Ariel Investment, LLC, founded by John Rogers (Trades, Portfolio), recently made a notable addition to his portfolio. On July 31, 2023, Ariel boosted in OneSpaWorld Holdings Ltd (OSW, Financial), a leading operator of health and wellness centers onboard cruise ships and at destination resorts worldwide. This article will delve into the details of this transaction, provide an overview of both Rogers' firm and OneSpaWorld Holdings Ltd, and analyze the potential implications of this acquisition.

Details of the Transaction

On July 31, 2023, Ariel Investment added 30,186 shares of OneSpaWorld Holdings Ltd to its portfolio at a trade price of $12.845 per share, bringing the holding to 13,810,291 shares. This transaction had a 0.22% change in shares and a 1.7% impact on Rogers's portfolio. As a result of this acquisition, the firm now holds a 13.90% stake in OneSpaWorld Holdings Ltd.

Profile of John Rogers (Trades, Portfolio)

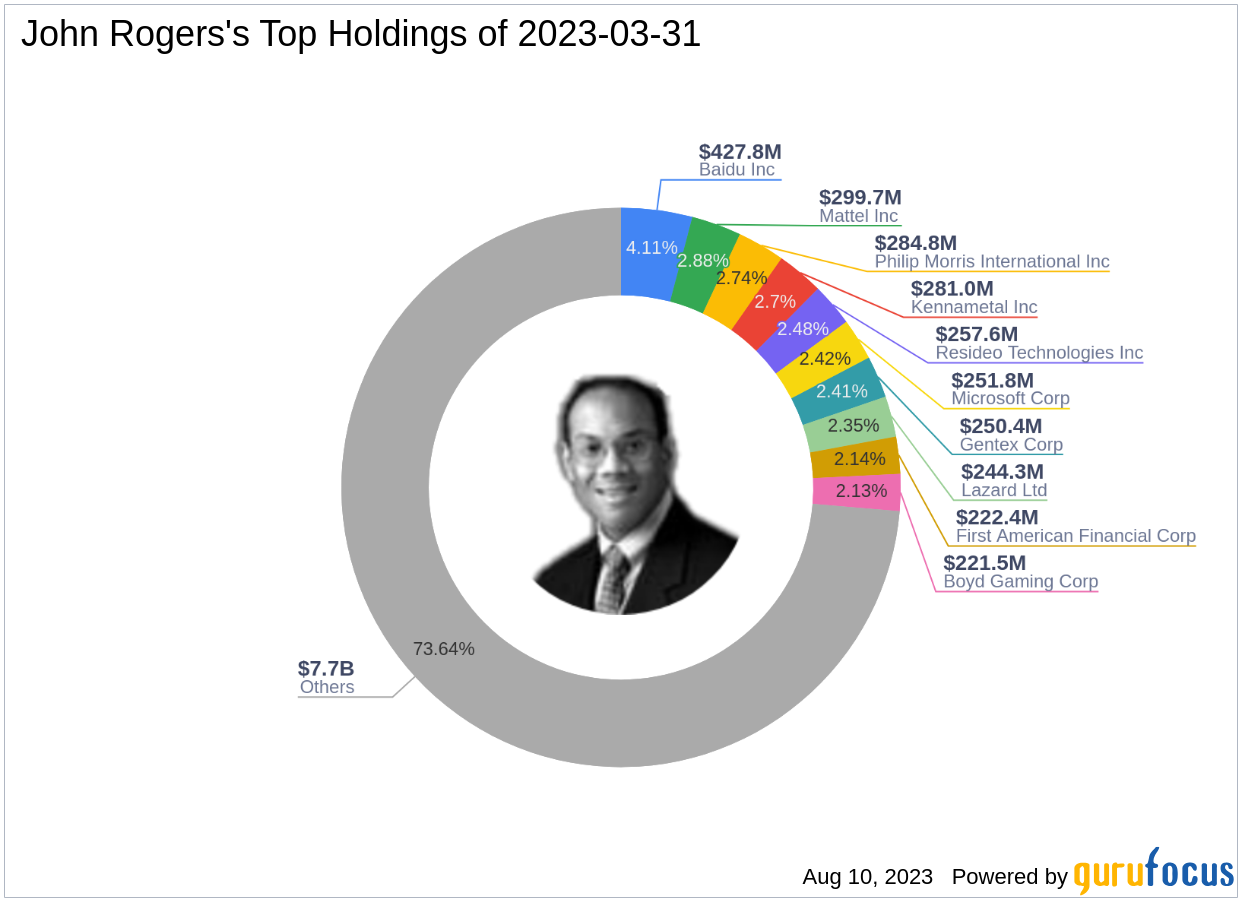

John Rogers (Trades, Portfolio) founded Ariel Investment, LLC in 1983 and has since been managing the firm's small and mid-cap institutional portfolios. Rogers is known for his patient investment approach, focusing on small and medium-sized companies that are undervalued. His top holdings include Baidu Inc (BIDU, Financial), Mattel Inc (MAT, Financial), Kennametal Inc (KMT, Financial), Philip Morris International Inc (PM, Financial), and Resideo Technologies Inc (REZI, Financial). His firm's equity stands at $10.41 billion, with the Consumer Cyclical and Financial Services sectors being the top sectors in his portfolio.

Overview of OneSpaWorld Holdings Ltd

OneSpaWorld Holdings Ltd, based in the Bahamas, operates health and wellness centers on cruise ships and at destination resorts worldwide. The company offers a suite of premium health, fitness, beauty, and wellness services and products. Since its IPO on March 20, 2019, the company has a market capitalization of $1.18 billion. Despite a PE percentage of 0.00, indicating the company is at a loss, the company's GF Value is $20.67, suggesting that the stock is significantly undervalued. The company's GF Score stands at 65/100, indicating a potential for average performance.

Analysis of the Transaction

Given Rogers's investment philosophy, the acquisition of OneSpaWorld Holdings Ltd shares aligns with his focus on undervalued companies. The company's significantly undervalued status and potential for average performance, as indicated by its GF Score, likely influenced Rogers's decision. This transaction could potentially enhance the diversity and performance of Rogers's portfolio.

Comparison with Other Gurus

Other investment gurus, such as Barrow, Hanley, Mewhinney & Strauss, also hold shares in OneSpaWorld Holdings Ltd. However, with his recent acquisition, Rogers now holds the largest stake in the company among these gurus.

Conclusion

In conclusion, John Rogers (Trades, Portfolio)'s recent acquisition of OneSpaWorld Holdings Ltd shares is a significant addition to his portfolio. Given the company's undervalued status and potential for average performance, this transaction aligns with Rogers's investment philosophy and could potentially enhance his portfolio's performance. As always, investors are advised to conduct their own comprehensive analysis before making investment decisions.