There is just one requirement for a stock to gain entrance into the Dividend Kings: a company must increase its dividend for at least 50 consecutive years.

Seems simple, but only 50 companies have met the minimum threshold to become a Dividend King. This makes these companies the best of the best when it comes to dividend durability.

These companies have enduring business models and provide products or services that customers need, even in recessionary periods.

This discussion will examine two of the newest additions to the Dividend Kings that can be counted on for income over the long-term.

Archer-Daniels-Midland

The first name up for discussion is Archer-Daniels-Midland Co. (ADM, Financial). Founded in 1902, the company, which is also called ADM, has transformed over time to become an agricultural giant. The company’s business segments provide processed cereal grains, oilseeds and storage and transportation. The company has a market capitalization of $43 billion and has generated almost $100 billion over the last year.

Archer-Daniels-Midland’s primary competitive advantage is it is the largest publicly traded farmland company in the country, giving it a size and scale that competitors have not been able to replicate. In addition, the need for food to meet growing populations remains very high, which has typically helped the company perform well during recessionary periods.

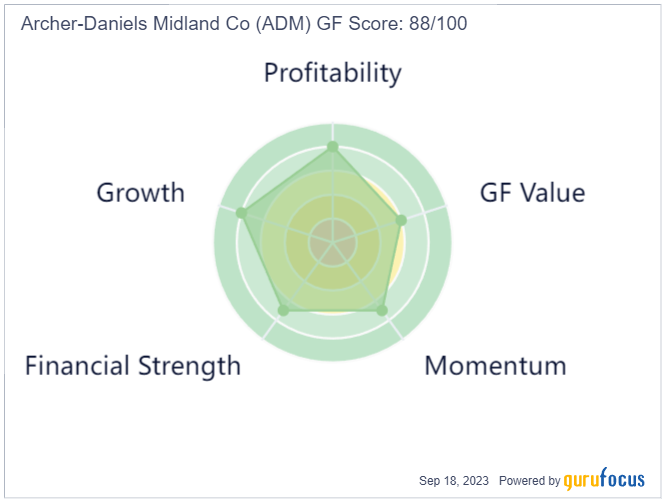

The GF Score of 88 out of 100 suggests modest returns at the current price. The company scores well in the area profitability and growth and has average rankings for momentum, financial strength and value.

While many companies struggled during the 2007 to 2009 period, Archer-Daniels-Midland’s earnings per share improved almost 29%. While the company did see declines in the middle of the last decade, earnings compounded at a rate of more than 14% for this period.

This high rate of growth has enabled the company to raise its dividend for 50 consecutive years, making it one of the newest members of the Dividend King Index. Dividend growth has been solid since 2013, with distributions growing at an annual rate of 8.6%. Archer-Daniels-Midland yields 2.3% currently, which is ahead of the S&P 500 Index’s average yield of 1.5%.

A dividend growth streak means little if the dividend is not safe. This should be an issue for Archer-Daniels-Midland as its projected payout ratio for this year is just 25%. This compares favorably to the average payout ratio of 39% since 2013. This likely means the company can continue to raise its dividend for years to come.

The stock’s GF Value Line suggests the stock is trading at a discount to its intrinsic value, based on the company’s historical ratios, past financial performance and analysts’ projections for future earnings growth. Archer-Daniels-Midland has a price-to-GF-Value ratio of 0.91, implying a possible return of 9.9% return from current levels. Inclusive of the dividend yield, total returns could be in the double digits.

S&P Global

Next up is S&P Global Inc. (SPGI, Financial), which provides financial services and business information to customers around the world. The company was originally named McGraw Hill Financial, where is first introduced the S&P 500 Index.

The company’s services include providing credit ratings, analytics and other data to market participants and capital markets. S&P Global is valued at $123 billion and generates annual revenue of approximately $12 billion.

S&P Global has a diversified business model. Roughly two-thirds of revenue comes from the Americas, with Europe, the Middle East and Africa contributing 25% and Asia Pacific-China adding the remainder. Investment banking and management are the two largest contributors to sales, making up half of the annual total combined. The company operates in an environment with few large players as the top three names in the financial debt ratings industry control more than 90% of the market.

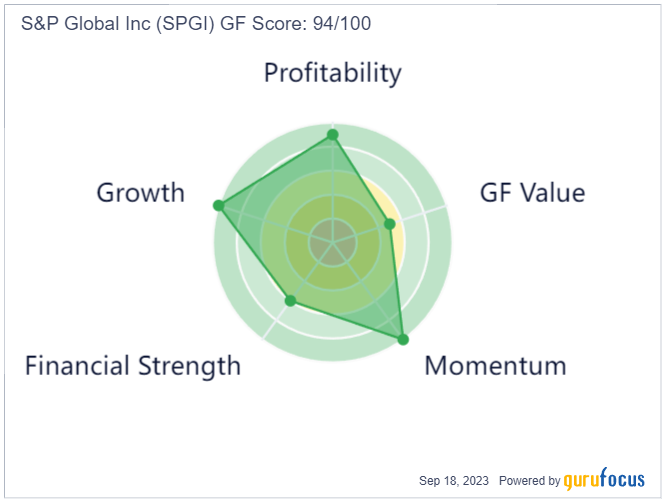

The company receives has a solid GF Score of 94 from GuruFocus. This score implies high returns moving forward and is powered by high marks for profitability, momentum, growth and value. These scores are partially offset by a middle of the road result for financial strength.

The company was not immune to the last recession, with earnings per share falling 21% from 2007 to 2009. However, S&P Global did return to growth in 2010, establishing a new high for earnings per share in 2013. Earnings per share have a compound annual growth rate of 14.4% for the last decade.

While bottom-line growth was sporadic during this period, S&P Global continued to raise its dividend. In fact, the company has paid an uninterrupted dividend since 1937. The company has also raised its dividend for 50 consecutive years.

Shares of S&P Global yield just 0.9%. What the stock lacks in income it makes up for in dividend growth and safety. S&P Global’s dividend has a CAGR of nearly 13% over the last decade. The projected payout ratio for 2023 is just 29%, which compares favorably to the long-term average payout ratio of 27%.

S&P Global’s GF Value Line implies shares are slightly undervalued. With a GF Value of 0.93, investors could see a 10% return from current levels.

Final thoughts

Investors looking for sources of safe and secure income are recommended to consider the Dividend Kings. These names have proven over a long period of time to have enduring business models that propel dividend growth.

Archer-Daniels-Midland and S&P Global are two of the newest members of the Dividend Kings. Both companies have strong business models and extensive track records for dividend growth, making each a good addition to an income orientated investor’s watchlist.