On August 15, 2023, NVIDIA Corp (NVDA, Financial) closed at $442.08, marking a 1.04% gain for the day and a 51.74% gain over the last three months. Despite the impressive growth and an Earnings Per Share (EPS) (EPS) of 1.92, our analysis suggests that the stock may be significantly overvalued. This article aims to provide a detailed valuation analysis of NVIDIA, guiding potential investors in making informed decisions.

Company Overview: NVIDIA Corp (NVDA, Financial)

NVIDIA is a leading designer of discrete graphics processing units that enhance the experience on computing platforms. The firm's chips are used in a variety of end markets, including PC gaming and data centers. In recent years, NVIDIA has broadened its focus from traditional PC graphics applications such as gaming to more complex and favorable opportunities, including artificial intelligence and autonomous driving, which leverage the high-performance capabilities of the firm's products. With a current price of $442.08 per share, NVIDIA has a market cap of $1.10 trillion, and its GF Value stands at $305.28, suggesting a significant overvaluation.

Understanding GF Value

The GF Value is a proprietary measure of a stock's intrinsic value. It is calculated based on three factors: historical trading multiples, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of the business performance. The GF Value Line provides an overview of the fair value that the stock should ideally be traded at. If the stock price is significantly above the GF Value Line, it is overvalued and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

For NVIDIA, the GF Value stands at $305.28, significantly lower than its current trading price. This suggests that NVIDIA's stock is significantly overvalued, and the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing NVIDIA's Financial Strength

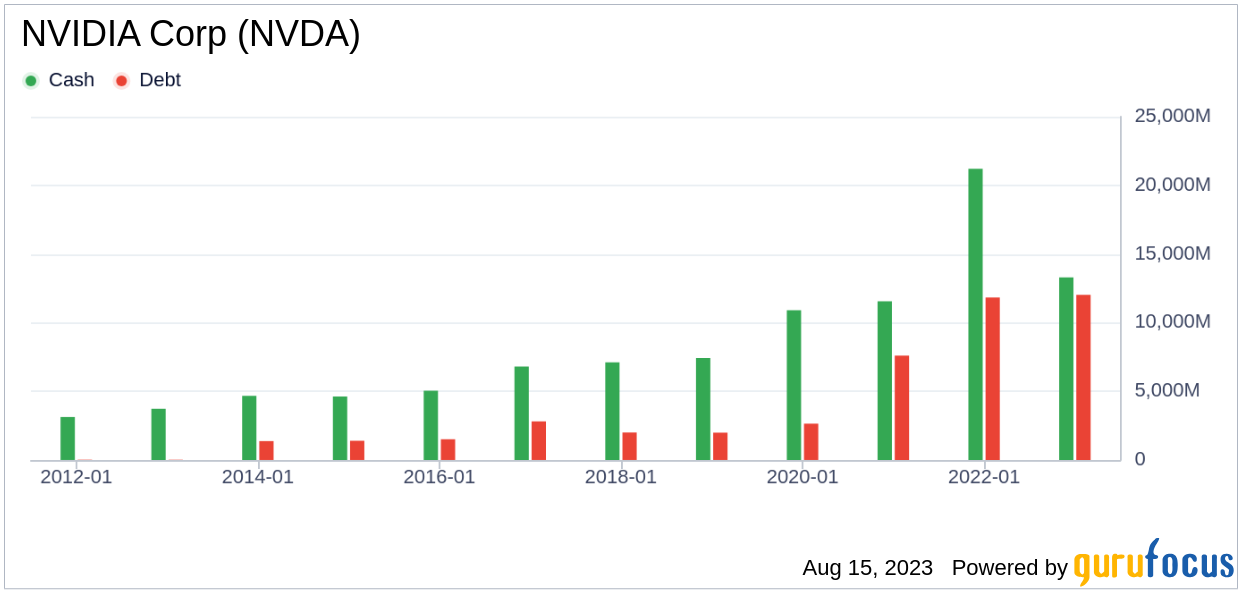

Investing in companies with poor financial strength carries a higher risk of permanent loss. Hence, it is crucial to analyze the financial strength of a company before buying its stock. Key indicators of financial strength include the cash-to-debt ratio and interest coverage. NVIDIA has a cash-to-debt ratio of 1.27, which is worse than 58.46% of companies in the Semiconductors industry. However, the overall financial strength of NVIDIA is 8 out of 10, indicating that the financial strength of NVIDIA is strong.

NVIDIA's Profitability and Growth

Investing in profitable companies carries less risk, especially in companies that have demonstrated consistent profitability over the long term. NVIDIA has been profitable 10 years over the past 10 years. During the past 12 months, the company had revenues of $25.90 billion and Earnings Per Share (EPS) of $1.92. Its operating margin of 17.37% is better than 75.88% of companies in the Semiconductors industry. Overall, GuruFocus ranks NVIDIA's profitability as strong.

Growth is a crucial factor in the valuation of a company. NVIDIA's 3-year average revenue growth rate is better than 87.88% of companies in the Semiconductors industry. However, NVIDIA's 3-year average EBITDA growth rate is 20.1%, which ranks worse than 53.12% of companies in the Semiconductors industry.

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) provides insights into its profitability. ROIC measures how well a company generates cash flow relative to the capital it has invested in its business. WACC is the rate that a company is expected to pay on average to all its security holders to finance its assets. If the ROIC exceeds the WACC, the company is likely creating value for its shareholders. During the past 12 months, NVIDIA's ROIC is 20.32 while its WACC came in at 16.65.

Conclusion

In conclusion, the stock of NVIDIA Corp (NVDA, Financial) is believed to be significantly overvalued. The company's financial condition is strong, and its profitability is robust. However, its growth ranks worse than 53.12% of companies in the Semiconductors industry. To learn more about NVIDIA stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out the GuruFocus High Quality Low Capex Screener.