Owl Creek Asset Management, L.P., a New York-based investment firm, has recently reduced its stake in 26 Capital Acquisition Corp (ADER, Financial). The transaction, which took place on August 18, 2023, saw the firm offload 152,060 shares at a price of $11.15 each. This move is of significant interest to value investors, as it provides insights into the investment strategies of one of the leading firms in the financial services sector.

Details of the Transaction

The transaction resulted in a 33.47% reduction in Owl Creek's holdings in ADER, leaving the firm with a total of 302,300 shares. This change had a -0.08% impact on the firm's portfolio and reduced its position in the traded stock to 2.93%. Despite the reduction, ADER still constitutes 0.16% of Owl Creek's portfolio, indicating the firm's continued confidence in the stock.

Profile of Owl Creek Asset Management, L.P.

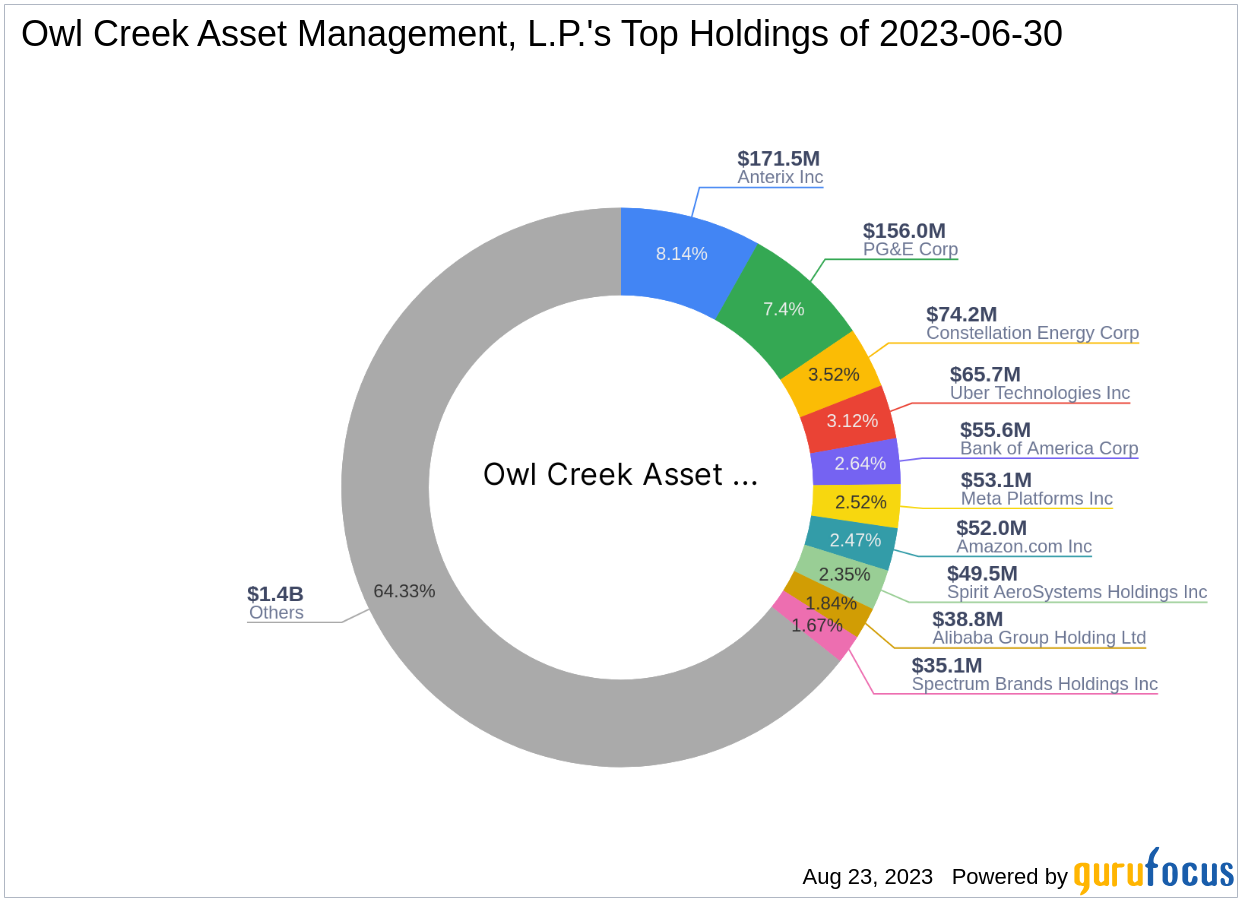

Owl Creek Asset Management, L.P., located at 640 Fifth Avenue, New York, NY, is a renowned investment firm with a diverse portfolio. The firm currently holds 149 stocks, with a total equity of $2.11 billion. Its top holdings include Anterix Inc (ATEX, Financial), Bank of America Corp (BAC, Financial), PG&E Corp (PCG, Financial), Uber Technologies Inc (UBER, Financial), and Constellation Energy Corp (CEG, Financial). The firm's investments are primarily concentrated in the Financial Services and Communication Services sectors.

Overview of 26 Capital Acquisition Corp

26 Capital Acquisition Corp (ADER, Financial), a US-based blank check company, went public on March 8, 2021. The company's market cap stands at $115.419 million, with a current stock price of $11.2. Since its IPO, the stock has gained 13.13%, and its year-to-date price change ratio is 11.22%. However, due to insufficient data, the GF Valuation and GF Value of the stock cannot be evaluated. The company's GF Score is 22/100, indicating a poor future performance potential.

Evaluation of 26 Capital Acquisition Corp's Financial Health

ADER's financial health, as indicated by its Financial Strength rank of 6/10 and Profitability Rank of 2/10, is moderate. The company's interest coverage is 10000.00, ranking it first in the industry. However, its Altman Z score is 0.00, and its Piotroski F-Score is 2, indicating financial instability. The company's ROE and ROA are -2.40 and -1.99, respectively, ranking it 492nd and 499th in the industry.

Analysis of 26 Capital Acquisition Corp's Growth and Momentum

ADER's growth and momentum are currently not measurable due to insufficient data. The company's gross margin growth, operating margin growth, revenue growth over three years, EBITDA growth over three years, and earning growth over three years are all 0.00. The company's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 47.93, 49.33, and 52.63, respectively. Its momentum index for 6 - 1 month and 12 - 1 month are 9.95 and 15.18, respectively.

Conclusion

In conclusion, Owl Creek Asset Management, L.P.'s recent reduction in its stake in 26 Capital Acquisition Corp provides valuable insights into the firm's investment strategy. Despite the reduction, ADER still constitutes a significant portion of the firm's portfolio, indicating its continued confidence in the stock. However, investors should note that ADER's financial health and growth potential are currently moderate, and its future performance potential is poor, according to its GF Score. Therefore, investors should exercise caution and conduct thorough research before making investment decisions.