Aspen Exploration Corporation (ASPN.OB) is being added to the ValueHuntr Portfolio. ASPN is an interesting special situations play we have been following for some time now. Based on yesterday’s trading price, we believe there may still be some value for shareholders in the event of a sale, merger or liquidation even after the payment of $0.73/share dividend. For the purpose of keeping our estimates as conservative as possible, we assume at least liquidation value.

THE COMPANY

Aspen Exploration Corporation does not have significant operations. It intends to seek possible business combinations with third parties. Prior to June 30, 2009, the company operated 67 gas wells and had a non-operated interest in 26 gas wells in the Sacramento Valley of northern California and approximately 37 oil wells in Montana.

RECENT EVENTS

On November 30, 2009, Aspen held its annual meeting of stockholders in Greenwood Village, Colorado. Two proposals were submitted to the stockholders for approval as set forth in Aspen’s definitive proxy statement dated October 19, 2009. A total of 5,965,534 shares (approximately 70% of the total outstanding as of the record date) were present at the meeting in person or by proxy.

According to the 12/02/09 SEC Filing, Aspen’s stockholders did not approve the resolution to grant Aspen’s Board of Directors the discretion to dissolve the company. To be approved Delaware law required that this proposal be approved by a majority of shares outstanding and entitled to vote thereon. Although more stockholders voted in favor of the proposal than voted against it, only approximately 41% of the total shares outstanding and entitled to vote on the proposal voted in favor of its approval. As a result, Aspen maintained its corporate status and decided to explore other business opportunities.

On November 2, 2009 ASPN declared a cash dividend of $0.73/share. The news release describing the dividend said:

The distribution follows the final settlement of the sale of Aspen’s California oil and gas assets to Venoco, Inc., at which the parties made a number of immaterial adjustments to the purchase price paid at the June 30, 2009 closing, and made certain other payments that were not determined until after the closing. At the final settlement date Aspen received a net payment from Venoco, but was required to make various payments to third parties which ultimately resulted in a cash outflow from Aspen in an amount not considered to be material.

Aspen expects that after the payment of the dividend, and its anticipated operations through the end of the current calendar year, on December 31, 2009 it will have more than $3 million of working capital remaining. Aspen currently intends to utilize its remaining funds to maintain its corporate status as a reporting issuer under the Securities Exchange Act of 1934 and to explore other business opportunities. “

QUICK ANALYSIS

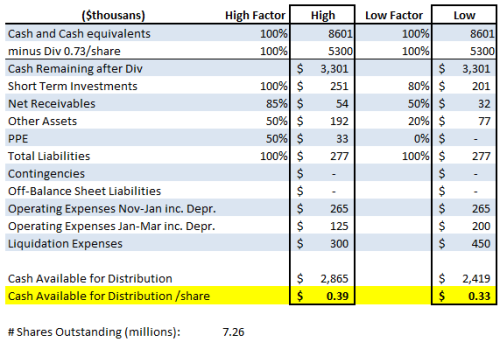

It is likely that if no interested buyer is found for ASPN’s remaining assets, the company will end up liquidating. Our rough estimates for an eventual liquidation, including expected operational expenses to be incurred until March, 2010 is shown below.

Currently trading at $30/share, our estimates show that there is still some value in ASPN. However, our estimates are highly dependent on the timing of the potential liquidation and on the assumptions outlined above. We believe that management will do what is right for shareholders, as the company’s CEO owns 20% of all shares.

THE BOTTOM LINE

ASPN has no significant operations, but it may have enough cash on its balance sheet to offer some value to shareholders. Although we wish we had a larger margin of safety, we believe it is likely that ASPN’s CEO will find the best deal for shareholders, or liquidate the company. As we have shown, even in liquidation the company’s value is above the company’s current price.