On August 10, 2023, Polar Asset Management Partners Inc. (Trades, Portfolio), a Toronto-based investment firm, reduced its stake in PHP Ventures Acquisition Corp (PPHP, Financial), a blank check company based in Malaysia. This article provides an in-depth analysis of the transaction, the profiles of the guru and the traded company, and the financial health and market momentum of the traded stock.

Details of the Transaction

The transaction saw Polar Asset Management Partners Inc. (Trades, Portfolio) reduce its holdings in PPHP by 6,974 shares, bringing its total share count to 271,847. This move had a negligible impact on the firm's portfolio, with PPHP now accounting for 0.07% of it. Despite the reduction, Polar Asset Management still holds a significant 7.77% stake in PPHP. The shares were traded at a price of $10.93 each.

Profile of Polar Asset Management Partners Inc. (Trades, Portfolio)

Polar Asset Management Partners Inc. (Trades, Portfolio) is a renowned investment firm located at 401 Bay Street, Toronto. The firm manages a diverse portfolio of 935 stocks, with a total equity of $4.54 billion. Its top holdings include iShares Russell 2000 ETF(IWM, Financial), Sprott Physical Gold Trust(PHYS, Financial), Horizon Therapeutics PLC(HZNP, Financial), Penumbra Inc(PEN, Financial), and Regal Rexnord Corp(RRX, Financial). The firm has a strong preference for the Financial Services and Technology sectors.

Overview of PHP Ventures Acquisition Corp

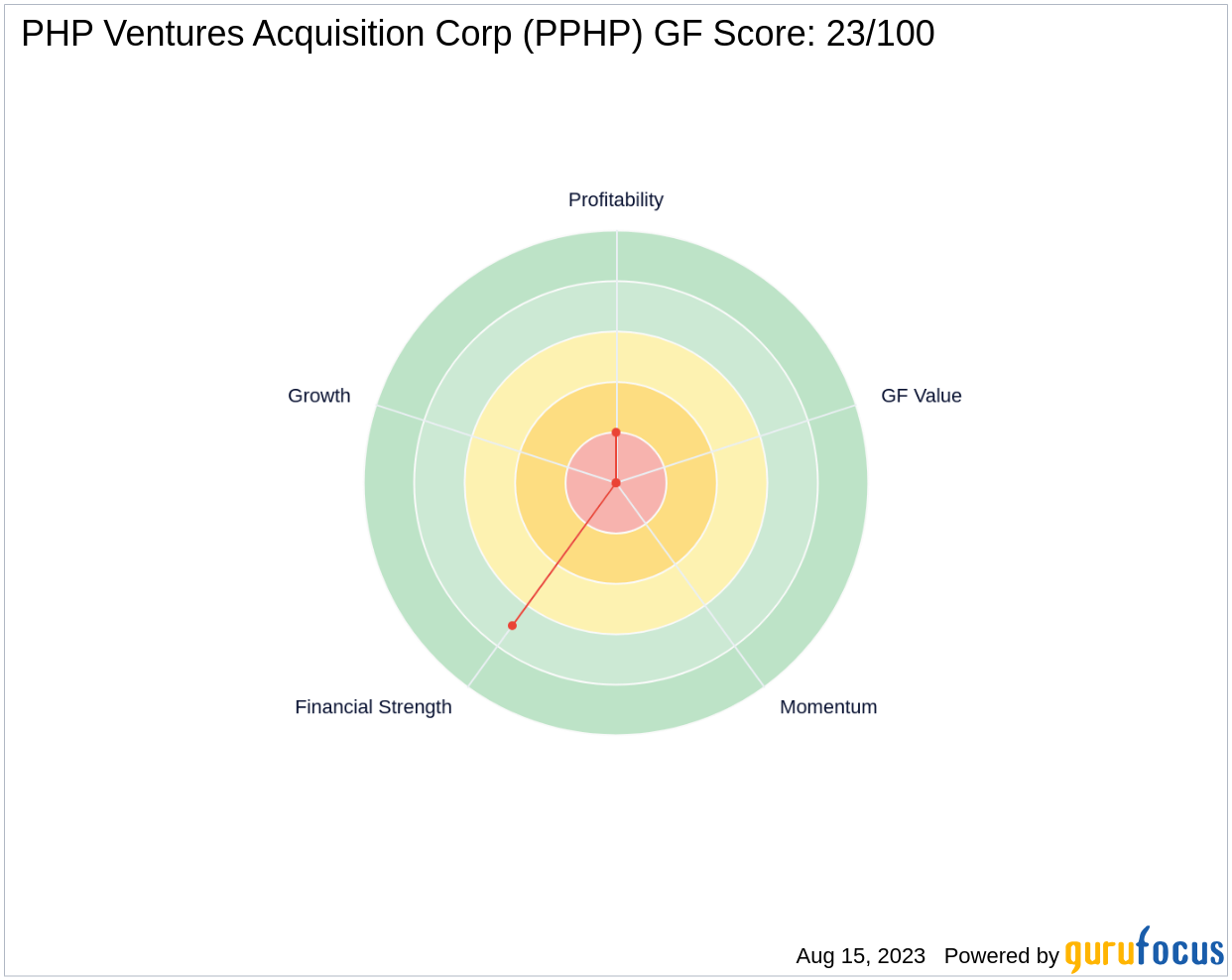

PHP Ventures Acquisition Corp (PPHP, Financial) is a blank check company based in Malaysia. Since its Initial Public Offering (IPO) on October 4, 2021, the company's stock has seen an 11.3% increase in price. As of August 15, 2023, the company has a market capitalization of $38.295 million and its stock is trading at $10.93. The company's GF Score stands at 23/100, indicating poor future performance potential.

Financial Health of PHP Ventures Acquisition Corp

PHP Ventures Acquisition Corp's financial health is a mixed bag. The company's Financial Strength is ranked 7/10, while its Profitability Rank is a low 2/10. The company's Growth Rank is not applicable due to insufficient data. The company's interest coverage is at an impressive 10,000, indicating a strong ability to cover its interest expenses. However, the company's Return on Equity (ROE) and Return on Assets (ROA) are -4.63 and -3.51 respectively, indicating poor profitability.

Market Momentum of PHP Ventures Acquisition Corp

PHP Ventures Acquisition Corp's stock has shown moderate momentum. The stock's 5-day, 9-day, and 14-day Relative Strength Index (RSI) are 47.45, 51.95, and 53.81 respectively. The stock's 6-month and 12-month Momentum Index are 1.99 and 6.63 respectively. However, the stock's Momentum Rank is not applicable due to insufficient data.

Conclusion

In conclusion, Polar Asset Management Partners Inc. (Trades, Portfolio)'s recent reduction in its stake in PHP Ventures Acquisition Corp is a noteworthy move. Despite the reduction, the firm still holds a significant stake in the company. PHP Ventures Acquisition Corp's financial health and market momentum present a mixed picture, with strong financial strength but poor profitability and growth potential. Investors should keep a close eye on this stock and the moves of Polar Asset Management Partners Inc. (Trades, Portfolio)