I recently pointed out that real-time indicators are showing that the economy is rebounding. As the markets have rallied from the reflation trade, my inflation-deflation timer model moved from a "neutral" reading to an "inflation" reading last week, which would move the model portfolio from equities to a basket of commodities (see report here).

Ken Heebner buying inflation too

The model appears to be in good company as I see that Ken Heebner has also put on an inflation bet in his portfolio. Heebner is a portfolio manager with a terrific long term record (though he has struggled in the last couple of years). He has a "swing for the fences" style and tends to make big top-down bets.

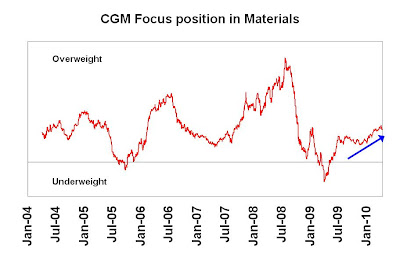

I reverse engineered his macro bets and my analysis shows that Heebner has positioned his CGM Focus Fund portfolio for a commodity inflation environment. He is at an overweight position in Materials:

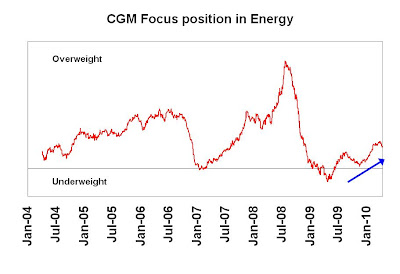

...and Energy:

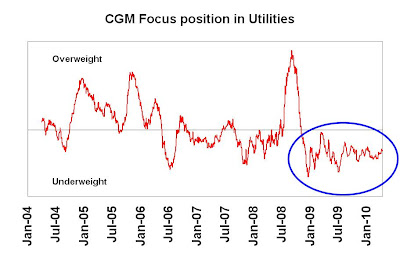

By contrast, he is underweight in Utilities:

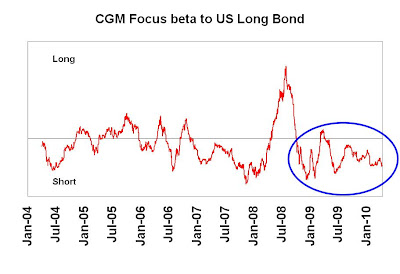

...and has an implicit short position in the US long bond:

Long commodities, short bonds and interest sensitives - that sounds like a commodity inflation bet to me.

Cam Hui

http://humblestudentofthemarkets.blogspot.com/

The model appears to be in good company as I see that Ken Heebner has also put on an inflation bet in his portfolio. Heebner is a portfolio manager with a terrific long term record (though he has struggled in the last couple of years). He has a "swing for the fences" style and tends to make big top-down bets.

I reverse engineered his macro bets and my analysis shows that Heebner has positioned his CGM Focus Fund portfolio for a commodity inflation environment. He is at an overweight position in Materials:

...and Energy:

By contrast, he is underweight in Utilities:

...and has an implicit short position in the US long bond:

Long commodities, short bonds and interest sensitives - that sounds like a commodity inflation bet to me.

Cam Hui

http://humblestudentofthemarkets.blogspot.com/