Highway Holdings Limited (HIHO, Financial) is presently the only stock listed on the American Association of Individual Investors website with a Piotroski F_SCORE of 9, the highest possible Piotroski F_SCORE. An F_SCORE of 9 indicates that HIHO is “financially strong” in Piotroski’s framework. An F_SCORE of 8 indicates that it has failed on one dimension, and so on. Piotroski’s F_SCORE probably works better in the aggregate than in the case of a single company simply because the binary signal of each component is insufficiently granular to provide much information. Ideally, I’d identify 30 high BM companies scoring 9 on the Piotroski F_SCORE and construct a portfolio from them. The only problem with the practical implementation of that strategy is there aren’t 30 high BM companies scoring 9 on the Piotroski F_SCORE, so we’re stuck with HIHO as the only representative of Piotroski’s F_SCORE in practice. For that reason, this test is imperfect, but that does not mean it is not useful. It analyses more dimensions that I typically do, so perhaps it will work fine for a single company.

HIHO closed Friday at $1.73, giving it a market capitalization of $6.5M. Book value is $11.4M, or $3.03 per share, which means that HIHO is trading at approximately 57% of book value (a P/B of 0.57 or a BM of 1.75). I estimate the liquidation value to be around $5.2M or $1.39 per share, which means that HIHO is trading at a premium to its liquidation value and is not, therefore, a liquidation play. I regard the $1.39 per share liquidation value as the downside in this instance, and the $3.03 per share book value as the upside.

About HIHO

HIHO is a foreign issuer based in Hong Kong. From the most recent 6K dated November 10, 2009:

The value proposition: Piotroski’s F_SCORE

The objective of Piotroski’s F_SCORE is to identify “financially strong high BM firms.” It does so by summing the following 9 binary signals (for a more full explanation, see my post on Piotroski’s F_SCORE):

The components are categorized as follows:

The value proposition: Liquidation value

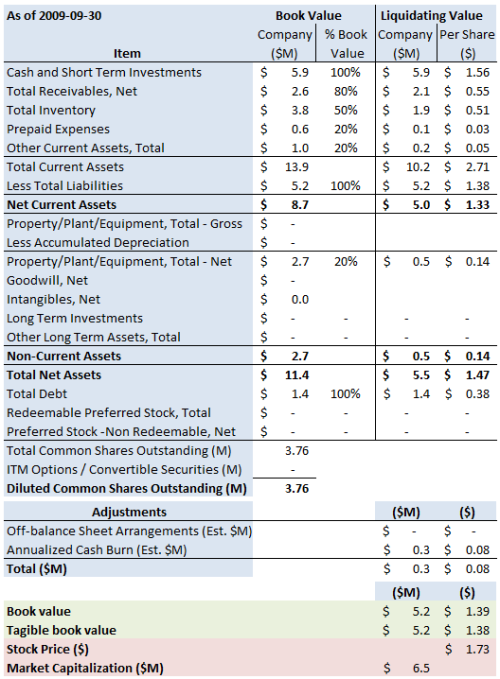

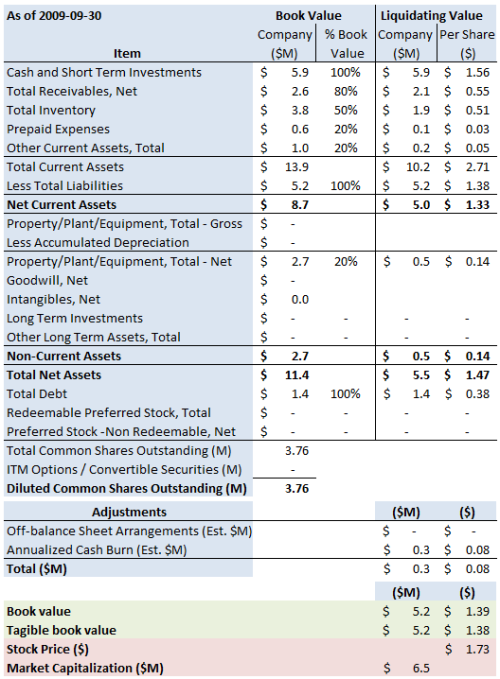

Here is the liquidation value analysis based on its most recent quarterly financial statement to September 30, 2009 (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

Conclusion

With a book value of $11.4M against a market capitalization of $6.5M, HIHO has a book-to-market ratio of 1.75 and is therefore a high BM stock. This makes HIHO an ideal candidate for the application of the Piotroski F_SCORE, which seeks to use “context-specific financial performance measures to differentiate strong and weak firms” within the universe of high BM stocks. HIHO scores a perfect 9 on the Piotroski F_SCORE, which indicates that it is a “strong firm” within that framework. As a check on the downside, I estimate the liquidation value to be around $5.2M or $1.39 per share. For these reasons, HIHO looks like a reasonable bet to me, so I’m adding it to the Special Situations portfolio.

HIHO closed Friday at $1.73.

The S&P500 Index closed Friday at 1,105.98.

[Full Disclosure: I do not have a holding in HIHO. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.]

Greenbackd

http://greenbackd.com/

HIHO closed Friday at $1.73, giving it a market capitalization of $6.5M. Book value is $11.4M, or $3.03 per share, which means that HIHO is trading at approximately 57% of book value (a P/B of 0.57 or a BM of 1.75). I estimate the liquidation value to be around $5.2M or $1.39 per share, which means that HIHO is trading at a premium to its liquidation value and is not, therefore, a liquidation play. I regard the $1.39 per share liquidation value as the downside in this instance, and the $3.03 per share book value as the upside.

About HIHO

HIHO is a foreign issuer based in Hong Kong. From the most recent 6K dated November 10, 2009:

Highway Holdings produces a wide variety of high-quality products for blue chip original equipment manufacturers — from simple parts and components to sub-assemblies. It also manufactures finished products, such as LED lights, radio chimes and other electronic products. Highway Holdings operates three manufacturing facilities in the People’s Republic of China.

The value proposition: Piotroski’s F_SCORE

The objective of Piotroski’s F_SCORE is to identify “financially strong high BM firms.” It does so by summing the following 9 binary signals (for a more full explanation, see my post on Piotroski’s F_SCORE):

F_SCORE = F_ROA + F_[Delta]ROA + F_CFO + F_ ACCRUAL + F_[Delta]MARGIN + F_[Delta]TURN + F_[Delta]LEVER + F_[Delta]LIQUID + EQ_OFFER.

The components are categorized as follows:

The following are based on HIHO’s March 31 year end accounts set out in its20F dated June 22, 2009. Here’s how HIHO achieves its F_SCORE of 9:

- F_ROA, F_[Delta]ROA, F_CFO, and F_ACCRUAL measure profitability

- F_[Delta]MARGIN and F_[Delta]TURN measure operating efficiency

- F_[Delta]LEVER, F_[Delta]LIQUID, and EQ_OFFER measure leverage, liquidity, and source of funds

HIHO has a perfect 9 on the Piotroski F_SCORE.

- F_ROA: Net income before extraordinary items scaled by beginning of the year total assets (1 if positive, 0 otherwise). HIHO’s net income for 2009 was $0.8M/$17.8M = 0.04, which is positive so F_ROA is 1.

- F_CFO: Cash flow from operations scaled by beginning of the year total assets (1 if positive, 0 otherwise). HIHO’s cash flow from operations for 2009 was $2.0M/$17.8M = 0.11, which is positive so F_CFO is 1.

- F_[Delta]ROA: Current year’s ROA less the prior year’s ROA (1 if positive, 0 otherwise). HIHO’s ROA for 2009 was 0.04, and its ROA for 2008 was -0.09, and 0.04 less -0.09 = 0.13, which is positive so F_ROA is 1.

- F_ACCRUAL: Current year’s net income before extraordinary items less cash flow from operations, scaled by beginning of the year total assets (1 if CFO is greater than ROA, 0 otherwise). HIHO’s net income for 2009 was $0.8M/$17.8M less cash flow from operations of $2.0M/$17.8M. CFO > ROA so F_ACCRUAL is 1.

- F_[Delta]LEVER: The change in the ratio of total long-term debt to average total assets year-on-year (1 if decrease, 0 if otherwise). HIHO’s long-term debt ratio in 2009 was $0.6M/average($17.8M and $20.5M) = 0.03 and in 2008 was $0.8M/average($22.4M and $20.5M) = 0.04, which is a decrease year-on-year so F_[Delta]LEVER is 1.

- F_[Delta]LIQUID: The change in the current ratio between the current and prior year (1 if increase, 0 if otherwise). HIHO’s current ratio in 2009 was $14.9M/$5.9M = 2.53 and in 2008 was $16.8M/$9.2M = 1.83, which means it was increasing year-on-year and so F_[Delta]LIQUID is 1.

- EQ_OFFER: 1 if the firm did not issue common equity in the year preceding portfolio formation, 0 otherwise. HIHO reduced its common equity on issue in 2009 by 99,000 shares, so EQ_OFFER is 1.

- F_[Delta]MARGIN: The current gross margin ratio (gross margin scaled by total sales) less the prior year’s gross margin ratio (1 if positive, 0 otherwise). HIHO’s gross margin ratio in 2009 was $6.7M/$33.7M = 0.2 and in 2008 was $5.1M/$33.2M = 0.15. 0.2 less 0.15 = 0.05, which is positive, so F_[Delta]MARGIN is 1.

- F_[Delta]TURN: The current year asset turnover ratio (total sales scaled by beginning of the year total assets) less the prior year’s asset turnover ratio (1 if positive, 0 otherwise). HIHO’s 2009 year asset turnover ratio was $33.7M/$17.8M = 1.9 and in 2008 was $33.2M/$20.5M = 1.6. 1.9 less 1.6 = 0.3, which is positive, so F_[Delta]TURN is 1.

The value proposition: Liquidation value

Here is the liquidation value analysis based on its most recent quarterly financial statement to September 30, 2009 (the “Book Value” column shows the assets as they are carried in the financial statements, and the “Liquidating Value” column shows our estimate of the value of the assets in a liquidation):

Conclusion

With a book value of $11.4M against a market capitalization of $6.5M, HIHO has a book-to-market ratio of 1.75 and is therefore a high BM stock. This makes HIHO an ideal candidate for the application of the Piotroski F_SCORE, which seeks to use “context-specific financial performance measures to differentiate strong and weak firms” within the universe of high BM stocks. HIHO scores a perfect 9 on the Piotroski F_SCORE, which indicates that it is a “strong firm” within that framework. As a check on the downside, I estimate the liquidation value to be around $5.2M or $1.39 per share. For these reasons, HIHO looks like a reasonable bet to me, so I’m adding it to the Special Situations portfolio.

HIHO closed Friday at $1.73.

The S&P500 Index closed Friday at 1,105.98.

[Full Disclosure: I do not have a holding in HIHO. This is neither a recommendation to buy or sell any securities. All information provided believed to be reliable and presented for information purposes only. Do your own research before investing in any security.]

Greenbackd

http://greenbackd.com/