Chuck Royce (Trades, Portfolio)'s firm, Royce Investment Partners, has revealed a large reduction in its Resources Connection Inc. (RGP, Financial) holding according to GuruFocus' Real-Time Picks, a Premium feature.

The firm invests in smaller companies, primarily those with market capitalizations up to $5 billion, although some of their funds may invest in companies with market capitalizations up to $10 billion. The value approaches that portfolio managers use are all looking for terrific stocks trading for less than the firm's estimate of the company's worth as a business.

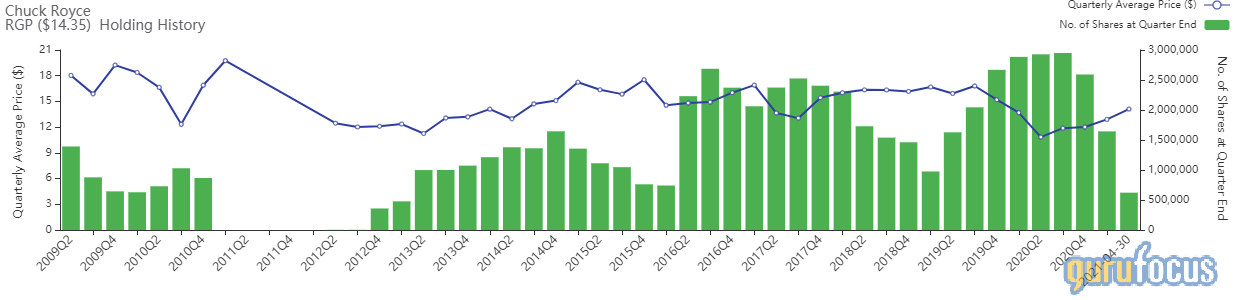

On April 30, the firm cut the holding by 1.02 million shares of Resources Connection (RGP, Financial) for an overall reduction of 62.15%. The sale marked the third large reduction in the holding since the fourth quarter of 2020. On the day of the transaction, the shares traded at an average price of $14.11 per share. GuruFocus estimates the firm has gained a total of 5.67% on the holding and the sale had an overall impact of -0.10%.

Resources Connection provides consulting and business initiative support services primarily through its operative subsidiary, Resources Global Professionals. The company offers transformation and improvement, financial reporting and analysis, strategy development, and program and project management services and support. Its clients operate in the accounting, finance, corporate governance, risk and compliance management, corporate advisory, strategic communications and restructuring, information management, human capital, supply chain management and legal and regulatory sectors.

As of May 11, the stock was trading at $14.78 per share with a market cap of $485.12 million. According to the GF Value Line, the shares are trading at a fair value rating.

GuruFocus gives the company a financial strength rating of 7 out of 10, a profitability rank of 7 out of 10 and a valuation rank of 8 out of 10. There is currently one severe warning sign issued for the company for an operating margin in decline. The company's weighted average cost of capital exceeds the return on invested capital, indicating struggles with profitability.

Royce's firm is the ninth-largest shareholder with 1.90% of shares outstanding. Other top shareholders include BlackRock Inc. (Trades, Portfolio), Dimensional Fund Advisors LP (Trades, Portfolio) and Vanguard Group Inc. (Trades, Portfolio).

Portfolio overview

At the end of the first quarter, the firm's portfolio contained 1,012 stocks, with 109 new holdings. It was valued at $14.88 billion and has seen a turnover rate of 17%. Top holdings at the end of the quarter were MKS Instruments Inc. (MKSI, Financial), Kulicke & Soffa Industries Inc. (KLIC, Financial), Huntsman Corp. (HUN, Financial), Quaker Chemical Corp. (KWR, Financial) and Kennedy-Wilson Holdings Inc. (KW, Financial).

By weight, the top three sectors represented are industrials (26.35%), technology (20.07%) and financial services (14.65%).

Disclosure: Author owns no stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.