Yacktman Asset Management (Trades, Portfolio) recently disclosed its portfolio updates for the first quarter of 2021, which ended on March 21.

Headquartered in Austin, Texas, Yacktman Asset Management (Trades, Portfolio) pursues long-term capital appreciation using a growth and value-based strategy. Specifically, the firm looks to purchase the stocks of business that have the following three characteristics: good business (high market share, high cash return on tangible assets, unique franchise characteristics, etc.), shareholder-oriented management (allocates capital wisely, does not overcompensate executives, etc.) and low purchase price. Stephen Yacktman, who joined the firm in 1993, is the chief investment officer.

Based on the above investing criteria, the firm's most notable sells during the quarter were Macy's Inc. (M, Financial) and News Corp. (NWSA, Financial), while its biggest buys were Canadian Natural Resources Ltd. (CNQ, Financial) and Berkshire Hathaway Inc. Class B shares (BRK.B, Financial).

Macy's

The firm reduced its investment in Macy's (M, Financial) by 15,858,559 shares, or 63.05%, for a remaining holding of 9,295,192 shares. The trade had a -2.21% impact on the equity portfolio. During the quarter, shares traded for an average price of $15.26.

Macy's is an American department store chain headquartered in New York. It sells a wide variety of home goods such as furniture, kitchen items and bedding, as well as clothing, jewelry, handbags and more.

On May 5, shares of Macy's traded around $17.32 for a market cap of $5.44 billion. According to the GuruFocus Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 5 out of 10. The cash-debt ratio of 0.2 is lower than 76% of industry peers, and the Altman Z-Score of 0.77 indicates the company could be in danger of bankruptcy over the next couple of years. After going into the negatives in 2020, the operating margin and net margin have recovered to 7.03% and 2.27%, respectively, as of the most recent quarter.

News Corp.

The firm cut its News Corp. (NWSA, Financial) holding by 5,138,263 shares, or 23.97%, for a remaining stake of 16,297,702 shares. The trade had a -1.14% impact on the equity portfolio. Shares traded for an average price of $22.43 during the quarter.

Formed in 2013 as a spinoff of the original News Corporation, News Corp. is a mass media and publishing company that operates in the digital real estate information, news media, book publishing and cable television industries.

On May 5, shares of News Corp. traded around $26.12 for a market cap of $15.03 billion. According to the GF Value chart, the stock is significantly overvalued.

The company has a financial strength rating of 6 out of 10 and a profitability rating of 4 out of 10. The interest coverage ratio of 13.44 is higher than 52% of industry peers, though the Altman Z-Score of 1.65 indicates the company may face liquidity issues in the coming years. The return on invested capital is consistently lower than the weighted average cost of capital, meaning the company's growth is not profitable.

Canadian Natural Resources

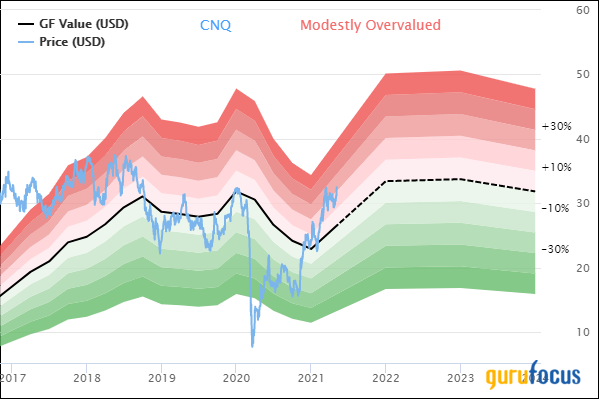

The firm established a new stake worth 6,698,614 shares in Canadian Natural Resources Ltd. (CNQ, Financial), impacting the equity portfolio by 2.16%. During the quarter, shares traded for an average price of $27.60.

Canadian Natural Resources is a hydrocarbon exploration and production company with operations mainly in Western Canada, the United Kingdom sector of the North Sea, offshore Côte d'Ivoire and Gabon. It is one of the world's largest independent crude oil and natural gas producers.

On May 5, shares of Canadian Natural Resources traded around $32.49 for a market cap of $38.62 billion. According to the GF Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. The Altman Z-Score of 1.28 indicates the company could be in danger of bankruptcy in the next couple of years, though the Piotroski F-Score of 4 out of 9 is typical of a financially stable company. The company has a three-year revenue growth rate of -1.6% and a three-year Ebitda growth rate of -11.9%.

Berkshire Hathaway

The firm added 629,168 shares, or 322.53%, to its investment in Berkshire Hathaway Class B shares (BRK.B, Financial) for a total stake of 824,243 shares. The trade impacted the equity portfolio by 1.68%. Shares traded for an average price of $242.84 during the quarter.

Berkshire Hathaway is the conglomerate headed by famous value investor Warren Buffett (Trades, Portfolio) and his partner Charlie Munger (Trades, Portfolio). The group owns a wide variety of businesses, including Geico and other insurance companies, Berkshire Hathaway Energy, BNSF and a sizable investment portfolio.

On May 5, shares of Berkshire Hathaway's Class B shares traded around $283.13 for a market cap of $647.21 billion. According to the GF Value chart, the stock is modestly overvalued.

The company has a financial strength rating of 5 out of 10 and a profitability rating of 7 out of 10. The equity-to-asset ratio of 0.51 is higher than 86% of industry peers, while the interest coverage ratio of 14.64 is about average. The company has a three-year revenue growth rate of 6.9% and a three-year Ebitda growth rate of 24.7%, though investors should note that most profitability metrics for the company will be skewed due to having to count unrealized capital gains from the equity portfolio as part of earnings.

Portfolio overview

As of the quarter's end, the firm had 66 common stock holdings valued at a total of $9.57 billion. The turnover rate for the quarter was 11%.

The firm's top holdings were Microsoft Corp. (MSFT, Financial) with 5.19% of the equity portfolio, Alphabet Inc. (GOOG, Financial) with 5.08% and PepsiCo Inc. (PEP, Financial) with 4.90%. In terms of sector weighting, the firm was most invested in consumer defensive, communication services and financial services.

Disclosure: Author owns no shares in any of the stocks mentioned. The mention of stocks in this article does not at any point constitute an investment recommendation. Portfolio updates reflect only common stock positions as per the regulatory filings for the quarter in question and may not include changes made after the quarter ended.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.