Chris Mayer, Agora Financial’s research editor for the Capital & Crisis newsletter. He took a close look at the announcement and has the following findings:

“The oil and gas company Canadian Natural (CNQ, Financial) reported good results last week. Oil production was up 18% from the same quarter a year ago. The company continues to generate a lot of cash and still has a huge inventory of projects to fuel further growth.

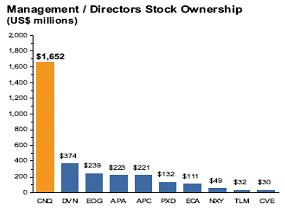

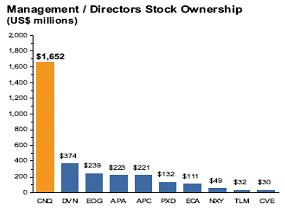

“One of the reasons I liked CNQ was because of the management team, which acts like owners — because they are owners. One of my favorite charts on CNQ is this one, which shows the dollar amount management has invested in the company:

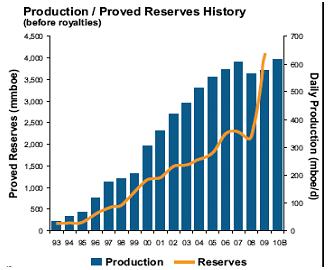

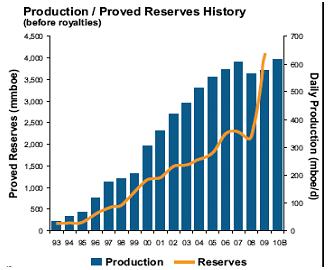

“Owners tend to make better long-term decisions for a business than renters, the same way it works in real estate. So CNQ is good with managing its capital intelligently. It’s hard to quibble with its track record. The company has boosted cash flow per share at a 17% annual clip since 1999. The company continues to be a low-cost producer. And it continues to beef up reserves and production, as this next chart shows:

“For 2010, the management expects to generate nearly $7 billion in cash flows — or nearly $13 per share. That’s a 12% increase on a 7% increase in production. And of that, about $2-2.6 billion will be free cash flow. The first priority for excess cash flow is to pay down debt, building more equity in the company in the same way paying down your mortgage does. In 2009, debt fell $3.3 billion, to $9.7 billion. (Keep in mind CNQ has a $40 billion market cap.) So the debt level here is fine.”

For Mayer, Canadian Natural appears to be a solid oil and gas holding, which he indicates by later sharing that the net asset value, according to his calculations, comfortably exceeds $100 per share.

If you’d like to follow more of his research, you should consider subscribing to his Capital & Crisis newsletter. To review the options for signing up visit the Agora Financial reports page here.

Best,

Rocky Vega,

The Daily Reckoning

“The oil and gas company Canadian Natural (CNQ, Financial) reported good results last week. Oil production was up 18% from the same quarter a year ago. The company continues to generate a lot of cash and still has a huge inventory of projects to fuel further growth.

“One of the reasons I liked CNQ was because of the management team, which acts like owners — because they are owners. One of my favorite charts on CNQ is this one, which shows the dollar amount management has invested in the company:

“Owners tend to make better long-term decisions for a business than renters, the same way it works in real estate. So CNQ is good with managing its capital intelligently. It’s hard to quibble with its track record. The company has boosted cash flow per share at a 17% annual clip since 1999. The company continues to be a low-cost producer. And it continues to beef up reserves and production, as this next chart shows:

“For 2010, the management expects to generate nearly $7 billion in cash flows — or nearly $13 per share. That’s a 12% increase on a 7% increase in production. And of that, about $2-2.6 billion will be free cash flow. The first priority for excess cash flow is to pay down debt, building more equity in the company in the same way paying down your mortgage does. In 2009, debt fell $3.3 billion, to $9.7 billion. (Keep in mind CNQ has a $40 billion market cap.) So the debt level here is fine.”

For Mayer, Canadian Natural appears to be a solid oil and gas holding, which he indicates by later sharing that the net asset value, according to his calculations, comfortably exceeds $100 per share.

If you’d like to follow more of his research, you should consider subscribing to his Capital & Crisis newsletter. To review the options for signing up visit the Agora Financial reports page here.

Best,

Rocky Vega,

The Daily Reckoning