About the company

Founded in 1947, The Preformed Line Products Company (PLPC, Financial) is an international designer and manufacturer of products and systems employed in the construction and maintenance of overhead and underground networks for energy, communications and broadband network companies.

Preformed Line's world headquarters are in Cleveland, Ohio, and the company operates two domestic manufacturing centers located in Rogers, Arkansas and Albemarle, North Carolina. The company serves its worldwide market through international operations in Argentina, Australia, Austria, Brazil, Canada, China, Colombia, France and many others around the globe. Despite its international scale, it is a small-cap with a market capitalization of $322 million.

I first became interested in Preformed Line after reading John Dorfman's article, "4 Small Stocks That Look Like Undiscovered Gems." In the article, Dorfman writes, "The company has relatively little debt, and the stock sells for only 11 times earnings. It has shown a profit for 21 consecutive years."

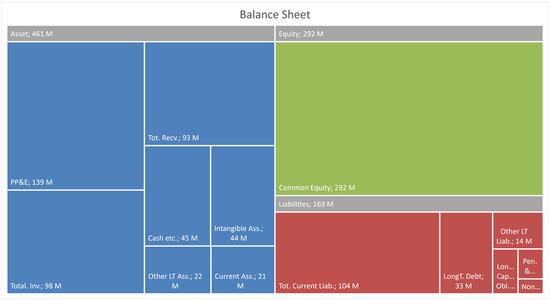

Financial strength

The company has extremely low debt, and the balance sheet is in exceptionally good shape. Long term debt is less than cash, which is good because Preformed Line operates in a cyclical industry, and a large debt load can spell trouble in an economic downturn.

The income statement over the last five years looks fairly good too. Revenue has grown from $337 million in 2016 to $466 million in 2020. In the same period, net income has doubled from $15 million to $30 million.

Growth has been decent, and we can see a good acceleration in recent years.

| Annual Rates (per share) | 10 yrs* | 5 yrs* | 12 months* |

| Revenue Growth (%) | 2.1 | 8.1 | 7 |

| EBITDA Growth (%) | 0.9 | 18.5 | 22.3 |

| Operating Income Growth (%) | 0.6 | 18.3 | 29.6 |

| EPS without NRI Growth (%) | -0.1 | 32.8 | 30.6 |

| Book Value Growth (%) | 3.5 | 7.2 | 10.8 |

| *% Compounded Annual Growth Rate |

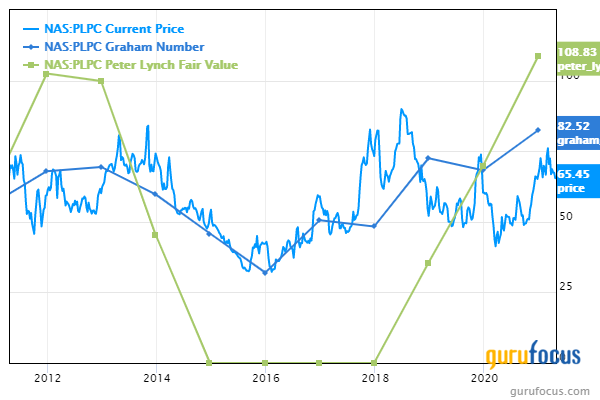

Valuation

The company scores well on value and growth metrics using some of the criteria laid out by Benjamin Graham and Peter Lynch. Specifically, the stock is undervalued based on the Graham Number and the Peter Lynch fair value.

Conclusion

Preformed Line's stock looks to be approximately 20% to 30% undervalued currently based on the above value criteria. It is an underfollowed and unappreciated small cap company with a strong balance sheet, which is the type of investment that does not typically draw large crowds of speculators or pension fund money.

However, with governments around the world increasing spending on infrastructure, more public money will likely go into the markets that Preformed Line serves, which are mainly electricity transmission and communications. Given the company's revenue and income growth trajectory and upcoming government spending on infrastructure, the short term and medium term future looks bright.

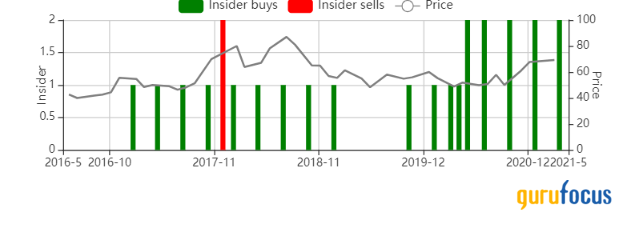

Insiders appear to agree and have being buying company stock consistently.

Disclosure: The author does not own shares of Preformed Line Products Co.

Read more here:

- Lordstown: Torquing Up Those Hub Motors

- Archegos Capital Management: A $10 Billion Fortune Smoked

- GEO Group - Too Much Pessimism Provides Opportunity

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.