Lone Pine Capital, the firm founded by Steve Mandel (Trades, Portfolio), disclosed this week that its top five trades during the second quarter included new positions in Moderna Inc. (MRNA, Financial) and RH (RH, Financial) and the closure of its holdings in MercadoLibre Inc. (MELI, Financial), Netflix Inc. (NFLX, Financial) and Atlassian Corp. PLC (TEAM, Financial).

Prior to founding the Greenwich, Connecticut-based firm, Mandel worked as senior managing director and consumer analyst at Julian Robertson (Trades, Portfolio)’s Tiger Management. The tiger cub established Lone Pine as a long-and-short equity firm, seeking long-term capital appreciation through growth and value methodologies using fundamental analysis and bottom-up stock picking.

As of June 30, Lone Pine’s $31.67 billion equity portfolio contains 36 stocks, with 10 new positions and a turnover ratio of 23%. The top four sectors in terms of weight are technology, communication services, consumer cyclical and health care, representing 37.54%, 20.70%, 20.08% and 10.53% of the equity portfolio.

Moderna

Lone Pine purchased 3,990,897 shares of Moderna (MRNA, Financial), allocating 2.96% of its equity portfolio to the position. Shares averaged $177.38 during the second quarter.

The Cambridge, Massachusetts-based biotech company manufactures through its messenger RNA technologies a wide range of therapeutics and vaccines, including one of the Covid-19 vaccines. GuruFocus ranks Moderna’s financial strength 7 out of 10 on the back of a strong Altman Z-score of 11.75, a triple-digit interest coverage ratio and a debt-to-Ebitda ratio that outperforms more than 81% of global competitors.

Other gurus with holdings in Moderna include Baillie Gifford (Trades, Portfolio), Philippe Laffont (Trades, Portfolio)’s Coatue Management and Jim Simons (Trades, Portfolio)’ Renaissance Technologies.

RH

Lone Pine revealed a 1,020,825-share stake in RH (RH, Financial), giving the position 2.19% equity portfolio weight. On July 16, the firm reported it owned 1,089,837 shares according to GuruFocus Real-Time Picks, a Premium feature.

Shares of the furniture company averaged $647.67 during the second quarter; the stock is significantly overvalued based on Thursday’s price-to-GF Value ratio of 3.63.

GuruFocus ranks RH’s profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 8 and profit margins and returns that outperform 89% of global competitors.

Other gurus with holdings in RH include Warren Buffett (Trades, Portfolio)’s Berkshire Hathaway Inc. (BRK.A, Financial)(BRK.B, Financial) and Daniel Loeb (Trades, Portfolio).

MercadoLibre

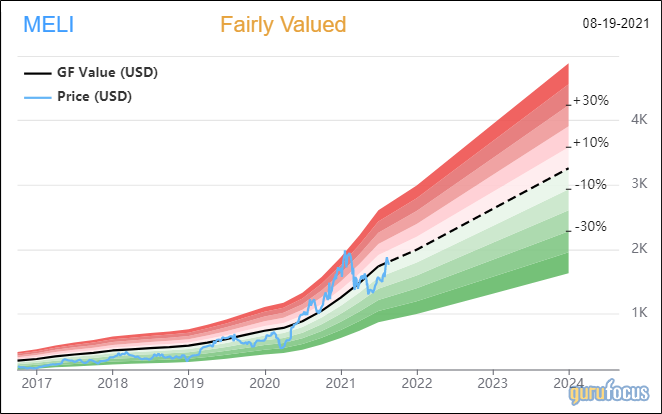

Lone Pine sold 715,152 shares of MercadoLibre (MELI, Financial), curbing 3.82% of its equity portfolio. Shares averaged $1,467.15 during the second quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.97.

GuruFocus ranks the Buenos Aires, Argentina-based retail company’s financial strength 4 out of 10 on the back of interest coverage and debt ratios that underperform more than 73% of global retail competitors despite the company having a strong Altman Z-score of 10.

Netflix

The firm sold 1,828,120 shares of Netflix (NFLX, Financial), cutting 3.46% off of its equity portfolio. Shares averaged $511.62 during the second quarter; the stock is fairly valued based on Thursday’s price-to-GF Value ratio of 0.93.

GuruFocus ranks the Los Gatos, California-based streaming giant’s profitability 9 out of 10 on several positive investing signs, which include a five-star business predictability rank and profit margins and returns that outperform more than 87% of global competitors.

Atlassian

The firm sold 2,974,571 shares of Atlassian (TEAM, Financial), discarding 2.28% of its equity portfolio. Shares averaged $233.58 during the second quarter; the stock is significantly overvalued based on Thursday’s price-to-GF Value ratio of 1.42.

GuruFocus ranks the Australian software company’s financial strength 5 out of 10: Although the company has a strong Altman Z-score of 18.26, interest coverage and debt ratios are underperforming more than 96% of global competitors.