super Micro Computer Inc's strong GF Score, robust financial strength, high profitability, and impressive growth make it a compelling investment option. However, its overvaluation and low momentum suggest that investors should proceed with caution.