Viking Global Investors, the investment firm founded by Andreas Halvorsen (Trades, Portfolio) in 1999, disclosed earlier this week it boosted its stake in Inhibrx Inc. (INBX, Financial) by 7.71% following a private placement financing agreement.

As a former protégé of the late Julian Robertson, head of Tiger Management (Trades, Portfolio), the guru's Greenwich, Connecticut-based hedge fund takes a long-term, research-intensive approach to investing. The firm selects stocks based on its understanding of the company’s fundamentals, business model and management team, while also taking cyclical and secular industry trends into consideration.

According to Real-Time Picks, a Premium GuruFocus feature based on 13D, 13G and Form 4 filings, Viking picked up 511,627 shares of the biotech company on Aug. 28, which had an impact of 0.04% on the equity portfolio. The stock traded for an average price of $19.35 per share on the day of the transaction.

The firm now holds 7.15 million shares in total, which account for 0.57% of the equity portfolio. GuruFocus estimates Viking has gained 10.43% on the investment since establishing it in the third quarter of 2020.

About Inhibrx

Founded in 2010, the La Jolla, California-based clinical-stage biotechnology company, which has protein-engineering expertise, focuses on developing novel therapeutics for oncology and rare diseases through its proprietary single-domain antibody platform.

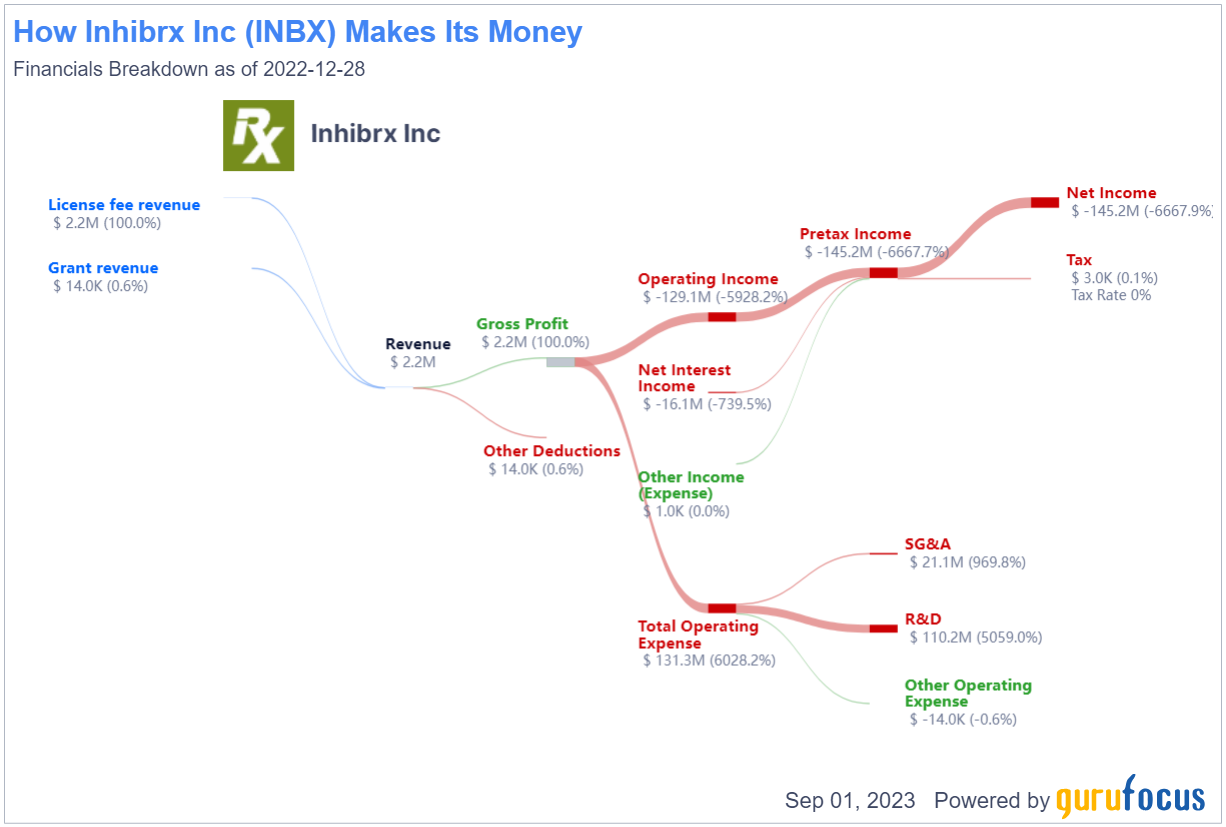

Inhibrx generates nearly all of its revenue through license fees. Only a small fraction is provided through grants.

The company went public in August of 2020.

Pipeline

Currently, the company has four drug candidates in various stages of clinical trials. Three of them, INBRX-106, INBRX-109 and INBRX-105, are for the treatment of several different forms of cancer. The other, INBRX-101, is for the treatment of alpha-1 antitrypsin deficiency, a condition that increases the risk of developing lung or liver disease.

On May 30, Inhibrx announced INBRX-101 was granted Fast Track designation by the Food and Drug Administration.

Financing agreement

On Aug. 29, Inhibrx announced it entered into a securities purchase agreement for a private placement financing that is projected to generated $200 million in proceeds.

The financing was limited to certain existing investors, including RA Capital Management, Viking Global, Perceptive Advisors and TCGX.

According to the terms of the agreement, the company sold an aggregate of 3.62 million shares of its common stock at a price of $19.35 each. In addition, it sold pre-funded warrants to purchase up to an aggregate of 6.71 million shares at a purchase price of $19.3499 per pre-funded warrant. Each warrant had an exercise price of 0.0001 cents per share and was immediately exercisable until exercised in full.

The financing agreement closed on Aug. 31.

Earnings review

On Aug. 7, Inhibrx reported its second-quarter financial results.

For the three months ended June 30, the company posted a net loss of $47.1 million, or $1.08 per share, which widened from the prior-year quarter. Revenue from licensing was negligible at $30,000.

Further, it recorded Ebitda of -$39 million, which also saw a decline from a year ago.

At the end of the quarter, the company had cash and cash equivalents of $192.5 million. Its total research and development expenses totaled $34.1 million, while its general and administrative costs totaled $7.3 million.

Valuation

Inhibrx has a $978.16 million market cap; its shares were trading around $22.40 on Friday with a price-sales ratio of 1,535.09.

The GF Value Line suggests the stock is significantly overvalued currently based on its historical ratios, past financial performance and analysts’ future earnings projections.

At 43 out of 100, the GF Score indicates the company has weak performance potential. While it received a high momentum rank, its ratings for financial strength, growth, profitability and value are low.

Guru investors

Viking Global has the largest position in Inhibrx currently with a 16.37% stake.

According to 13F filings for the second quarter, the stock is also being held by Steven Cohen (Trades, Portfolio), Jim Simons (Trades, Portfolio)’ Renaissance Technologies and Ron Baron (Trades, Portfolio).

Portfolio composition

Nearly half of the firm’s $24.34 billion equity portfolio, which the 13F filing showed was composed of 85 stocks as of the end of the second quarter, was invested in the health care and technology sectors.

Other companies in the biotechnology space Viking Global had positions in as of June 30 included Roivant Sciences Ltd. (ROIV, Financial), BridgeBio Pharma Inc. (BBIO, Financial), Biomarin Pharmaceutical Inc. (BMRN, Financial), Royalty Pharma PLC (RPRX, Financial) and Ginkgo Bioworks Holdings Inc. (DNA, Financial).

Investors should be aware 13F filings do not give a complete picture of a firm’s holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.