One biotech has seen intensive insider buying during the last 30 days. Intensive insider buying can be defined by the following three criteria:

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Fate Therapeutics (FATE), a clinical-stage biopharmaceutical company, discovers and develops pharmacologic modulators of adult stem cells to treat orphan diseases.

Insider Buying During the Last 30 Days

Here is a table of Fate Therapeutics' insider-trading activity during the last 30 days by insider.

There have been 2,599,999 shares purchased by insiders during the last 30 days. The shares were purchased pursuant to the initial public offering.

Financials

Fate Therapeutics reported the pro forma first six months financial results with the following highlights:

Upcoming Milestones

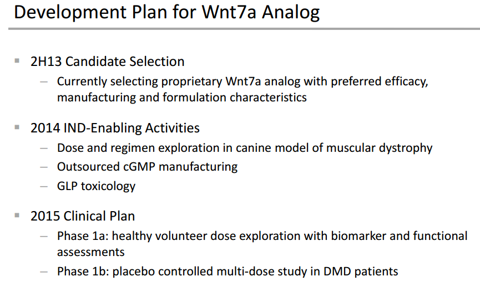

Fate Therapeutics' Wnt7a analogs have demonstrated proof-of-concept in animal models of muscular dystrophy. In these studies, Fate Therapeutics' Wnt7a analogs were shown to drive a significant expansion of the SSC population, as well as significant increases in muscle hypertrophy and muscle strength. Fate Therapeutics is presently advancing its Wnt7a analogs in preclinical development with the goal of filing an Investigational New Drug application in 2014.

Competition

There are several clinical-stage development programs that seek to improve human UCBT through the use of ex vivo expansion technologies to increase the quantity of HSCs for use in HSCT or the use of ex vivo differentiation technologies to increase the quantity of hematopoietic progenitor cells for use in HSCT. Companies active in this area include, but are not limited to, Gamida Cell, Biotest Pharmaceuticals, Aldagen, a wholly-owned subsidiary of Cytomedix (CMXI.OB), Novartis (NVS) and Celerant Technology.

Currently, there are no approved pharmaceutical products specifically developed for the treatment of muscular dystrophies. Fate Therapeutics is aware of several other companies developing therapies that are in various stages of development for the treatment of muscular dystrophies, including Prosensa Holding B.V. (RNA), Sarepta Therapeutics (SRPT), PTC Therapeutics (PTCT), Summit Corporation plc, Halo Therapeutics LLC and Tivorsan Pharmaceuticals.

Conclusion

There have been five different insiders buying Fate Therapeutics and there have not been any insiders selling Fate Therapeutics during the past 30 days. All five of these insiders increased their holdings by more than 10%.

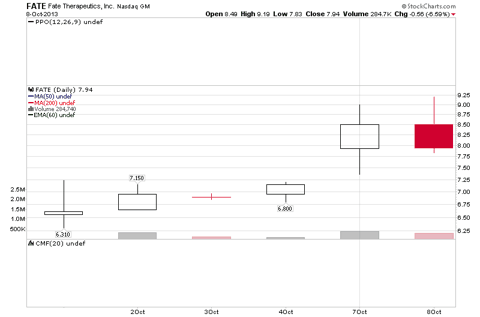

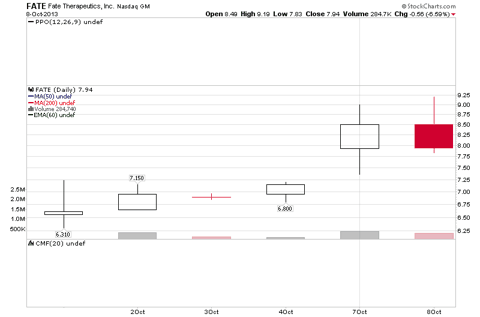

Fate Therapeutics started trading on Oct. 1 after the IPO. The insiders paid $6 for their shares and the stock is currently trading at $7.94. I believe the stock could be a good pick at $6 based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

The stock is purchased by three or more insiders within one month.

The stock is sold by no insiders in the month of intensive purchasing.

At least two purchasers increase their holdings by more than 10%.

Fate Therapeutics (FATE), a clinical-stage biopharmaceutical company, discovers and develops pharmacologic modulators of adult stem cells to treat orphan diseases.

Insider Buying During the Last 30 Days

Here is a table of Fate Therapeutics' insider-trading activity during the last 30 days by insider.

| Name | Title | Trade Date | Shares Purchased | Current Ownership (Direct+Indirect) | Increase In Shares |

| Venrock Associates | 10% Owner | Oct 4 | 833,333 | 2,473,187 | 50.8% |

| Polaris Venture Management | 10% Owner | Oct 4 | 833,333 | 2,473,186 | 50.8% |

| Arch Venture Fund | 10% Owner | Oct 4 | 833,333 | 2,473,188 | 50.8% |

| William Rastetter | Director | Oct 4 | 83,333 | 201,693 | 70.4% |

| John Mendlein | Director | Oct 4 | 16,667 | 156,774 | 11.9% |

There have been 2,599,999 shares purchased by insiders during the last 30 days. The shares were purchased pursuant to the initial public offering.

Financials

Fate Therapeutics reported the pro forma first six months financial results with the following highlights:

| Revenue | $0.8 million |

| Net loss | $9.1 million |

| Cash | $56.4 million |

| Tangible book value | $2.75 per share |

Upcoming Milestones

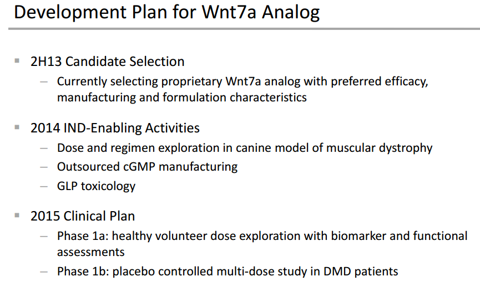

Fate Therapeutics' Wnt7a analogs have demonstrated proof-of-concept in animal models of muscular dystrophy. In these studies, Fate Therapeutics' Wnt7a analogs were shown to drive a significant expansion of the SSC population, as well as significant increases in muscle hypertrophy and muscle strength. Fate Therapeutics is presently advancing its Wnt7a analogs in preclinical development with the goal of filing an Investigational New Drug application in 2014.

Competition

There are several clinical-stage development programs that seek to improve human UCBT through the use of ex vivo expansion technologies to increase the quantity of HSCs for use in HSCT or the use of ex vivo differentiation technologies to increase the quantity of hematopoietic progenitor cells for use in HSCT. Companies active in this area include, but are not limited to, Gamida Cell, Biotest Pharmaceuticals, Aldagen, a wholly-owned subsidiary of Cytomedix (CMXI.OB), Novartis (NVS) and Celerant Technology.

Currently, there are no approved pharmaceutical products specifically developed for the treatment of muscular dystrophies. Fate Therapeutics is aware of several other companies developing therapies that are in various stages of development for the treatment of muscular dystrophies, including Prosensa Holding B.V. (RNA), Sarepta Therapeutics (SRPT), PTC Therapeutics (PTCT), Summit Corporation plc, Halo Therapeutics LLC and Tivorsan Pharmaceuticals.

Conclusion

There have been five different insiders buying Fate Therapeutics and there have not been any insiders selling Fate Therapeutics during the past 30 days. All five of these insiders increased their holdings by more than 10%.

Fate Therapeutics started trading on Oct. 1 after the IPO. The insiders paid $6 for their shares and the stock is currently trading at $7.94. I believe the stock could be a good pick at $6 based on the intensive insider buying.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.