JOYY Inc (YY, Financial) recently experienced a daily loss of 5.64%, yet it boasts a 3-month gain of 22.29%. With an Earnings Per Share (EPS) of $3.27, investors are prompted to question whether the stock is significantly overvalued. This article delves into JOYY's valuation, providing investors with a comprehensive analysis to determine the stock's true market value. Continue reading for an insightful valuation exploration.

Company Introduction

JOYY Inc is a global technology company renowned for its innovative capabilities, enabling real-time user interaction and expanding its global commerce Software-as-a-Service solutions. With a strong emphasis on technological innovation, JOYY holds a significant number of patent applications and licenses, underscoring its industry recognition. Currently, JOYY's stock price stands at $39.33, juxtaposed against a GF Value of $27.29, suggesting a potential overvaluation which warrants a closer examination.

Summarize GF Value

The GF Value is a unique measure of intrinsic stock value, incorporating historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This value serves as a benchmark for the stock's fair trading price. JOYY (YY, Financial) appears significantly overvalued according to our GF Value, which suggests that the current price of $39.33 per share may not align with the company's long-term business growth and could result in poorer future returns.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investors must consider a company's financial strength to mitigate the risk of permanent capital loss. JOYY's cash-to-debt ratio of 6.95, which ranks better than 52.12% of its peers in the Interactive Media industry, along with an overall financial strength score of 7 out of 10, suggests a fair financial condition.

Profitability and Growth

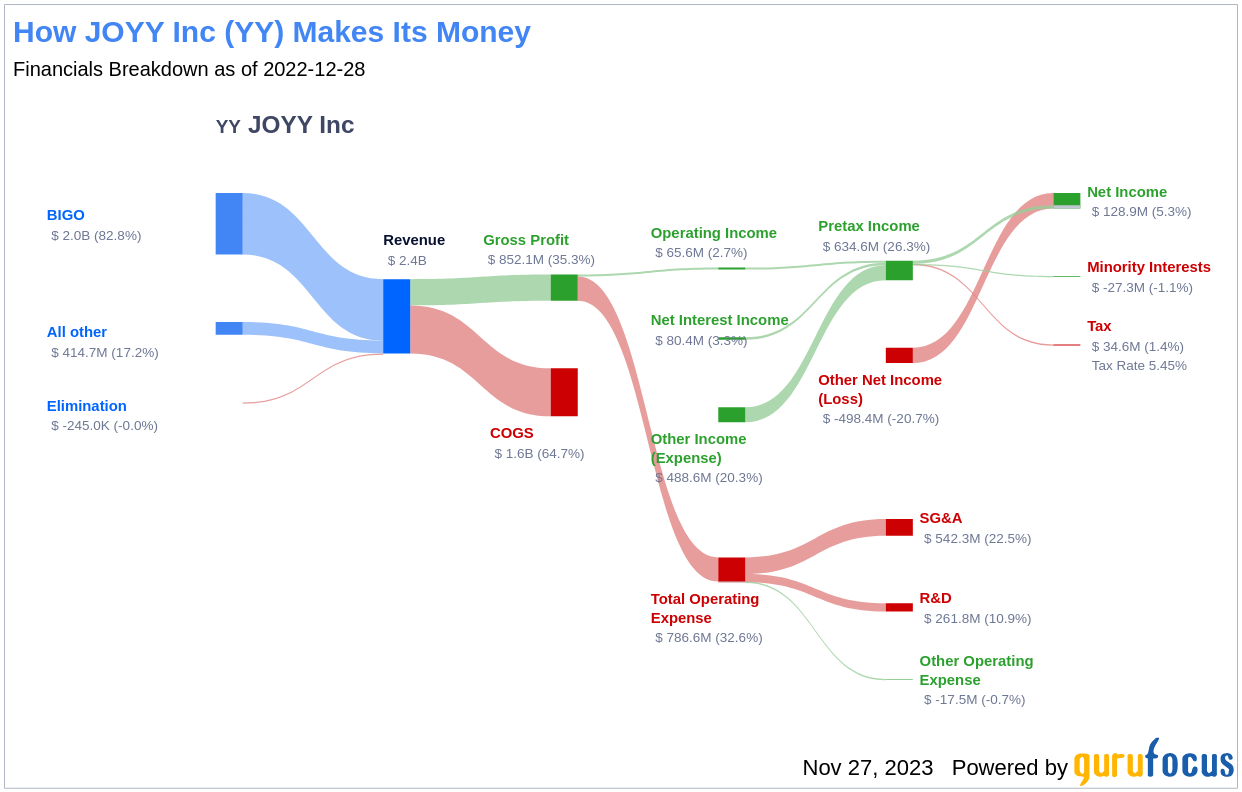

Profitable companies generally present less risk, and JOYY has been profitable for 9 out of the past 10 years. Despite its operating margin of 1.4% being lower than some industry counterparts, the company's strong profitability is evident with $2.30 billion in revenue and an Earnings Per Share (EPS) of $3.27. Moreover, JOYY's average annual revenue growth of 36% and 3-year average EBITDA growth of 99.2% rank it highly within the Interactive Media industry, indicating robust growth prospects.

ROIC vs WACC

An analysis of a company's profitability can be further refined by comparing its Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC). JOYY's ROIC of 0.59 and WACC of 4.45 suggest that the company may not be creating value for its shareholders as effectively as possible.

Conclusion

In summary, despite strong profitability and growth metrics, JOYY (YY, Financial) shows signs of significant overvaluation. The company's fair financial standing and exceptional growth in the Interactive Media industry are noteworthy. To gain further insights into JOYY's financials, investors can explore its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, visit the GuruFocus High Quality Low Capex Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.