MillerKnoll Inc (MLKN, Financial), formerly known as Herman Miller Inc, is a globally recognized company that designs, manufactures, sells, and distributes interior furnishings. With a diverse product range sold through various channels, including contract furniture dealers, direct customer sales, retailers, direct-mail catalogs, and online stores, MillerKnoll Inc has established a strong presence in the industry. The company operates through three reportable segments: Americas Contract, International Contract & Specialty International & Specialty, and Global Retail, with the independent retailer division generating the majority of its overall sales.

Ownership Breakdown and Recent Performance

As per the latest data, MillerKnoll Inc has an outstanding share count of 74.84 million. The institutional ownership stands at 58.38 million shares, which constitutes 78% of the total shares. On the other hand, insiders hold 1.26 million shares, accounting for 1.68% of the total share count.

The stock value of MillerKnoll Inc has experienced a decline of about 9.9% over the past week. As of Sep 22, 2023, the stock fell by 1.82%, contrasting with its three-month return of 38.1%. The company's market cap has also seen fluctuations, dropping to $1.03 billion in the most recent quarter from $1.81 billion in the preceding one. These market dynamics have sparked keen interest in the company's ownership trends.

Institutional Ownership and Key Players

The institutional ownership history of MillerKnoll Inc provides valuable insights into the levels of trust and confidence that major players have in the company's future. As of August 31, 2023, the institutional ownership level is 78%, down from 80.91% as of May 31, 2023, and down from 99.77% from a year ago.

The top fund managers holding significant stakes in MillerKnoll Inc's stock include HOTCHKIS & WILEY (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio), owning 1.32%, 0.02%, and 0.02% of shares outstanding respectively. The recent institutional trading activity provides a vivid picture of the market sentiment, with HOTCHKIS & WILEY (Trades, Portfolio) adding 254 shares, Joel Greenblatt (Trades, Portfolio) adding 3 shares, and Jefferies Group (Trades, Portfolio) buying 13 new shares during the quarter ending June 30, 2023.

Financial Performance and Future Prospects

Over the past three years, MillerKnoll Inc's Ebitda growth averaged 40.1% per year, outperforming 88.83% of 349 companies in the Furnishings, Fixtures & Appliances industry. The company's estimated earnings growth for the future is 12% per year, which is higher than the earnings growth of 0% during the past three years.

Insider Ownership and Activities

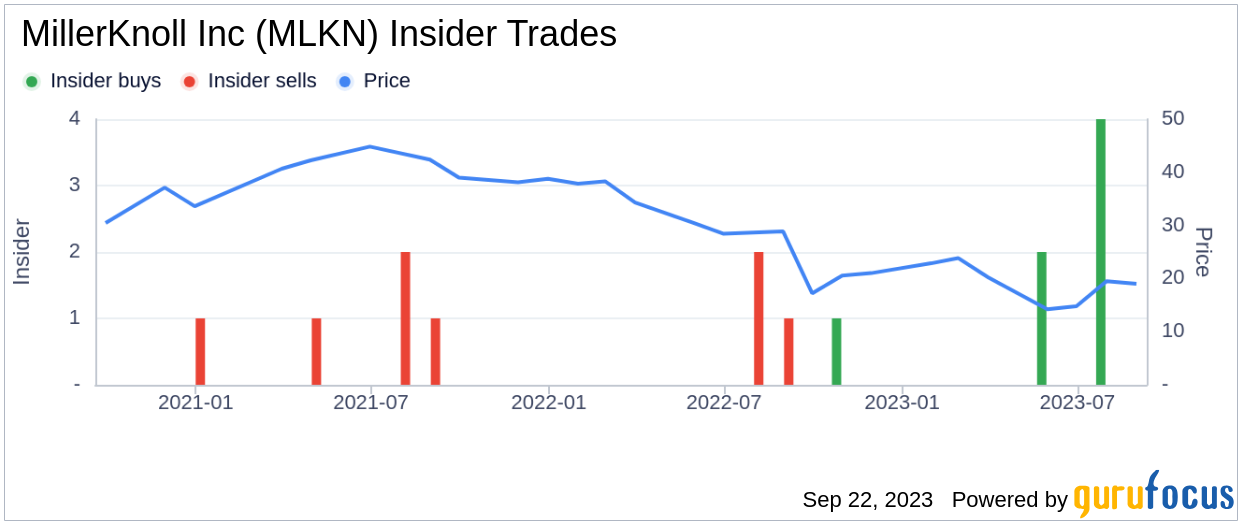

Insider ownership provides insights into the convictions of the company's board directors and C-level employees. As of August 31, 2023, MillerKnoll Inc's insider ownership is approximately 1.68%, up from 1.3% from a year ago, reflecting the increased faith of those intimately familiar with the company's operations.

In the past three months, MillerKnoll Inc recorded 4 insider buy transactions, with Director Michael A Volkema buying 13,584 shares, Director Michael R Smith buying 1,200 shares, Director Mike C. Smith buying 4,000 shares, and Director Lisa A Kro buying 5,950 shares.

Conclusion

In the ever-evolving realm of stocks, understanding the nuances of ownership and earnings is critical. MillerKnoll Inc's recent dip is a case study in how major players react to market shifts, and their movements offer crucial insights for potential investors. As always, a holistic view, combining both past performance and future projections, remains key to sound investment decisions. Investors can screen for stocks with high Insider Cluster Buys using the following page: https://www.gurufocus.com/insider/cluster.