Vector Group Ltd (VGR, Financial) has experienced a notable uptick in its stock performance, with a market capitalization now standing at $1.84 billion. The current price of VGR stock is $11.77, reflecting a significant 17.00% gain over the past week. Over the past three months, the stock has also seen a 10.81% gain. When compared to the GF Value of $12.27, Vector Group is currently considered fairly valued, a shift from its previous status of being modestly undervalued when the GF Value was at $12.59.

Introduction to Vector Group Ltd

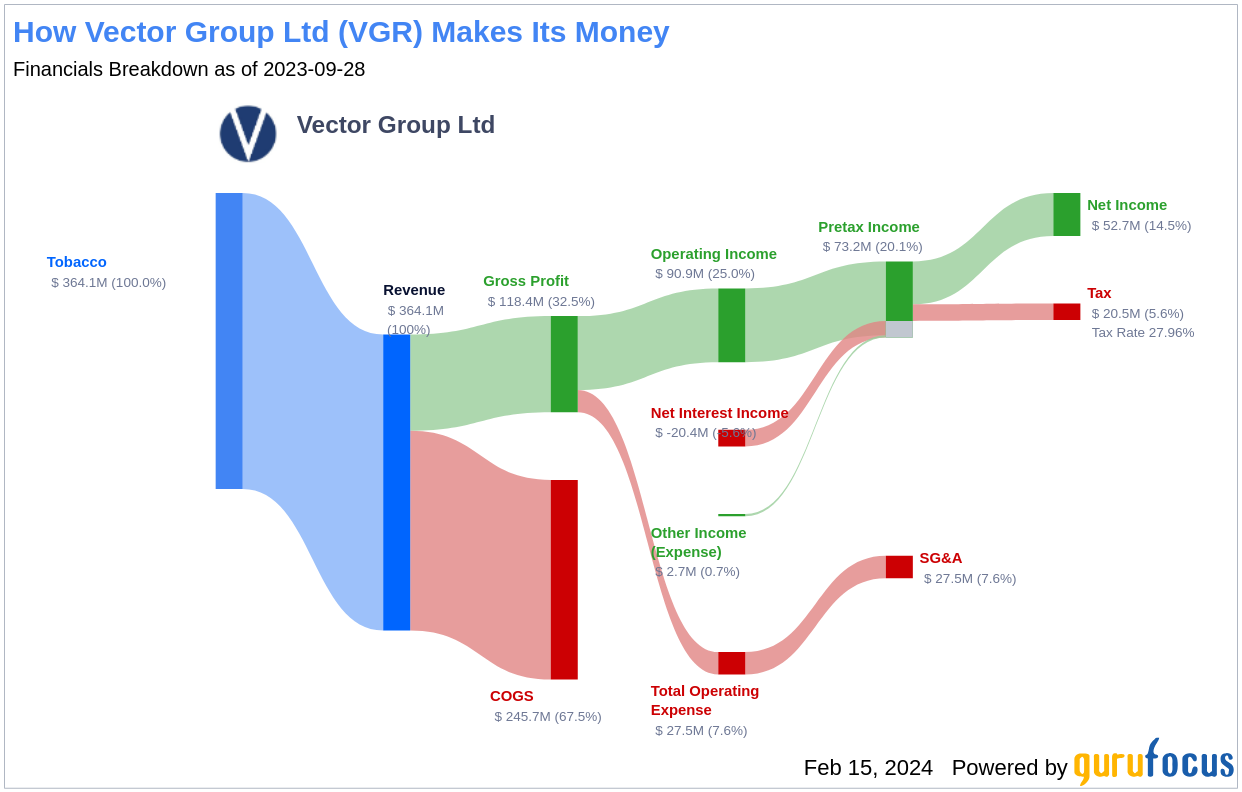

Vector Group Ltd operates within the tobacco products industry, functioning as a holding company with subsidiaries that focus on tobacco products and real estate investments. Its tobacco business, through Liggett Group and Vector Tobacco, offers discount cigarettes in the United States under various brand names. New Valley, another subsidiary, has a majority stake in Douglas Elliman Realty, which invests in real estate globally and runs the largest residential brokerage in the New York City area. Tobacco sales contribute to over half of the company's total revenue, with real estate comprising the rest.

Assessing Vector Group's Profitability

Vector Group's Profitability Rank stands at an impressive 8/10. The company's operating margin is at 24.14%, which is better than 79.25% of 53 companies in the industry. Although the Return on Equity (ROE) data is not applicable, the Return on Assets (ROA) is at a healthy 17.20%, and the Return on Invested Capital (ROIC) is at a robust 55.17%. These figures indicate that Vector Group is outperforming a majority of its peers in terms of profitability. The company has also maintained profitability over the past 10 years, which is a testament to its stable financial health.

Growth Trajectory of Vector Group

Vector Group's Growth Rank is 7/10, indicating a strong growth trajectory. The company has a 3-Year Revenue Growth Rate per Share of 7.50%, which is better than 55.81% of 43 companies in the same industry. However, the 5-Year Revenue Growth Rate per Share shows a decline of -7.40%. Looking ahead, the Total Revenue Growth Rate (Future 3Y To 5Y Est) is estimated at 6.19%. The 3-Year EPS without NRI Growth Rate is at 33.60%, and the 5-Year EPS without NRI Growth Rate is at 28.50%, both of which are higher than the majority of their industry counterparts.

Key Shareholders in Vector Group

Vector Group's shareholder base includes notable investors such as Jim Simons (Trades, Portfolio), who holds 7,767,815 shares, representing 4.98% of the company. Chuck Royce (Trades, Portfolio) owns 129,822 shares, accounting for 0.08%, and Joel Greenblatt (Trades, Portfolio) holds a stake of 0.01% with 22,124 shares. These investors' commitment to Vector Group reflects confidence in the company's financial prospects and strategic direction.

Competitive Landscape

In comparison to its competitors, Vector Group holds a strong position with a market cap of $1.84 billion. Its closest competitor, Universal Corp (UVV, Financial), has a market cap of $1.23 billion, followed by Ispire Technology Inc (ISPR, Financial) at $614.443 million, and Turning Point Brands Inc (TPB, Financial) at $398.566 million. Vector Group's market cap suggests a leading position within the tobacco industry, potentially offering a competitive edge in terms of scale and market presence.

Conclusion

In summary, Vector Group Ltd's stock performance has been robust, with a 17% gain over the past week and a 10.81% gain over the past three months. The company is currently fairly valued according to the GF Value. Vector Group's profitability is strong, with high operating margins and ROIC, and it has demonstrated consistent profitability over the past decade. Growth prospects remain positive, with solid EPS growth rates. The company's significant shareholders, including Jim Simons (Trades, Portfolio), Chuck Royce (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio), maintain a substantial interest in Vector Group, underscoring their confidence in its future. When compared to its competitors, Vector Group's market capitalization indicates a strong position within the tobacco industry, which may continue to drive its stock performance in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.