For the first seven months of the year the portfolio rose by 25.2% vs. 19.3% for the index. During the month, the 6.4% gain was 150 basis points ahead. Three trends continued: the gradual increase in fund flows into equity markets relative to other asset classes, slightly improving economic data across most developed countries, and a mild deterioration in many developing nations.

Without shame we admit to being trend junkies in preference to statistical data points. On 1 August every American was $1,783 “better off” than the night before, because of revisions to calculations of official statistics. These also showed a milder recession and a stronger recovery than previously believed. Yet notlong before, investors had swooned over the depth of the former and the weakness of the latter. Thus, reacting to statistically “precise” data points often leads to missing the wood for the trees. Trends are clearer. Currently, several patterns stand out.

Japan's radical policies are working, such as the leap in nominal and real exports (chart 1, page 4). This pattern is mirrored by rising inflation. Now that Prime Minister Abe and the LDP party have triumphed in the Upper House elections, the next phase of the Abenomics experiment will commence imminently, and propel domestic equity prices higher. America's recovery remains relatively weak and statistically dodgy. Allegedly, second quarter growth annualised was 1.7%, yet simultaneously first quarter growth was revised down by 38%, from 1.8% to 1.1%! Moreover, the June quarter data showed a significant 64% rise in inventories to $57bn, rarely a good indicator of strong growth. European data shows a modest expansion, with fractional improvements in employment, but the recovery overall is weak. Unusually, only UK data seems genuinely strong - such as July's PMI manufacturing index at 58.2, a whopping 29% increase. These improvements may simply be because of robust investment by foreign businesses and individuals (high net worth immigration is off the scale) due to an overall friendly investment climate despite some awesomely bad 19th century infrastructure.

Central bankers have a new 'let's pretend' game – guaranteed long term interest rate forecasts. The Fed, ECB, and Banks of Japan and England have all commenced publishing long-term guidance, often based on unemployment. It stretches belief that investors will trust in such malleable guarantees for long, given that employment data can be easily manipulated to include (or exclude) as required, factors such as zero hour contracts, participation rates or the black economy. Central banks seemingly believe that they can micro- manage investment flows. It has never worked so far. Although they may incrementally reduce their bond purchasing programmes, our guess is that they will be reversed to re-emerge in different guises for many quarters, for two reasons. The first is persistently weak domestic credit growth (to non-financial companies). Without government support to create credit, a return to a recession becomes probable. American overall credit growth has halved this year and for the private sector has turned negative; it is already so in the eurozone. Only Japan has improved significantly, from -3% to +3% over the 12 months to end-June. For all the cheer in many developed countries about rising house prices, for its effect on “personal balance sheets”, caution is advisable because housing as a percentage of GDP is now small. In America for example, it accounted for 2.5% in the first quarter of 2013, vs. 6.3% at the peak in 2005.

The second reason is the increasing signs of deflation taking root, then growing out of control. Trends in China are especially worrisome. Although our credence in its home-baked statistics is zero, less unreliable external data shows various patterns; one is the economy failing to rebalance at all. It is worth recalling that in the first quarter this year, China accounted for 49.6% of world GDP growth. Yet on rebalancing, domestic consumption has fallen this year from 35% to 33%, real urban incomes from 9% to 6%. Other patterns include exports and producer prices in June down 3.1% and 2.7% year-on-year and corporate profit margins collapsing from 7.6% to 5.4%. Even official data shows ROE for the dominant state–owned enterprises at 5.9% for 2012, nearly half the 10.2% rate in 2010. The economy is being squeezed. Old solutions of infrastructure expenditure and pumping liquidity into the banks no longer work. The rational action would be to close capacity and redirect credit to non state-owned industries, but this remains politically and socially unacceptable.

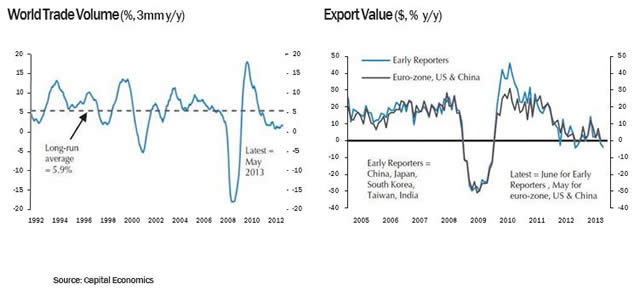

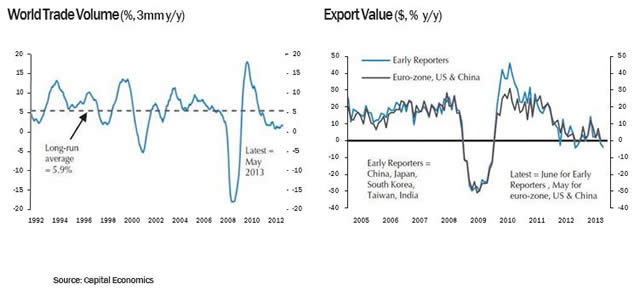

Therefore a currency devaluation seems inevitable, a shock to capital markets. Despite the politburo seemingly paralysed by the hard choices, politically devaluation is the easiest option. The deflationary impact will be considerable and quickly exported, accelerating the steady downward trend in world trade (chart 2, page 4). Europe”Ÿs modest expansion would cease overnight. It is no coincidence that German factory output has risen in tandem with China”Ÿs bank lending since 2008. Timing a renminbi devaluation is impossible, but because globally the deflationary and slow growth trends are already clear, portfolio construction is relatively simple. China-dependent emerging markets must continue to disappoint overall; flows into developed market equities should continue to surprise. Those sectors with significant overcapacity, or requiring robust trade or credit growth, look horrible, even if valuations were low, because margins and revenue will be affected simultaneously. These include shipping, autos, heavy industry (Caterpillar's recent results showed a collapse in exports to Asia), high-end consumption and industrial mining stocks. Yet even as China's looming black hole becomes the talking point, many economies and sectors will benefit or adapt. Only five years ago, China”Ÿs manufacturing boom was hollowing out many industries internationally. They are now redeveloping a competitive edge.

1. Japan exports (real and nominal): devaluation works

2. A global recovery with weakening world trade?

Without shame we admit to being trend junkies in preference to statistical data points. On 1 August every American was $1,783 “better off” than the night before, because of revisions to calculations of official statistics. These also showed a milder recession and a stronger recovery than previously believed. Yet notlong before, investors had swooned over the depth of the former and the weakness of the latter. Thus, reacting to statistically “precise” data points often leads to missing the wood for the trees. Trends are clearer. Currently, several patterns stand out.

Japan's radical policies are working, such as the leap in nominal and real exports (chart 1, page 4). This pattern is mirrored by rising inflation. Now that Prime Minister Abe and the LDP party have triumphed in the Upper House elections, the next phase of the Abenomics experiment will commence imminently, and propel domestic equity prices higher. America's recovery remains relatively weak and statistically dodgy. Allegedly, second quarter growth annualised was 1.7%, yet simultaneously first quarter growth was revised down by 38%, from 1.8% to 1.1%! Moreover, the June quarter data showed a significant 64% rise in inventories to $57bn, rarely a good indicator of strong growth. European data shows a modest expansion, with fractional improvements in employment, but the recovery overall is weak. Unusually, only UK data seems genuinely strong - such as July's PMI manufacturing index at 58.2, a whopping 29% increase. These improvements may simply be because of robust investment by foreign businesses and individuals (high net worth immigration is off the scale) due to an overall friendly investment climate despite some awesomely bad 19th century infrastructure.

Central bankers have a new 'let's pretend' game – guaranteed long term interest rate forecasts. The Fed, ECB, and Banks of Japan and England have all commenced publishing long-term guidance, often based on unemployment. It stretches belief that investors will trust in such malleable guarantees for long, given that employment data can be easily manipulated to include (or exclude) as required, factors such as zero hour contracts, participation rates or the black economy. Central banks seemingly believe that they can micro- manage investment flows. It has never worked so far. Although they may incrementally reduce their bond purchasing programmes, our guess is that they will be reversed to re-emerge in different guises for many quarters, for two reasons. The first is persistently weak domestic credit growth (to non-financial companies). Without government support to create credit, a return to a recession becomes probable. American overall credit growth has halved this year and for the private sector has turned negative; it is already so in the eurozone. Only Japan has improved significantly, from -3% to +3% over the 12 months to end-June. For all the cheer in many developed countries about rising house prices, for its effect on “personal balance sheets”, caution is advisable because housing as a percentage of GDP is now small. In America for example, it accounted for 2.5% in the first quarter of 2013, vs. 6.3% at the peak in 2005.

The second reason is the increasing signs of deflation taking root, then growing out of control. Trends in China are especially worrisome. Although our credence in its home-baked statistics is zero, less unreliable external data shows various patterns; one is the economy failing to rebalance at all. It is worth recalling that in the first quarter this year, China accounted for 49.6% of world GDP growth. Yet on rebalancing, domestic consumption has fallen this year from 35% to 33%, real urban incomes from 9% to 6%. Other patterns include exports and producer prices in June down 3.1% and 2.7% year-on-year and corporate profit margins collapsing from 7.6% to 5.4%. Even official data shows ROE for the dominant state–owned enterprises at 5.9% for 2012, nearly half the 10.2% rate in 2010. The economy is being squeezed. Old solutions of infrastructure expenditure and pumping liquidity into the banks no longer work. The rational action would be to close capacity and redirect credit to non state-owned industries, but this remains politically and socially unacceptable.

Therefore a currency devaluation seems inevitable, a shock to capital markets. Despite the politburo seemingly paralysed by the hard choices, politically devaluation is the easiest option. The deflationary impact will be considerable and quickly exported, accelerating the steady downward trend in world trade (chart 2, page 4). Europe”Ÿs modest expansion would cease overnight. It is no coincidence that German factory output has risen in tandem with China”Ÿs bank lending since 2008. Timing a renminbi devaluation is impossible, but because globally the deflationary and slow growth trends are already clear, portfolio construction is relatively simple. China-dependent emerging markets must continue to disappoint overall; flows into developed market equities should continue to surprise. Those sectors with significant overcapacity, or requiring robust trade or credit growth, look horrible, even if valuations were low, because margins and revenue will be affected simultaneously. These include shipping, autos, heavy industry (Caterpillar's recent results showed a collapse in exports to Asia), high-end consumption and industrial mining stocks. Yet even as China's looming black hole becomes the talking point, many economies and sectors will benefit or adapt. Only five years ago, China”Ÿs manufacturing boom was hollowing out many industries internationally. They are now redeveloping a competitive edge.

1. Japan exports (real and nominal): devaluation works

2. A global recovery with weakening world trade?