ExxonMobil Corporation (XOM) is the largest of the world’s “big oil” companies. The company is involved in the exploration and production of crude oil and natural gas, as well as the manufacturing of petroleum products. The company also distributes petrochemicals such as olefins, aromatics, polypropylene plastics, and a wide range of specialty products. ExxonMobil also transports and sells crude oil and natural gas, and has interests in electric power generation facilities. The company currently operates in the United States, Canada, South America, Europe, Africa, Asia, and Australia.

In 2012, 64% of ExxonMobil’s segment earnings was in natural gas exploration and production, 28% was in refining and marketing, and 8% in chemicals. It is the world’s third largest company in terms of revenue, and the second largest publicly traded company in terms of market cap. The company was also ranked number 5 on Forbes’ Global 2000 list in 2013. ExxonMobil had about 72 billion barrels of oil equivalent (BOE) at the end of 2007, which was said to be able to last more than 14 years. The company has 37 oil refineries in 21 countries making ExxonMobil the largest refiner in the world.

ExxonMobil has a daily production of 3.921 million BOE. They have stated that they expect to add 1 million BOE/d by 2017. The company plans to invest about $190 billion over the next five years ($38 billion a year). 28 major oil and gas projects will begin production between 2013 and 2017. The company also expects to start 22 major projects in the next three years.

In August of 2011, ExxonMobil entered an agreement with Russian company Rosneft that allows the companies to undertake joint exploration and development of hydrocarbon resources in Russia, the United States, and other countries around the world. These two companies will also take part in technology and expertise-sharing activities. The agreement apparently involves $3.2 billion in funding the exploration of the Kara Sea and Black Sea. These two seas are among the most promising and least explored offshore areas around the globe. ExxonMobil and Rosneft also agreed to conduct a joint study of developing tight oil resources in Western Siberia, and will create an Arctic Research and Design Center for Offshore Developments.

In June of 2010, XOM purchased XTO Energy, Inc. with a stock only deal valued at $40.5 billion. This giant deal added 2,471 million BOE. ExxonMobil’s technical expertise should unlock additional resource potential in the coming years with this acquisition.

Financial Strength

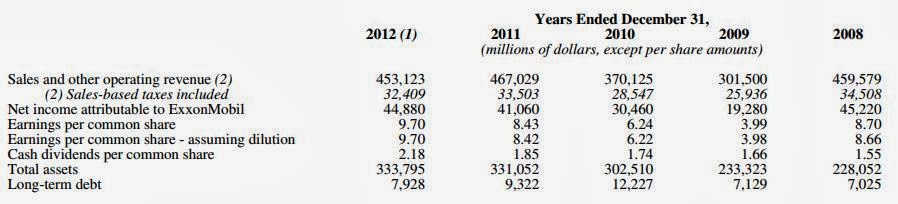

ExxonMobil has longevity. The company currently almost has twice as many assets as liabilities, and is raking in excess of a massive $400 billion a year in revenue. Here are some impressive numbers hand-picked by the company for their recent 10-K:

It is also always important to look at the Return on Average Capital Employed for capital-intensive companies such as oil. This is yet another area where ExxonMobil shines. The company is able to squeeze higher profits from smaller amounts of cash compared to competitors.

Shareholder returns are also super impressive for XOM. The company currently offers a 2.66% dividend yield, and the following chart assumes that all dividends are reinvested across the board.

Management

ExxonMobil’s management is amazing. The company’s CEO, Rex Tillerson, joined The Exxon Company (pre-merger with Mobil) in 1975 as an engineer. He has since respectively worked his way up the ranks to his current position, which he assumed in 2006.

XOM rocks an impressive 10.28% Return on Assets, 20.35% Return on Equity, and 13.3% Return on Invested Capital. Non-Controlling Interests account for 64.5% of XOM’s share price. Dividends have increased every year for the past 10 years.

The company, like the majority of companies, has a pretty fair method of tying executive compensation to performance.

Valuation

A trailing twelve month P/E of 12.37x and an estimated forward twelve month P/E of 11.92x for one of the best managed and most profitable corporations in the world just scratches the surface of an impressive company. The company’s P/E ratio has been lower than the P/E ratio of the S&P for the last 10 years, as well as the trailing twelve months.

According to the Peter Lynch chart, the company is currently undervalued.

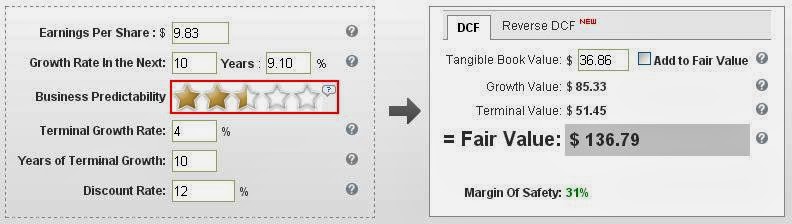

Looking at the DCF Calculator on our website, we can see that a current 31% margin of safety is above the widely accepted 30% for value investors.

Why Did Buffett Buy?

Well, to put it simply, the company is cheap. Buffett has bought and sold the company before, and he understands it. Buffett has said on many occasions that due to the large amount of money Berkshire has, it’s imperative for the company to go after purchases of mega corporations rather than outright buying a bunch of small ones. XOM is no exception. ExxonMobil is one of the largest companies in the world, it’s in a sector that has been doing tremendously well lately, and it has a multi-generational time horizon.

End Notes

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.

In 2012, 64% of ExxonMobil’s segment earnings was in natural gas exploration and production, 28% was in refining and marketing, and 8% in chemicals. It is the world’s third largest company in terms of revenue, and the second largest publicly traded company in terms of market cap. The company was also ranked number 5 on Forbes’ Global 2000 list in 2013. ExxonMobil had about 72 billion barrels of oil equivalent (BOE) at the end of 2007, which was said to be able to last more than 14 years. The company has 37 oil refineries in 21 countries making ExxonMobil the largest refiner in the world.

ExxonMobil has a daily production of 3.921 million BOE. They have stated that they expect to add 1 million BOE/d by 2017. The company plans to invest about $190 billion over the next five years ($38 billion a year). 28 major oil and gas projects will begin production between 2013 and 2017. The company also expects to start 22 major projects in the next three years.

In August of 2011, ExxonMobil entered an agreement with Russian company Rosneft that allows the companies to undertake joint exploration and development of hydrocarbon resources in Russia, the United States, and other countries around the world. These two companies will also take part in technology and expertise-sharing activities. The agreement apparently involves $3.2 billion in funding the exploration of the Kara Sea and Black Sea. These two seas are among the most promising and least explored offshore areas around the globe. ExxonMobil and Rosneft also agreed to conduct a joint study of developing tight oil resources in Western Siberia, and will create an Arctic Research and Design Center for Offshore Developments.

In June of 2010, XOM purchased XTO Energy, Inc. with a stock only deal valued at $40.5 billion. This giant deal added 2,471 million BOE. ExxonMobil’s technical expertise should unlock additional resource potential in the coming years with this acquisition.

Financial Strength

ExxonMobil has longevity. The company currently almost has twice as many assets as liabilities, and is raking in excess of a massive $400 billion a year in revenue. Here are some impressive numbers hand-picked by the company for their recent 10-K:

It is also always important to look at the Return on Average Capital Employed for capital-intensive companies such as oil. This is yet another area where ExxonMobil shines. The company is able to squeeze higher profits from smaller amounts of cash compared to competitors.

Shareholder returns are also super impressive for XOM. The company currently offers a 2.66% dividend yield, and the following chart assumes that all dividends are reinvested across the board.

Management

ExxonMobil’s management is amazing. The company’s CEO, Rex Tillerson, joined The Exxon Company (pre-merger with Mobil) in 1975 as an engineer. He has since respectively worked his way up the ranks to his current position, which he assumed in 2006.

XOM rocks an impressive 10.28% Return on Assets, 20.35% Return on Equity, and 13.3% Return on Invested Capital. Non-Controlling Interests account for 64.5% of XOM’s share price. Dividends have increased every year for the past 10 years.

The company, like the majority of companies, has a pretty fair method of tying executive compensation to performance.

Valuation

A trailing twelve month P/E of 12.37x and an estimated forward twelve month P/E of 11.92x for one of the best managed and most profitable corporations in the world just scratches the surface of an impressive company. The company’s P/E ratio has been lower than the P/E ratio of the S&P for the last 10 years, as well as the trailing twelve months.

According to the Peter Lynch chart, the company is currently undervalued.

Looking at the DCF Calculator on our website, we can see that a current 31% margin of safety is above the widely accepted 30% for value investors.

Why Did Buffett Buy?

Well, to put it simply, the company is cheap. Buffett has bought and sold the company before, and he understands it. Buffett has said on many occasions that due to the large amount of money Berkshire has, it’s imperative for the company to go after purchases of mega corporations rather than outright buying a bunch of small ones. XOM is no exception. ExxonMobil is one of the largest companies in the world, it’s in a sector that has been doing tremendously well lately, and it has a multi-generational time horizon.

End Notes

Disclosure: No current position held at the time of writing.

Disclaimer: The opinions and ideas in this article are for informational and educational purposes only. They are not a recommendation to buy or sell any stock at any given time. As always, it is imperative for each individual investor to do their own due diligence and perform their own research on any and all stocks before making an investment decision.