I picked up some shares of Andrew Peller Ltd. (TSX:ADW.A, Financial) (TSX:ADW.B, Financial) recently as I consider them to be undervalued. The company is consolidating the wine industry in Canada by acquiring small wineries here and there. Founded in British Columbia in 1961 (as Andres Wines), it is the second-largest Canadian wine producer and distributor. 2006 marked its 46th anniversary. At that time, it underwent a corporate name change to Andrew Peller Ltd.

Peller owns multiple vineyards in Ontario and British Columbia. The company's premium brands include Peller Estates, Trius, Hillebrand, Thirty Bench, Sandhill, Copper Moon, Calona Vineyards Artist Series VQA wines and Red Rooster. Complementing these premium brands are a number of more modestly priced brands, including Hochtaler, Domaine D'Or, Schloss Laderheim, Royal and Sommet. It also produces craft beverage alcohol products, including No Boats on Sunday ciders and seltzers, and various beer, spirits and cream whisky products under the Wayne Gretzky No. 99 brand.

In addition, the company produces and markets personal winemaking products through Global Vintners Inc. While Peller's products are sold predominantly in Canada, it also distributes a broad range of international brands through its two import divisions, Grady Wine Marketing in British Columbia, Alberta, Saskatchewan and Manitoba, and The Small Winemakers Collection in Ontario.

Peller is also pushing into the hospitality and tourism business, having recently acquired a winery and vineyard with an on-site hotel (The Riverbend Inn and Vineyard in Niagara-on-the-Lake).

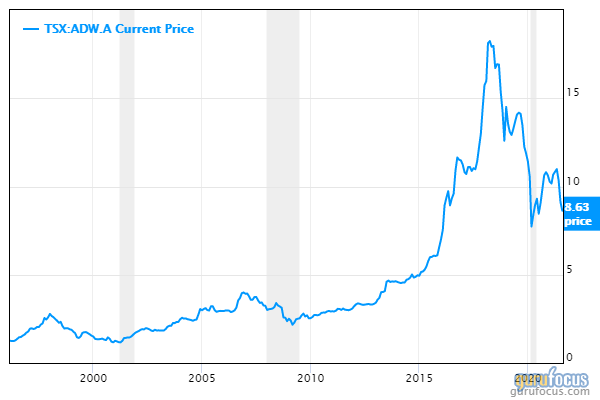

The common shares trade on the Toronto Stock Exchange. The shares hit a high around 2018, but have come down to a more reasonable level since then. The company is controlled by the Peller family via Class B voting shares.

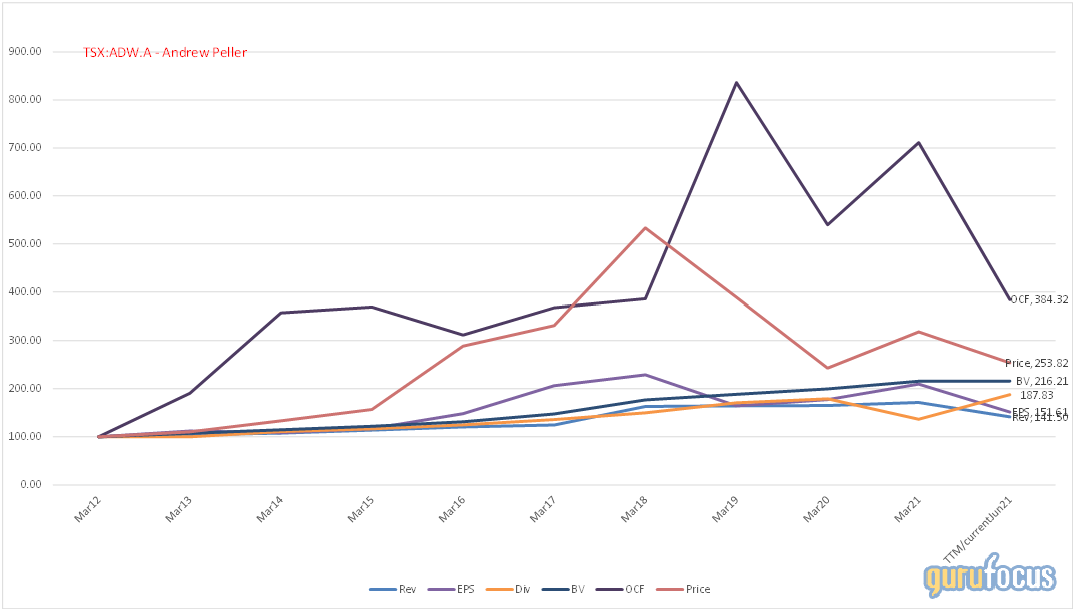

The following chart presents the various per-share financial metrics of the company as a chain index. This method makes it easy for investors to follow the various metrics over time from a common starting index value of 100, covering a period of 10 years. As you can see, the stock price has risen by 153% over 10 years (from $100 to $253). Operating cash flow per share rose from $100 to $384 and so on. The other metrics are 4evenue per share, earnings per share, book value per share and dividend per share. Overall, the share price is consistent with fundamental data. The pandemic had a minor impact on the company.

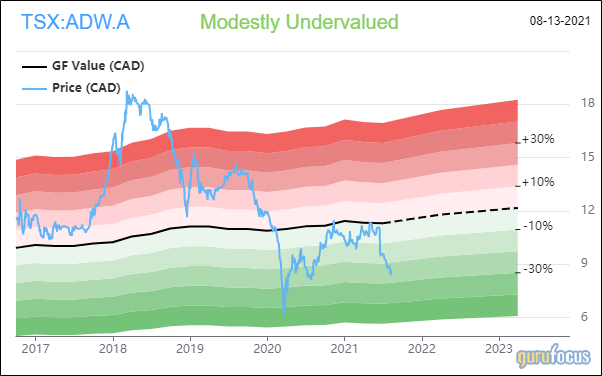

The GF Value Line also suggests the company is modestly undervalued.

The balance sheet, as illustrated below, is in decent shape. The company owns a lot of land, which is carried on its books at original cost and much below market value. It also has a large inventory ($180 million), of which most is bulk wine and spirits and finished goods. The long-term debt is from a revolving credit facility that is worth $350 million, which matures on Dec. 8, 2024.

Conclusion

Andrew Peller is a steady, low-risk company growing in the mid-single digits, which may appeal to wine aficionados. It's a relatively simple, understandable business. More and more grapes are being grown in Canada as it appears climate change is opening more areas of the country up to grape growing. Family control ensures the company is run for the long-term benefit of shareholders. The company pays a modest dividend of 2.7%, which it has increased by about 4% a year. The company reinvests a sizable proportion of retained earning into capital expenditures and acquisitions and has been compounding book value at a steady, high single-digit (about 6% to 8%) clip.

It may also be a takeover candidate. The company's larger rival, Arterra Wines Canada, was sold to the Ontario Teachers' Pension Plan by Constellation Brands (STZ, Financial) in 2016. Similar pension plans are always interested in these steady-eddy, long-term businesses. Until that happens, though, I can always tell my friends that I own a winery.