The Signature Select Canadian Fund (Trades, Portfolio), part of Canada-based CI Investments, disclosed this week that its top four trades during the six months ending March 2021 included new buys in Galaxy Digital Holdings Ltd. (TSX:GLXY, Financial), Royal Bank of Canada (TSX:RY, Financial) and CI Global Financial Sector ETF (TSX:FSF.TO, Financial) and the closure of its stake in the SPDR Gold Shares ETF (GLD, Financial).

The fund seeks long-term capital appreciation by investing in Canadian companies that offer dividend income potential. The Signature approach makes investment decisions based on an analysis of the full capital structure of a company, which includes looking at qualitative characteristics such as management and financial disclosures.

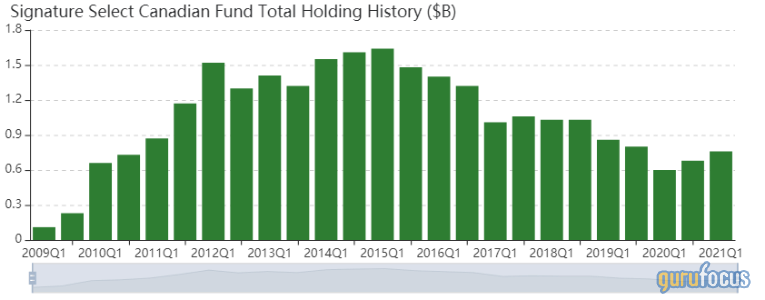

The fund releases its portfolios semiannually, at the end of March and the end of September. As of March 2021, the fund’s $757 million equity portfolio contains 105 stocks, with 12 new positions and a semiannual turnover of 16%. The top four sectors in terms of weight are financial services, technology, industrials and energy, with weights of 30.29%, 14.46%, 9.16% and 9.07%, respectively.

Galaxy Digital Holdings

The fund purchased 841,262 shares of Galaxy Digital Holdings (TSX:GLXY, Financial), giving the position a 2.84% weight in the equity portfolio. Shares averaged 10.67 Canadian dollars ($8.65) during the first quarter of 2021.

According to GuruFocus, the New York-based diversified financial services and investment management company’s return on equity outperforms more than 95% of global competitors.

Royal Bank of Canada

The fund purchased 131,776 shares of Royal Bank of Canada (TSX:RY, Financial), giving the position a 2.02% weight in the equity portfolio. Shares averaged C$105.48 ($85.15) during the first quarter; the stock is modestly overvalued based on Tuesday’s price-to-GF-Value ratio of 1.11.

GuruFocus ranks the Montreal-based bank’s financial strength 4 out of 10. Although the company’s cash-to-debt and debt-to-equity ratios outperform more than 85% of global competitors, Royal Bank of Canada’s equity-to-asset ratio underperforms more than 83% of global banks.

Leith Wheeler Canadian Equity (Trades, Portfolio) and Mawer Canadian Equity Fund (Trades, Portfolio) also have positions in Royal Bank of Canada.

CI Global Financial Sector ETF

The fund purchased 573,541 shares of CI Global Financial Sector ETF (TSX:FSF.TO, Financial), giving the position a 1.68% weight in the equity portfolio. Shares averaged $20.69 during the first quarter.

According to the fund’s website, the fund seeks to track the performance of an index fund consisting of financial service companies in global and emerging-market countries.

SPDR Gold Shares ETF

The fund sold 68,930 shares of the SPDR Gold Shares ETF (GLD, Financial), trimming 2.39% of the equity portfolio. Shares averaged $168.06 during the first quarter.

According to the fund website, the SPDR Gold Shares ETF seeks to track the performance of gold bullion prices.