According to the GuruFocus All-in-One Screener, a Premium feature, as of June 11, the following guru-held companies have positive future earnings estimates from Morningstar analysts.

Old Dominion Freight Line

Shares of Old Dominion Freight Line Inc. (ODFL) were trading around $255.40 on Friday.

The U.S. less-than-truckload carrier has a GuruFocus profitability rating of 9 out of 10. Its earnings per share have risen 14.80% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 14.80%. The return on equity of 23.55% and return on assets of 17.58% are outperforming 92% of companies in the transportation industry.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 0.22% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 0.15% and Jerome Dodson (Trades, Portfolio) with 0.12%.

AvalonBay Communities

On Friday, AvalonBay Communities Inc. (AVB) was trading around $211.03 per share.

With a market cap of $29.46 billion, the company has a GuruFocus profitability rating of 7 out of 10. Its earnings per share have declined 2.50% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 11.47%. The ROE of 7.43% and ROA of 4.15% are outperforming 74% of companies in the REITs industry.

Pioneer Investments (Trades, Portfolio) is the company's largest guru shareholder with 0.15% of outstanding shares, followed by Jim Simons (Trades, Portfolio)’ Renaissance Technologies with 0.08% and Chris Davis (Trades, Portfolio) with 0.07%.

The Kroger

Shares of The Kroger Co. (KR) were trading around $38.89 per share on Friday.

With a market cap of $29.44 billion, the U.S. grocer has a GuruFocus profitability rating of 8 out of 10. Its earnings per share have risen 16.10% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 2.68%. The ROE of 27.29% and ROA of 5.46% are outperforming 72% of companies in the retail - defensive industry.

Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway is the company's largest guru shareholder with 6.79% of outstanding shares, followed by Renaissance Technologies with 2.28% and Pioneer Investments (Trades, Portfolio) with 0.44%.

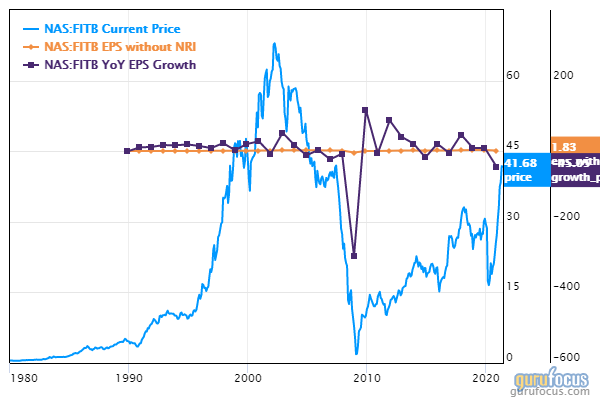

Fifth Third Bancorp

Fifth Third Bancorp (FITB) was trading around $41.68 per share on Friday.

The diversified financial services company has a market cap of $29.34 billion and a GuruFocus profitability rating of 5 out of 10. Its earnings per share have declined 13.30% over the past three years.

Analysts project a three-year to five-year earnings growth rate of 11.50%. The ROE of 8.68% and ROA of 1.04% are outperforming 51% of companies in the banks industry.

The T Rowe Price Equity Income Fund (Trades, Portfolio) is the company's largest guru shareholder with 1.14% of outstanding shares, followed by Richard Pzena (Trades, Portfolio) with 0.24% and Donald Smith & Co with 0.16%.

Lennar

On Friday, Lennar Corp. (LEN) was trading around $95.88 per share.

With a market cap of $29.32 billion, the U.S. homebuilder has a GuruFocus profitability rating of 8 out of 10. Its earnings per share have climbed 32.80% over the last three years.

Analysts project a three-year to five-year earnings growth rate of 14.82%. The return on equity of 17.49% and return on assets of 10.34% are outperforming 74% of companies in the homebuilding and construction industry.

With 1.51% of outstanding shares, Barrow, Hanley, Mewhinney & Strauss is the company's largest guru shareholder, followed by Ken Fisher (Trades, Portfolio) with 0.31% and Smead Value Fund (Trades, Portfolio) with 0.31%.