Bed Bath & Beyond (BBBY) operates one of the largest chains of retail stores focusing on domestic merchandise and home furnishings in the United States. The company prides itself on offering products that generally exceed what is available in the majority of department stores and other specialty retail stores. Bed Bath & Beyond stores generally range from 18,000 square feet to 50,000 square feet, with some locations as large as 100,000 square feet. Founded in 1971, BBBY has been growing exponentially, from only 34 stores at the end of fiscal 1993, to an impressive 1,004 locations in 50 states, as well as the District of Columbia, Puerto Rico, and Canada at the end of fiscal 2013. The company opened 12 new stores throughout fiscal year 2013, and 13 new stores in fiscal 2012.

BBBY plans to continue its expansion mission, and estimates that the domestic market can support over 1,300 Bed Bath & Beyond stores. The company also plans to aggressively pursue expansion in Canada after opening their first store in 2007. By the end of fiscal 2013, BBBY had opened a total of 34 stores in Canada.

Key Acquisitions

Bed Bath & Beyond has had enough cash piled up ($839 million in the latest quarter) to make some useful acquisitions:

In March of 2002, BBBY acquired Harmon Stores, Inc. (a health and beauty care retailer). Harmon had 47 stores in 4 states in March of 2013.

In June of 2003, the company acquired Christmas Tree Shops, which sells home decor, giftware, housewares, food, and more. BBBY purchased the company, which operated 74 stores in 22 states at the end of fiscal 2013, for about $194.4 million.

In March of 2007, BBBY acquired buybuy BABY, which sells infant and toddler merchandise at 82 stores in 29 states at the end of fiscal 2013, for about $67 million.

In May of 2012, BBBY acquired Cost Plus for approximately $495 million. Cost Plus, a specialty retailer carrying casual home furnishings and gourmet consumables, operated 264 stores in 30 states in March of 2013.

In June of 2012, BBBY acquired Linen Holdings for about $105 million. Linen Holdings linens and other textile products and amenities to hospitality, cruise line, food service, and other customers.

Financial Strength

Bed Bath & Beyond recently reported a 9% sales growth for its second fiscal quarter ($2.82 billion), as well as an 18% increase in earnings per share from the same time last year. Over the last 3 fiscal years, Bed Bath & Beyond posted a compound annual growth rate (CAGR) in sales of 11.7%. This impressive growth reflects the company’s recent acquisitions, the opening of new stores, and the average increase of same store sales by 5.5% over the three year time period.

The company has been putting up some pretty impressive returns, thanks to management. BBBY has most recently posted a 17.05% return on assets (ROA) as well as a 26.64 return on equity (ROE). The most impressive and meaningful to me, however, is the return on invested capital (ROIC). BBBY’s ROIC was most recently a huge 25.6% in fiscal 2013, which is a nice increase from a recent low ROIC of 15.1% in fiscal 2009.

That’s not all. If you haven’t yet taken the time to check out the balance sheet of this impressive company, I advise you to do so. BBBY has nearly no debt and enough current assets to pay off total liabilities. The company almost has enough total assets to pay off total liabilities 3 times over. This helps drive the retailer to be able to grow its position organically, or through acquisitions, with ease.

Bed Bath & Beyond continues its impressive momentum for the year, achieving a 37% increase in share price year to date. The recovery of the housing market has been helping the home furnishings sector tremendously. The company has been steadily growing through small acquisitions, new store openings, and same store sales growth. Earnings per share growth has been moving higher over the years as the company has been executing well-timed share repurchases.

Since 2004 through the end of fiscal 2012, BBBY has repurchased about $5 billion of its common stock through share repurchase programs. The company has been aggressively repurchasing shares, dedicating more than 90% of its operating cash flow to repurchases during the past two years.

Valuation

Due to the recent significant momentum from solid operating performance, the housing market recovery, and constant share repurchases, BBBY appears fairly valued at the moment.

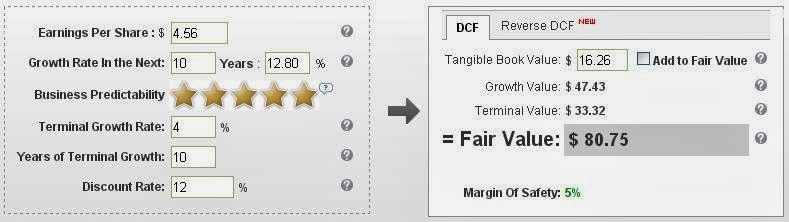

Looking at the Discounted Cash Flow calculator offered on GuruFocus.com, we can find a fair value of $80.75, which only gives us a 5% margin of safety.

Taking a look at Peter Lynch’s famous Price at P/E 15, it appears as if the share price is currently overvalued.

End Notes

Bed Bath & Beyond has a predictable history of growth over the long run, and should see continued growth with help from a more solid housing recovery. What are your thoughts on the company? Do you think the stock is undervalued, or fairly priced?

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.

BBBY plans to continue its expansion mission, and estimates that the domestic market can support over 1,300 Bed Bath & Beyond stores. The company also plans to aggressively pursue expansion in Canada after opening their first store in 2007. By the end of fiscal 2013, BBBY had opened a total of 34 stores in Canada.

Key Acquisitions

Bed Bath & Beyond has had enough cash piled up ($839 million in the latest quarter) to make some useful acquisitions:

In March of 2002, BBBY acquired Harmon Stores, Inc. (a health and beauty care retailer). Harmon had 47 stores in 4 states in March of 2013.

In June of 2003, the company acquired Christmas Tree Shops, which sells home decor, giftware, housewares, food, and more. BBBY purchased the company, which operated 74 stores in 22 states at the end of fiscal 2013, for about $194.4 million.

In March of 2007, BBBY acquired buybuy BABY, which sells infant and toddler merchandise at 82 stores in 29 states at the end of fiscal 2013, for about $67 million.

In May of 2012, BBBY acquired Cost Plus for approximately $495 million. Cost Plus, a specialty retailer carrying casual home furnishings and gourmet consumables, operated 264 stores in 30 states in March of 2013.

In June of 2012, BBBY acquired Linen Holdings for about $105 million. Linen Holdings linens and other textile products and amenities to hospitality, cruise line, food service, and other customers.

Financial Strength

Bed Bath & Beyond recently reported a 9% sales growth for its second fiscal quarter ($2.82 billion), as well as an 18% increase in earnings per share from the same time last year. Over the last 3 fiscal years, Bed Bath & Beyond posted a compound annual growth rate (CAGR) in sales of 11.7%. This impressive growth reflects the company’s recent acquisitions, the opening of new stores, and the average increase of same store sales by 5.5% over the three year time period.

The company has been putting up some pretty impressive returns, thanks to management. BBBY has most recently posted a 17.05% return on assets (ROA) as well as a 26.64 return on equity (ROE). The most impressive and meaningful to me, however, is the return on invested capital (ROIC). BBBY’s ROIC was most recently a huge 25.6% in fiscal 2013, which is a nice increase from a recent low ROIC of 15.1% in fiscal 2009.

That’s not all. If you haven’t yet taken the time to check out the balance sheet of this impressive company, I advise you to do so. BBBY has nearly no debt and enough current assets to pay off total liabilities. The company almost has enough total assets to pay off total liabilities 3 times over. This helps drive the retailer to be able to grow its position organically, or through acquisitions, with ease.

Bed Bath & Beyond continues its impressive momentum for the year, achieving a 37% increase in share price year to date. The recovery of the housing market has been helping the home furnishings sector tremendously. The company has been steadily growing through small acquisitions, new store openings, and same store sales growth. Earnings per share growth has been moving higher over the years as the company has been executing well-timed share repurchases.

Since 2004 through the end of fiscal 2012, BBBY has repurchased about $5 billion of its common stock through share repurchase programs. The company has been aggressively repurchasing shares, dedicating more than 90% of its operating cash flow to repurchases during the past two years.

Valuation

Due to the recent significant momentum from solid operating performance, the housing market recovery, and constant share repurchases, BBBY appears fairly valued at the moment.

Looking at the Discounted Cash Flow calculator offered on GuruFocus.com, we can find a fair value of $80.75, which only gives us a 5% margin of safety.

Taking a look at Peter Lynch’s famous Price at P/E 15, it appears as if the share price is currently overvalued.

End Notes

Bed Bath & Beyond has a predictable history of growth over the long run, and should see continued growth with help from a more solid housing recovery. What are your thoughts on the company? Do you think the stock is undervalued, or fairly priced?

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.